- China

- /

- Specialty Stores

- /

- SHSE:605599

3 Asian Dividend Stocks Yielding Up To 5.7%

Reviewed by Simply Wall St

As global markets grapple with uncertainties surrounding trade policies and economic growth, investors are increasingly looking towards Asia for opportunities, particularly in dividend stocks that offer stable returns amid volatility. In this environment, selecting dividend stocks with strong fundamentals and consistent payout histories can be a prudent strategy for those seeking to balance risk and income potential.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.66% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.02% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.12% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.85% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.32% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.22% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

Click here to see the full list of 1131 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

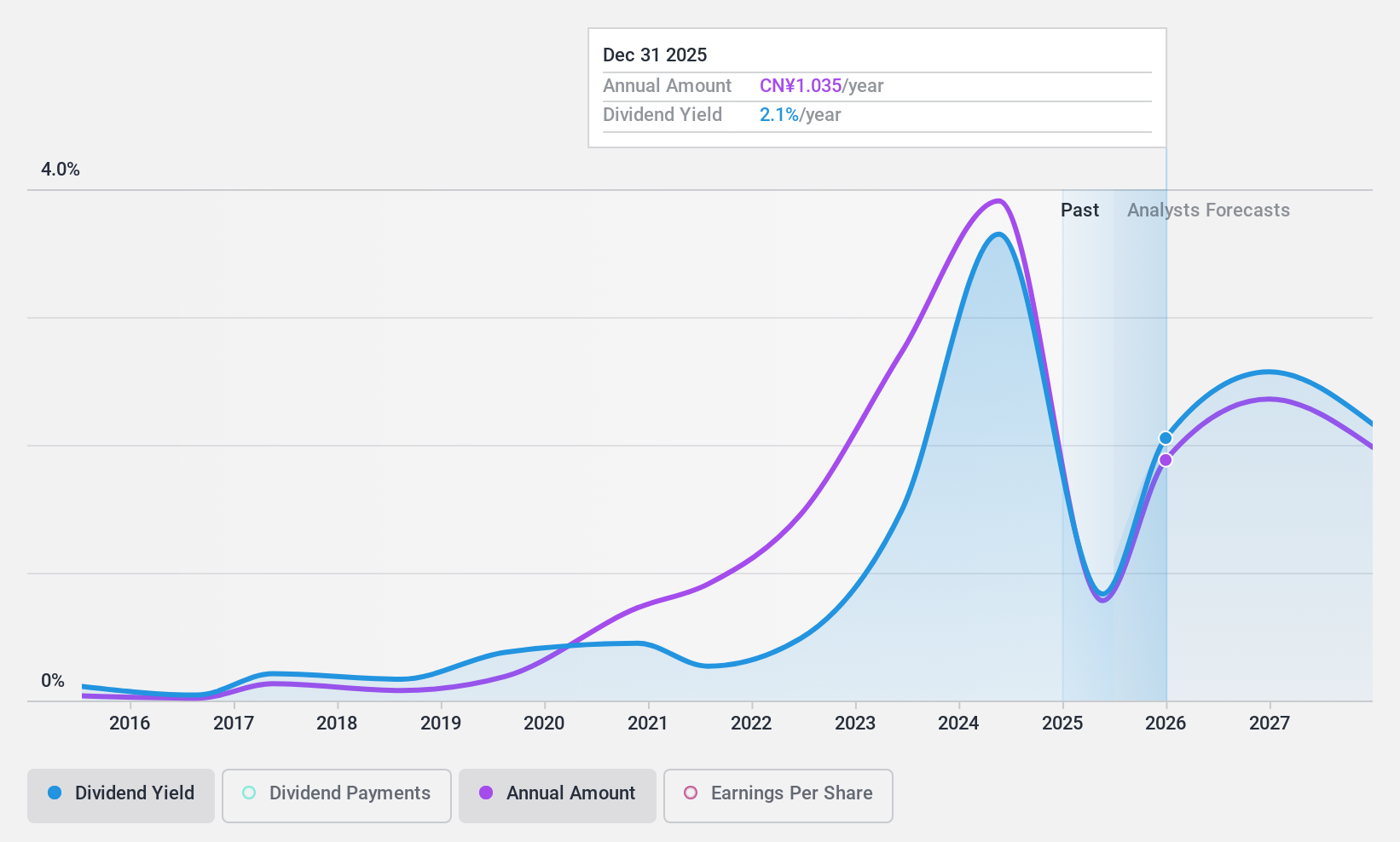

Shede Spirits (SHSE:600702)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shede Spirits Co., Ltd. designs, produces, and sells liquor products in China with a market cap of CN¥19.70 billion.

Operations: Shede Spirits Co., Ltd. generates its revenue from the design, production, and sale of liquor products in China.

Dividend Yield: 3.6%

Shede Spirits, while offering a dividend yield of 3.61%, faces challenges with its dividend sustainability due to the lack of free cash flow coverage and volatile payment history over the past decade. Despite trading at a significant discount to its estimated fair value and having dividends covered by earnings through a reasonable payout ratio, profit margins have decreased from last year. Recent share buybacks totaling CNY 0.39 million highlight efforts to enhance shareholder value amidst these concerns.

- Delve into the full analysis dividend report here for a deeper understanding of Shede Spirits.

- Our valuation report here indicates Shede Spirits may be undervalued.

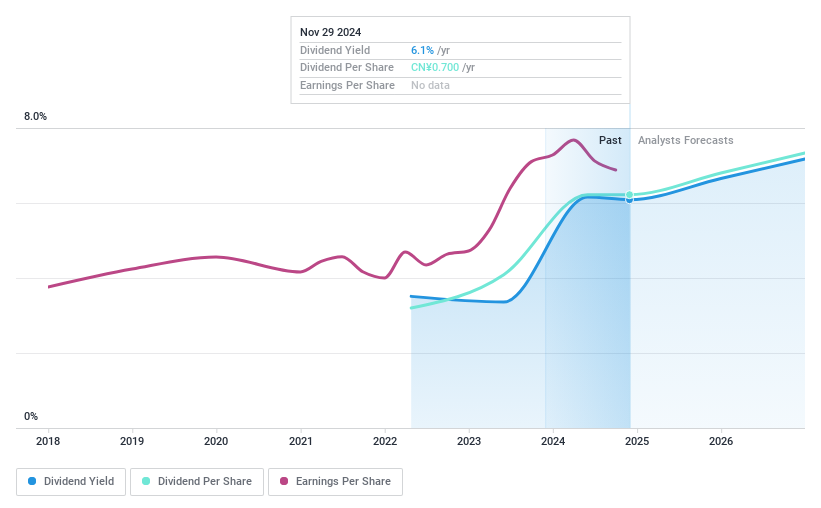

Beijing Caishikou Department StoreLtd (SHSE:605599)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Caishikou Department Store Co., Ltd. operates as a retail company, focusing on department store services, and has a market cap of CN¥9.45 billion.

Operations: Beijing Caishikou Department Store Ltd. generates revenue primarily from the sale of gold and jewellery, amounting to CN¥19.53 billion.

Dividend Yield: 5.8%

Beijing Caishikou Department Store Ltd. offers a dividend yield of 5.76%, placing it in the top 25% of CN market payers, with stable payments over three years. The dividends are well-covered by earnings (81.4% payout ratio) and cash flows (61.6%), suggesting sustainability despite its short dividend history. Trading at 72.9% below fair value estimates, analysts expect a price rise of 23.1%. Earnings are projected to grow annually by 11.36%.

- Get an in-depth perspective on Beijing Caishikou Department StoreLtd's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Beijing Caishikou Department StoreLtd shares in the market.

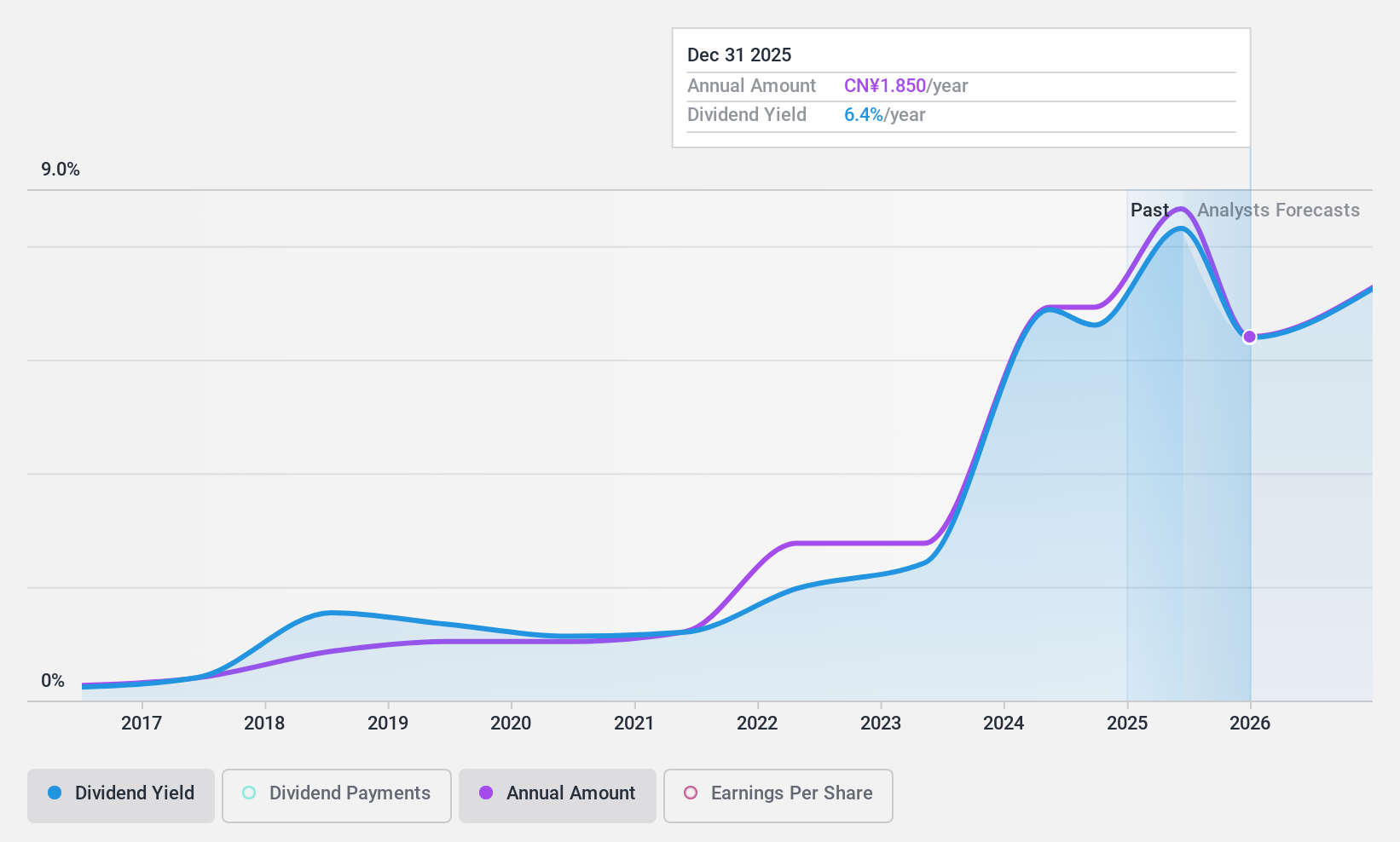

Shandong Wit Dyne HealthLtd (SZSE:000915)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shandong Wit Dyne Health Co., Ltd. operates in the pharmaceutical sector in China with a market capitalization of CN¥6.62 billion.

Operations: Shandong Wit Dyne Health Co., Ltd.'s revenue segments include its pharmaceutical operations in China.

Dividend Yield: 3.5%

Shandong Wit Dyne Health Ltd. offers a dividend yield of 3.54%, ranking in the top 25% of payers in China, though dividends are not well covered by earnings due to a high payout ratio (119.6%). Despite this, cash flows adequately cover dividends with a low cash payout ratio (32%). The stock trades at 43.2% below estimated fair value but has shown volatile and unreliable dividend payments over the past decade. Recent board changes may impact future strategies.

- Click here and access our complete dividend analysis report to understand the dynamics of Shandong Wit Dyne HealthLtd.

- In light of our recent valuation report, it seems possible that Shandong Wit Dyne HealthLtd is trading behind its estimated value.

Next Steps

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1128 more companies for you to explore.Click here to unveil our expertly curated list of 1131 Top Asian Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Caishikou Department StoreLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605599

Beijing Caishikou Department StoreLtd

Beijing Caishikou Department Store Co.,Ltd.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives