- China

- /

- Consumer Durables

- /

- SHSE:603833

Asian Dividend Stocks: Inner Mongolia Yili Industrial Group And 2 Other Leading Choices

Reviewed by Simply Wall St

As global markets grapple with heightened uncertainty due to unexpected tariff announcements, investors are increasingly focused on the potential impacts on economic growth and inflation. In this volatile environment, dividend stocks in Asia offer a compelling option for those seeking stability and income, with Inner Mongolia Yili Industrial Group being one of the notable choices.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.94% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.19% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.90% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.58% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.75% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.65% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.17% | ★★★★★★ |

| Torigoe (TSE:2009) | 5.34% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.64% | ★★★★★★ |

Click here to see the full list of 1220 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

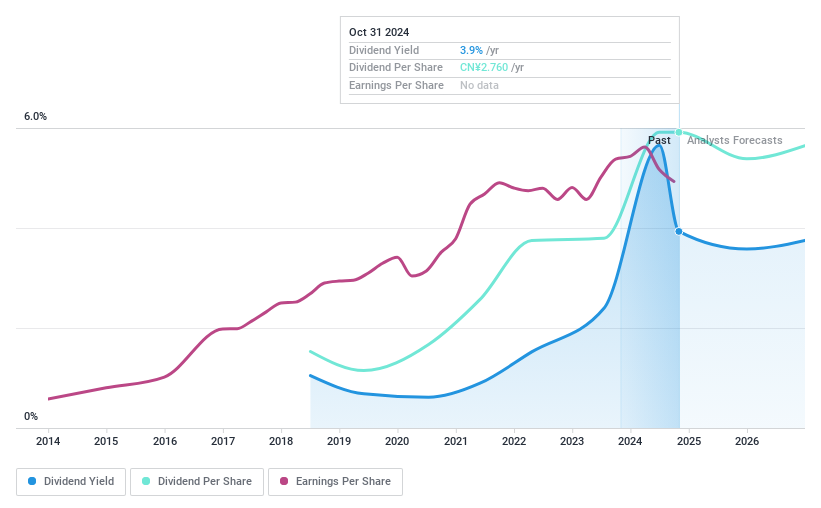

Inner Mongolia Yili Industrial Group (SHSE:600887)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Inner Mongolia Yili Industrial Group Co., Ltd. operates as a major player in the dairy industry, providing a wide range of dairy products, with a market cap of CN¥182.24 billion.

Operations: Inner Mongolia Yili Industrial Group Co., Ltd. generates its revenue primarily from various segments within the dairy industry, though specific segment details are not provided in the available text.

Dividend Yield: 4.2%

Inner Mongolia Yili Industrial Group offers a compelling dividend profile, with stable and growing payments over the past decade. Its dividends are well-covered by both earnings (payout ratio: 63.8%) and cash flows (cash payout ratio: 49.5%). The dividend yield of 4.18% places it in the top quartile among Chinese stocks, suggesting attractiveness for income-focused investors. Additionally, Yili's recent financial services agreement renewal supports operational stability and potential continued profitability improvements.

- Click to explore a detailed breakdown of our findings in Inner Mongolia Yili Industrial Group's dividend report.

- Upon reviewing our latest valuation report, Inner Mongolia Yili Industrial Group's share price might be too pessimistic.

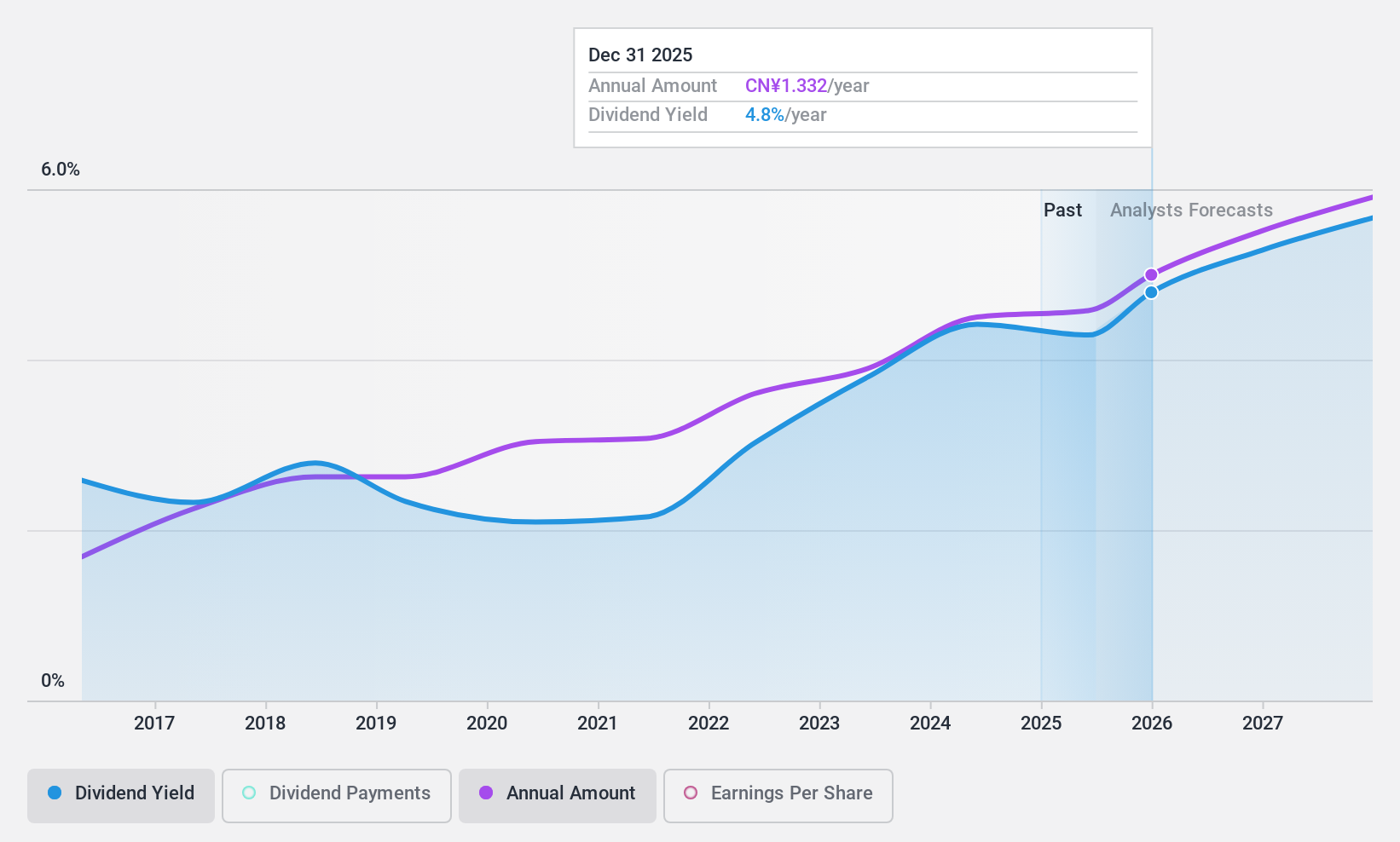

Oppein Home Group (SHSE:603833)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oppein Home Group Inc. is a cabinetry manufacturer operating in Asia with a market cap of approximately CN¥40.39 billion.

Operations: Oppein Home Group Inc. generates revenue primarily from its Building Products segment, which accounts for CN¥20.10 billion.

Dividend Yield: 4.1%

Oppein Home Group's dividend yield of 4.14% ranks in the top 25% of Chinese dividend payers, indicating potential appeal for income investors. While dividends are covered by earnings (payout ratio: 61.1%) and cash flows (cash payout ratio: 82.2%), their reliability is questionable due to volatility over the past seven years. The price-to-earnings ratio of 14.7x suggests good value compared to the broader CN market, yet historical instability may concern cautious investors.

- Delve into the full analysis dividend report here for a deeper understanding of Oppein Home Group.

- Our comprehensive valuation report raises the possibility that Oppein Home Group is priced higher than what may be justified by its financials.

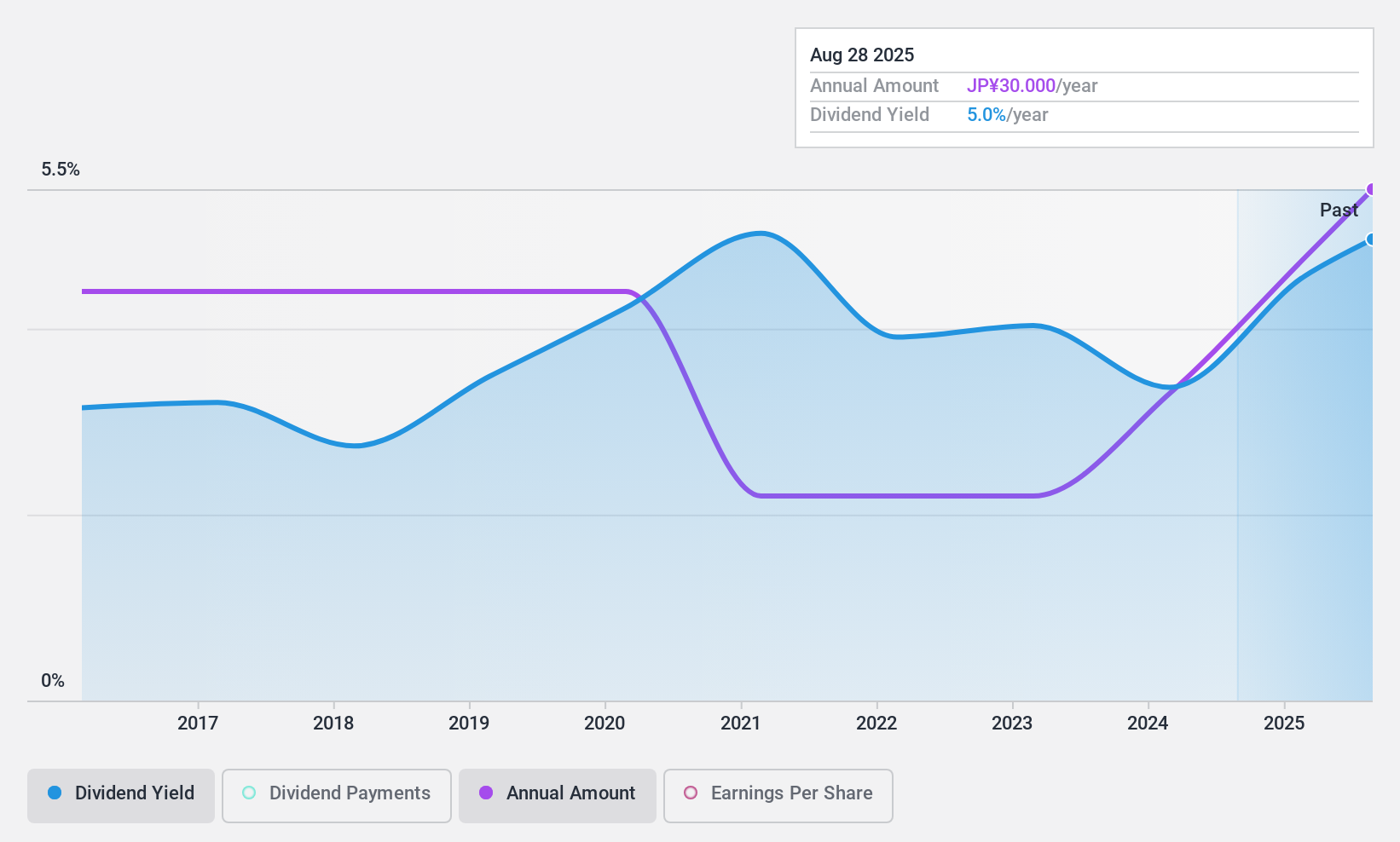

Onward Holdings (TSE:8016)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Onward Holdings Co., Ltd. designs, manufactures, and sells men's, women's, and children's apparel across Japan, China, the United Kingdom, and the United States with a market cap of approximately ¥73.84 billion.

Operations: Onward Holdings Co., Ltd. generates revenue primarily from its Domestic Business segment, which accounts for ¥191.50 billion, and its Overseas Business segment, contributing ¥21.76 billion.

Dividend Yield: 5.5%

Onward Holdings' dividend yield is among the top 25% in Japan, but its sustainability is questionable due to a high cash payout ratio of 716.9%, indicating dividends are not well covered by free cash flows. While earnings cover the payments with a low payout ratio of 41.4%, past volatility and unreliability raise concerns. Recent guidance suggests a decrease in future dividends, reflecting financial caution despite previous growth in profits and revenue.

- Get an in-depth perspective on Onward Holdings' performance by reading our dividend report here.

- Our expertly prepared valuation report Onward Holdings implies its share price may be too high.

Next Steps

- Delve into our full catalog of 1220 Top Asian Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603833

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives