Asian Stocks With Estimated Discounts Up To 48% That May Offer Value

Reviewed by Simply Wall St

As trade tensions between the U.S. and China show signs of easing, Asian markets have experienced a boost in investor sentiment, with indices like Japan's Nikkei 225 and China's Shanghai Composite seeing gains. In this environment, identifying undervalued stocks can be particularly rewarding as these equities may offer potential value when the market stabilizes further.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥74.76 | CN¥144.95 | 48.4% |

| Pegasus (TSE:6262) | ¥473.00 | ¥915.75 | 48.3% |

| Alexander Marine (TWSE:8478) | NT$141.00 | NT$279.84 | 49.6% |

| Micro-Star International (TWSE:2377) | NT$136.50 | NT$265.25 | 48.5% |

| Tongqinglou Catering (SHSE:605108) | CN¥20.99 | CN¥41.22 | 49.1% |

| World Fitness Services (TWSE:2762) | NT$80.30 | NT$155.61 | 48.4% |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥39.00 | CN¥77.30 | 49.6% |

| giftee (TSE:4449) | ¥1522.00 | ¥2977.64 | 48.9% |

| Swire Properties (SEHK:1972) | HK$16.50 | HK$32.60 | 49.4% |

| Visional (TSE:4194) | ¥8421.00 | ¥16492.53 | 48.9% |

Here we highlight a subset of our preferred stocks from the screener.

Xiamen TungstenLtd (SHSE:600549)

Overview: Xiamen Tungsten Co.,Ltd. operates in China, focusing on the sale of tungsten, molybdenum, rare earth, and new energy materials with a market cap of CN¥30.04 billion.

Operations: The company's revenue is derived from the sale of tungsten, molybdenum, rare earth, and new energy materials within China.

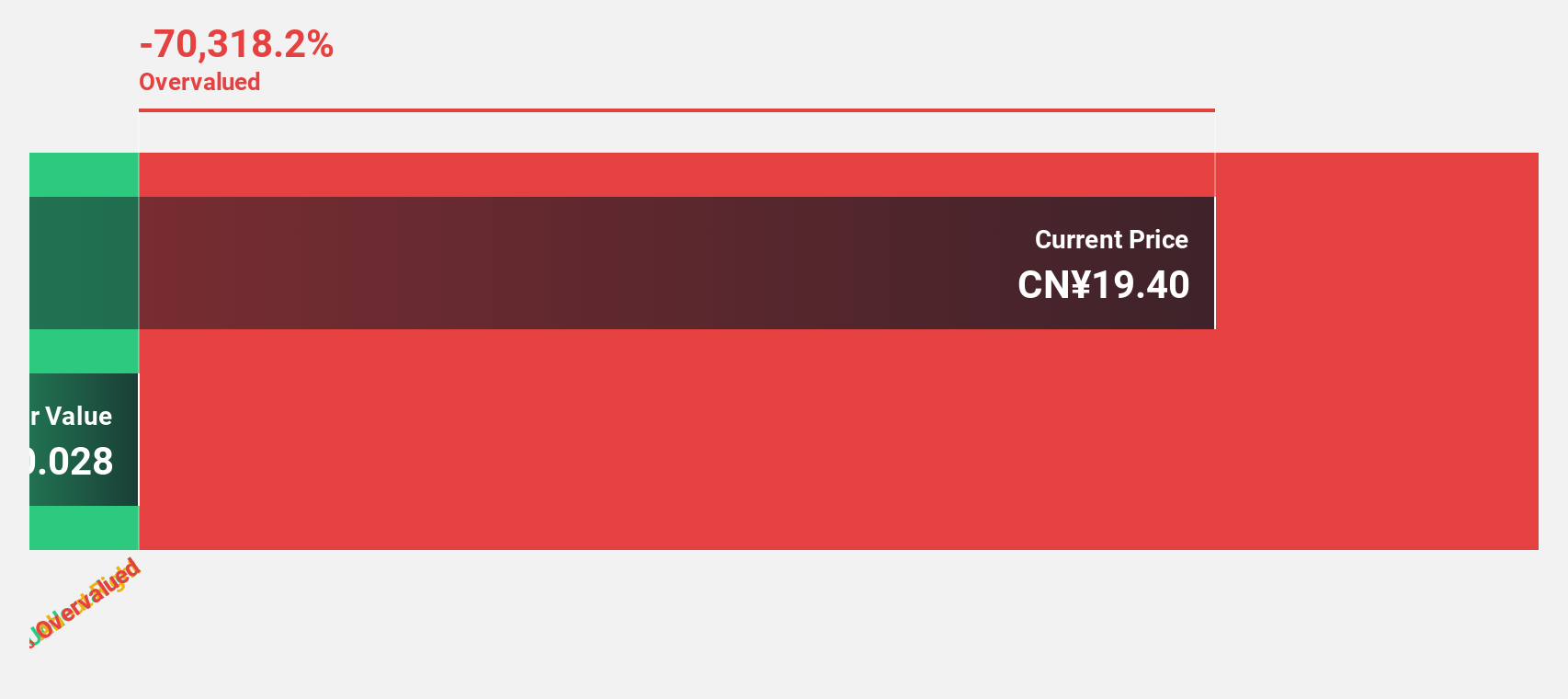

Estimated Discount To Fair Value: 42.2%

Xiamen Tungsten Ltd. appears undervalued, trading 42.2% below its estimated fair value of CNY 32.72, with a current price of CNY 18.92. Despite a recent dip in net income to CNY 391 million for Q1 2025, earnings are forecast to grow significantly at 25.8% annually, outpacing the Chinese market average growth rate. However, potential investors should note its unstable dividend track record despite strong cash flow indicators and growth forecasts.

- According our earnings growth report, there's an indication that Xiamen TungstenLtd might be ready to expand.

- Get an in-depth perspective on Xiamen TungstenLtd's balance sheet by reading our health report here.

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution and utilization systems in China and internationally, with a market cap of CN¥36.99 billion.

Operations: The company's revenue segments include the manufacturing and sale of power distribution and utilization systems both domestically and internationally.

Estimated Discount To Fair Value: 48%

Ningbo Sanxing Medical Electric Ltd. is trading 48% below its estimated fair value of CN¥50.41, with a current price of CN¥26.22, suggesting it is undervalued based on cash flows. Despite a dividend yield of 3.39% not being well covered by free cash flows, the company reported strong Q1 2025 results with revenues rising to CN¥3.63 billion and net income increasing to CN¥489.31 million, indicating robust financial performance and growth prospects in revenue and earnings.

- Our expertly prepared growth report on Ningbo Sanxing Medical ElectricLtd implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Ningbo Sanxing Medical ElectricLtd with our comprehensive financial health report here.

Kuaijishan Shaoxing Rice Wine (SHSE:601579)

Overview: Kuaijishan Shaoxing Rice Wine Co., Ltd. is engaged in the production, processing, and sale of rice wine both domestically in China and internationally, with a market capitalization of CN¥6.87 billion.

Operations: The company's revenue primarily comes from the Rice Wine Industry, amounting to CN¥1.48 billion.

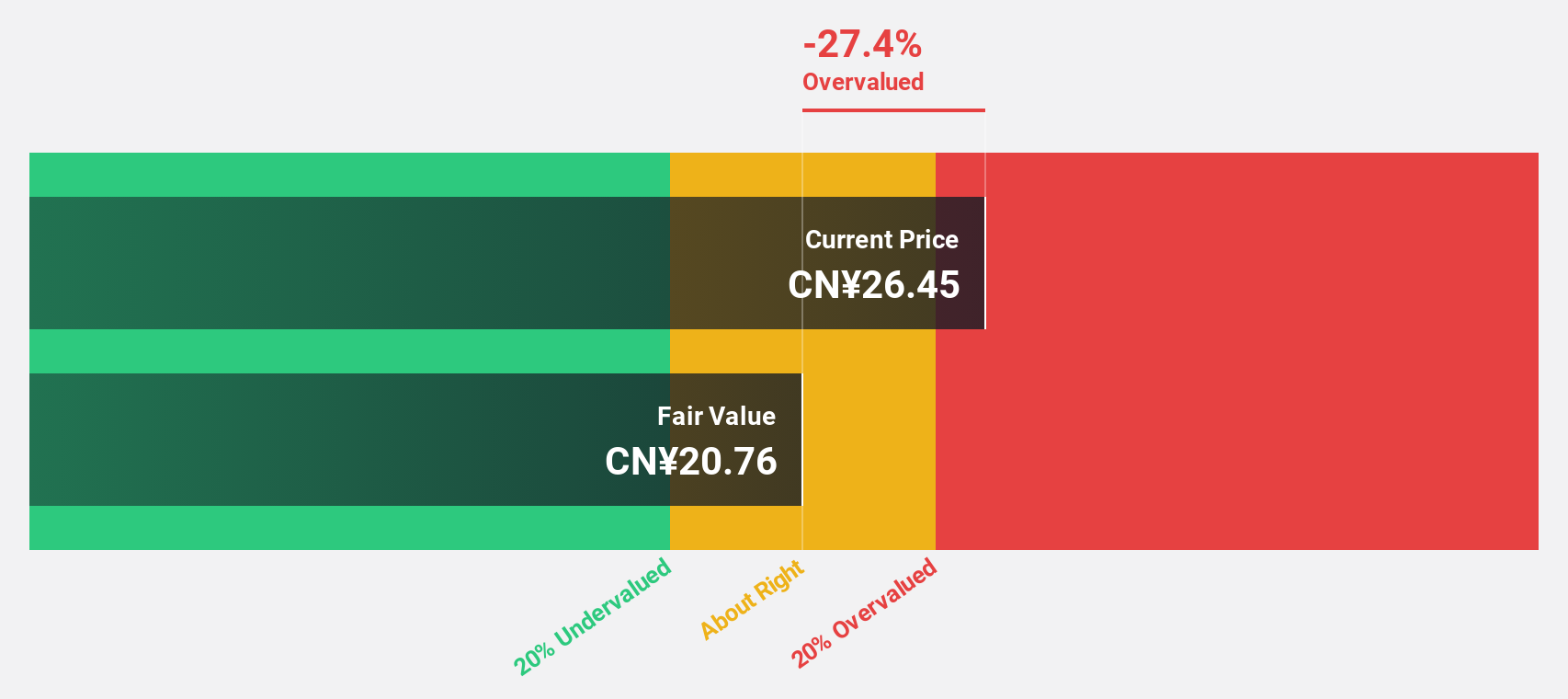

Estimated Discount To Fair Value: 29.5%

Kuaijishan Shaoxing Rice Wine Co., Ltd. is trading at CN¥14.6, significantly below its estimated fair value of CN¥20.7, highlighting undervaluation based on cash flows. Despite a dividend yield of 2.74% not being well covered by earnings, the company reported increased sales and net income for 2024, with forecasts predicting significant annual earnings growth over the next three years and revenue growth outpacing the Chinese market average.

- Insights from our recent growth report point to a promising forecast for Kuaijishan Shaoxing Rice Wine's business outlook.

- Dive into the specifics of Kuaijishan Shaoxing Rice Wine here with our thorough financial health report.

Taking Advantage

- Click this link to deep-dive into the 256 companies within our Undervalued Asian Stocks Based On Cash Flows screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaijishan Shaoxing Rice Wine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601579

Kuaijishan Shaoxing Rice Wine

Produces, processes, and sells rice wine in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives