Tonghua Grape WineLtd (SHSE:600365 shareholders incur further losses as stock declines 11% this week, taking five-year losses to 39%

Ideally, your overall portfolio should beat the market average. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in Tonghua Grape Wine Co.,Ltd (SHSE:600365), since the last five years saw the share price fall 39%. And we doubt long term believers are the only worried holders, since the stock price has declined 24% over the last twelve months. Unfortunately the share price momentum is still quite negative, with prices down 12% in thirty days. However, we note the price may have been impacted by the broader market, which is down 8.8% in the same time period.

Since Tonghua Grape WineLtd has shed CN¥137m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Tonghua Grape WineLtd

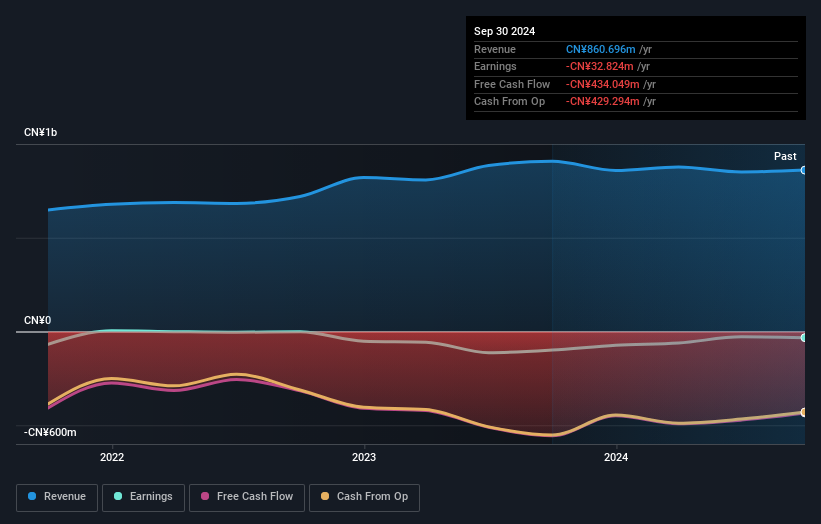

Tonghua Grape WineLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Tonghua Grape WineLtd saw its revenue increase by 1.5% per year. That's not a very high growth rate considering it doesn't make profits. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 7% (annualized) in the same time frame. The key question is whether the company can make it to profitability, and beyond, without trouble. It could be worth putting it on your watchlist and revisiting when it makes its maiden profit.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Tonghua Grape WineLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Tonghua Grape WineLtd had a tough year, with a total loss of 24%, against a market gain of about 6.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Tonghua Grape WineLtd better, we need to consider many other factors. Take risks, for example - Tonghua Grape WineLtd has 2 warning signs we think you should be aware of.

Of course Tonghua Grape WineLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tonghua Grape WineLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600365

Tonghua Grape WineLtd

Manufactures and sells fruit wines and wine in China.

Mediocre balance sheet low.

Market Insights

Community Narratives