As global markets navigate the impact of rising U.S. Treasury yields, investors are closely watching how these shifts influence equity performance, particularly with large-cap and growth stocks showing resilience amidst broader market pressures. In this environment of cautious economic growth and evolving monetary policies, dividend stocks can offer a stable income stream and potential for capital appreciation, making them an attractive consideration for those seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.20% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.93% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.00% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.03% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.92% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2013 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

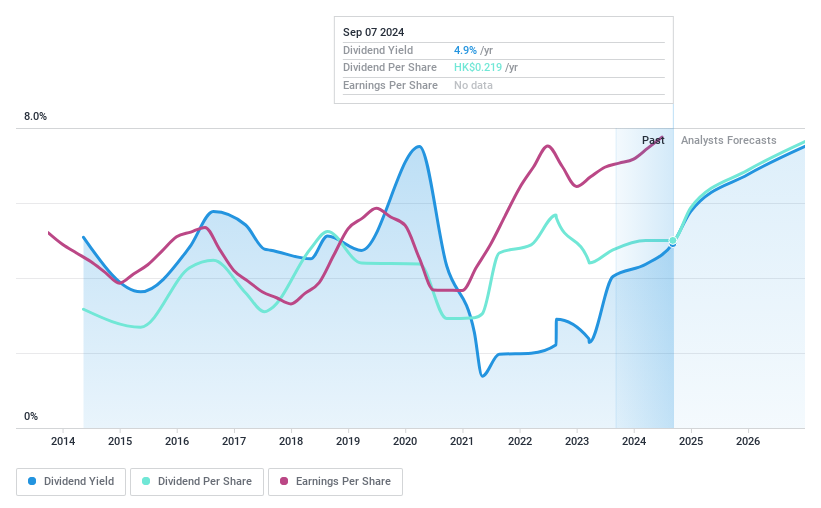

Xtep International Holdings (SEHK:1368)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xtep International Holdings Limited is a company that designs, develops, manufactures, and markets sports footwear, apparel, and accessories for adults and children in China with a market cap of HK$14.67 billion.

Operations: Xtep International Holdings Limited's revenue is derived from three main segments: Athleisure (CN¥1.68 billion), Mass Market (CN¥12.31 billion), and Professional Sports (CN¥1.04 billion).

Dividend Yield: 3.8%

Xtep International Holdings' dividend profile shows mixed signals for investors. While the company has increased its interim dividend to HK$0.156 per share, dividends have been volatile over the past decade, with periods of significant drops. Despite this instability, dividends are well-covered by earnings and cash flows, with a payout ratio of 48.8% and a cash payout ratio of 33.9%. Recent earnings growth supports potential future payouts, though historical volatility remains a concern for stability-focused investors.

- Dive into the specifics of Xtep International Holdings here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Xtep International Holdings shares in the market.

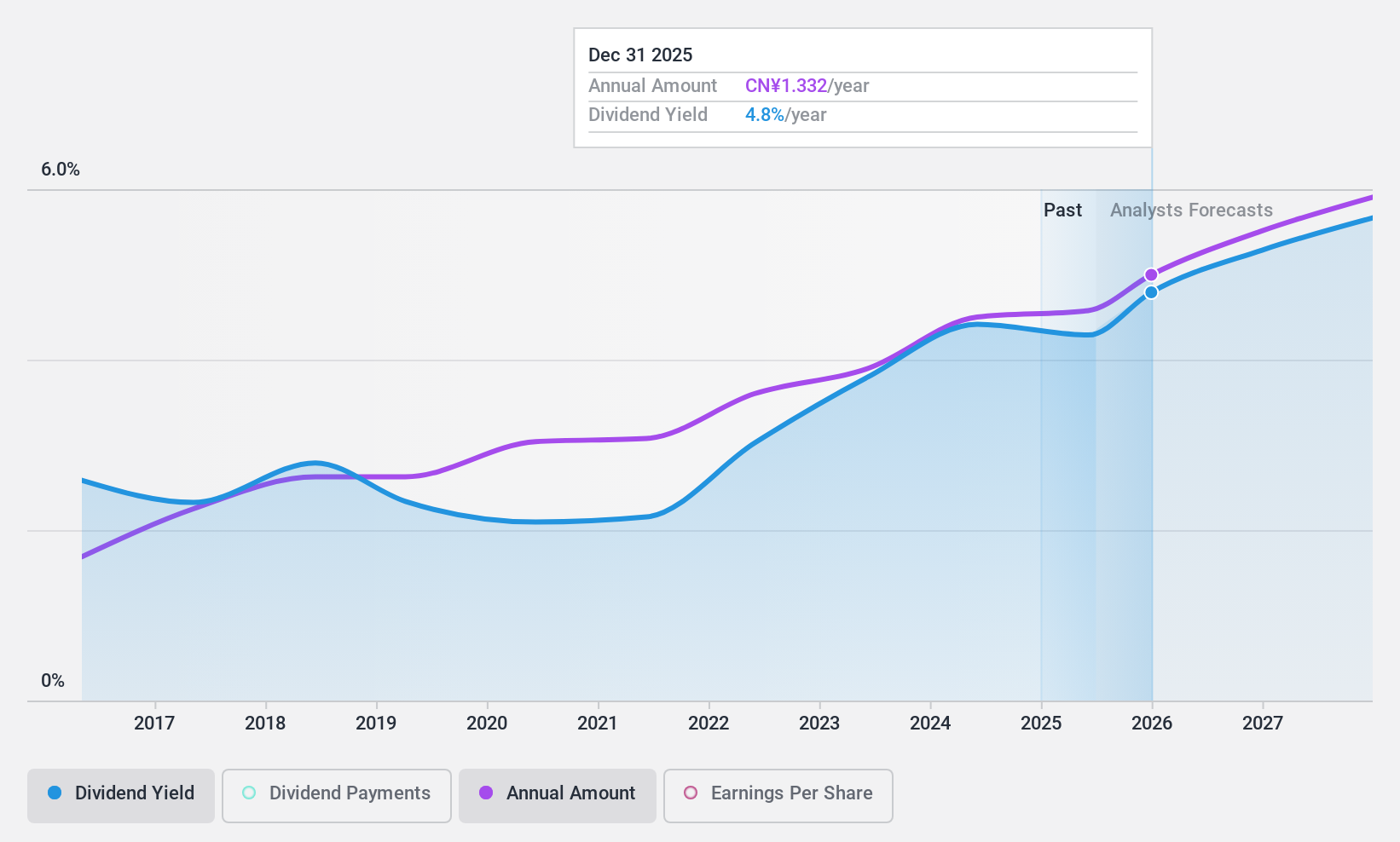

Inner Mongolia Yili Industrial Group (SHSE:600887)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Inner Mongolia Yili Industrial Group Co., Ltd. operates as a leading dairy producer in China, with a market cap of CN¥167.72 billion.

Operations: Inner Mongolia Yili Industrial Group Co., Ltd.'s revenue segments are not specified in the provided text.

Dividend Yield: 4.3%

Inner Mongolia Yili Industrial Group offers a strong dividend profile, with stable and growing payments over the past decade. Its dividend yield of 4.3% ranks in the top quartile of Chinese stocks, supported by a payout ratio of 63.8% and cash payout ratio of 49.5%, ensuring coverage by earnings and cash flows. Despite a recent decline in sales to CNY 88.73 billion for nine months ended September 2024, net income rose to CNY 10.87 billion, reflecting robust profitability that underpins its dividend sustainability.

- Unlock comprehensive insights into our analysis of Inner Mongolia Yili Industrial Group stock in this dividend report.

- The analysis detailed in our Inner Mongolia Yili Industrial Group valuation report hints at an deflated share price compared to its estimated value.

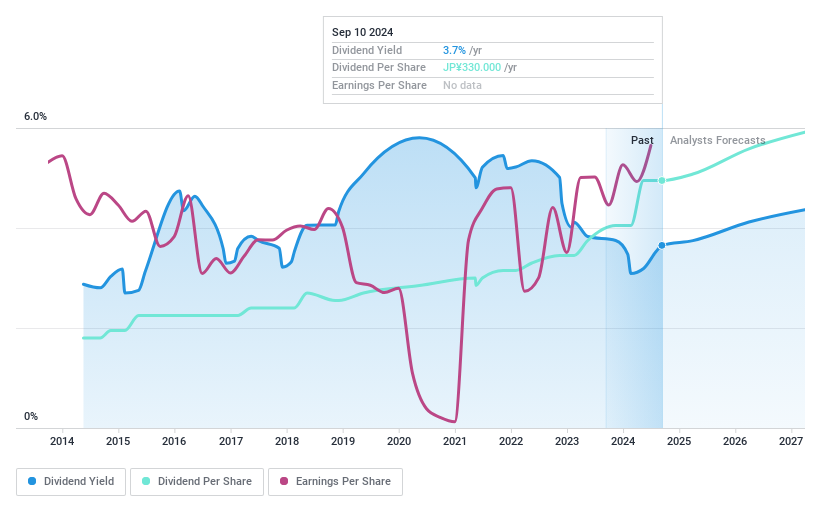

Sumitomo Mitsui Financial Group (TSE:8316)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Mitsui Financial Group, Inc., along with its subsidiaries, offers a range of services including banking, leasing, securities, and consumer finance across Japan and several international regions such as the Americas, Europe, the Middle East, Asia, and Oceania; it has a market cap of ¥12.83 trillion.

Operations: Sumitomo Mitsui Financial Group's revenue is primarily derived from its Global Business Unit (¥1.40 billion), Retail Business Unit (¥1.32 billion), Wholesale Business Sector (¥866.40 million), and Market Business Unit (¥545.40 million).

Dividend Yield: 3.4%

Sumitomo Mitsui Financial Group offers a stable dividend history with consistent growth over the past decade. The dividend yield of 3.36% is reliable, though it falls short compared to the top 25% of Japanese dividend payers. A low payout ratio of 35.8% indicates dividends are well covered by earnings, enhancing sustainability. Recent financial performance shows increased net income and interest income, supporting its capacity to maintain dividends despite a low allowance for bad loans at 89%.

- Navigate through the intricacies of Sumitomo Mitsui Financial Group with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Sumitomo Mitsui Financial Group's share price might be too pessimistic.

Where To Now?

- Click here to access our complete index of 2013 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Inner Mongolia Yili Industrial Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600887

Inner Mongolia Yili Industrial Group

Inner Mongolia Yili Industrial Group Co., Ltd.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives