- China

- /

- Oil and Gas

- /

- SZSE:002259

Asian Penny Stocks To Consider In April 2025

Reviewed by Simply Wall St

Amidst global market fluctuations and trade uncertainties, Asian markets have been navigating a complex landscape. For investors willing to explore beyond the well-known giants, penny stocks—often representing smaller or newer companies—remain an intriguing investment area. Despite being considered a somewhat outdated term, these stocks can offer unique growth opportunities when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.70 | THB1.71B | ✅ 2 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.45 | SGD182.38M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.101 | SGD42.92M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.193 | SGD38.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.06 | SGD8.11B | ✅ 5 ⚠️ 0 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$3.33 | HK$1.37B | ✅ 4 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$44.67B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.03 | HK$649.88M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.04 | HK$1.73B | ✅ 4 ⚠️ 2 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥2.97 | CN¥3.44B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,152 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

China Zheshang Bank (SEHK:2016)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Zheshang Bank Co., Ltd. offers a range of commercial banking products and services across Mainland China, with a market cap of HK$83.30 billion.

Operations: The bank's revenue is primarily derived from Corporate Banking at CN¥22.30 billion, followed by Treasury Business at CN¥12.11 billion and Retail Banking at CN¥2.77 billion.

Market Cap: HK$83.3B

China Zheshang Bank, with a market cap of HK$83.30 billion, derives significant revenue from corporate banking (CN¥22.30 billion) and treasury business (CN¥12.11 billion). The bank maintains primarily low-risk funding through customer deposits, reflected in its appropriate loans to deposits ratio of 83%. Despite trading at a good value compared to peers and industry standards, the bank's return on equity remains low at 7.7%. Recent executive changes include Mr. Chen Haiqiang's appointment as acting president, subject to regulatory approval, while the dividend track record has shown instability with recent decreases announced for 2024.

- Click here and access our complete financial health analysis report to understand the dynamics of China Zheshang Bank.

- Gain insights into China Zheshang Bank's outlook and expected performance with our report on the company's earnings estimates.

Sichuan Shengda Forestry Industry (SZSE:002259)

Simply Wall St Financial Health Rating: ★★★★☆☆

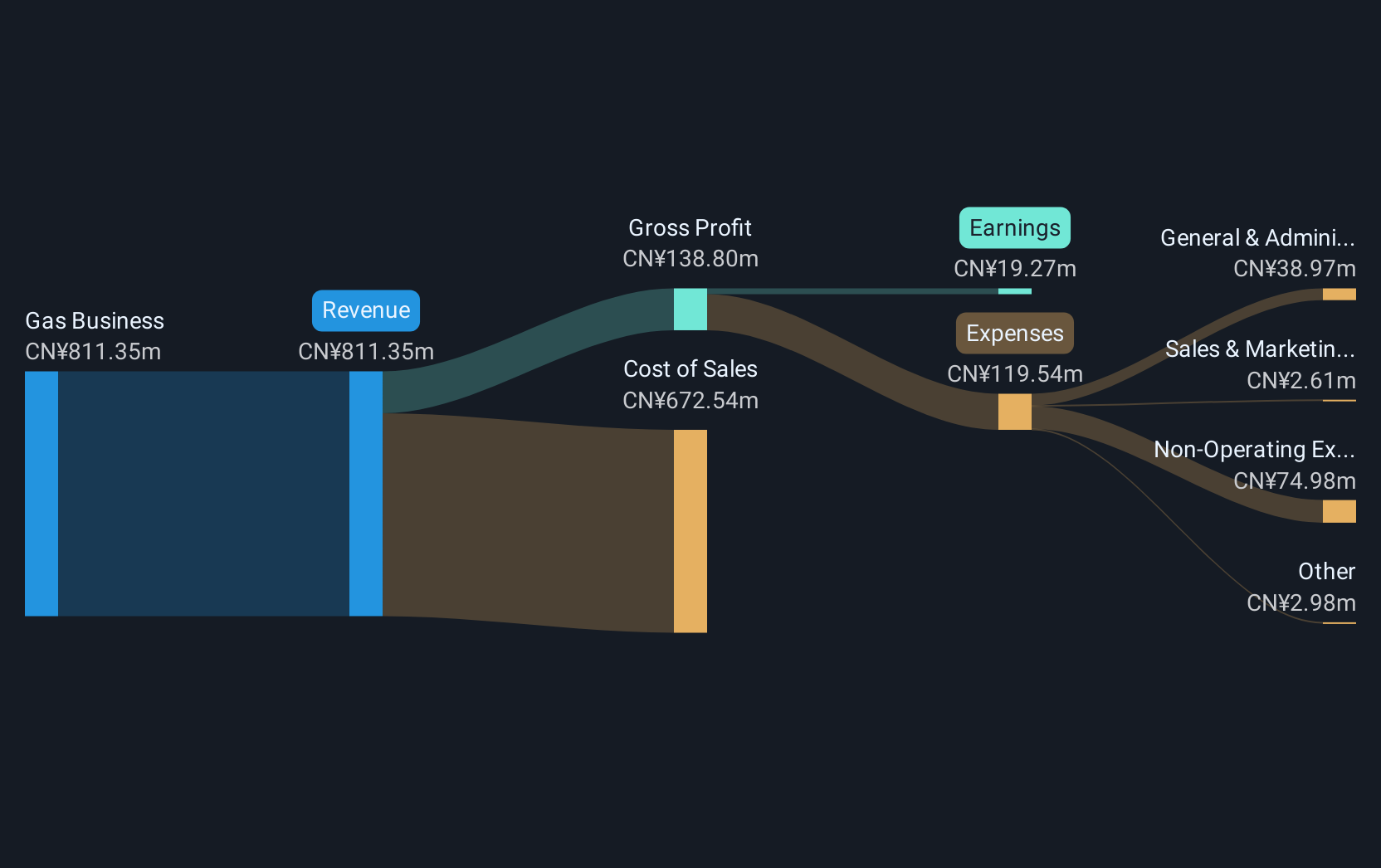

Overview: Sichuan Shengda Forestry Industry Co., Ltd is involved in the production and sale of liquefied natural gas (LNG) in China, with a market cap of CN¥1.99 billion.

Operations: The company's revenue is primarily derived from its gas business, which generated CN¥685.80 million.

Market Cap: CN¥1.99B

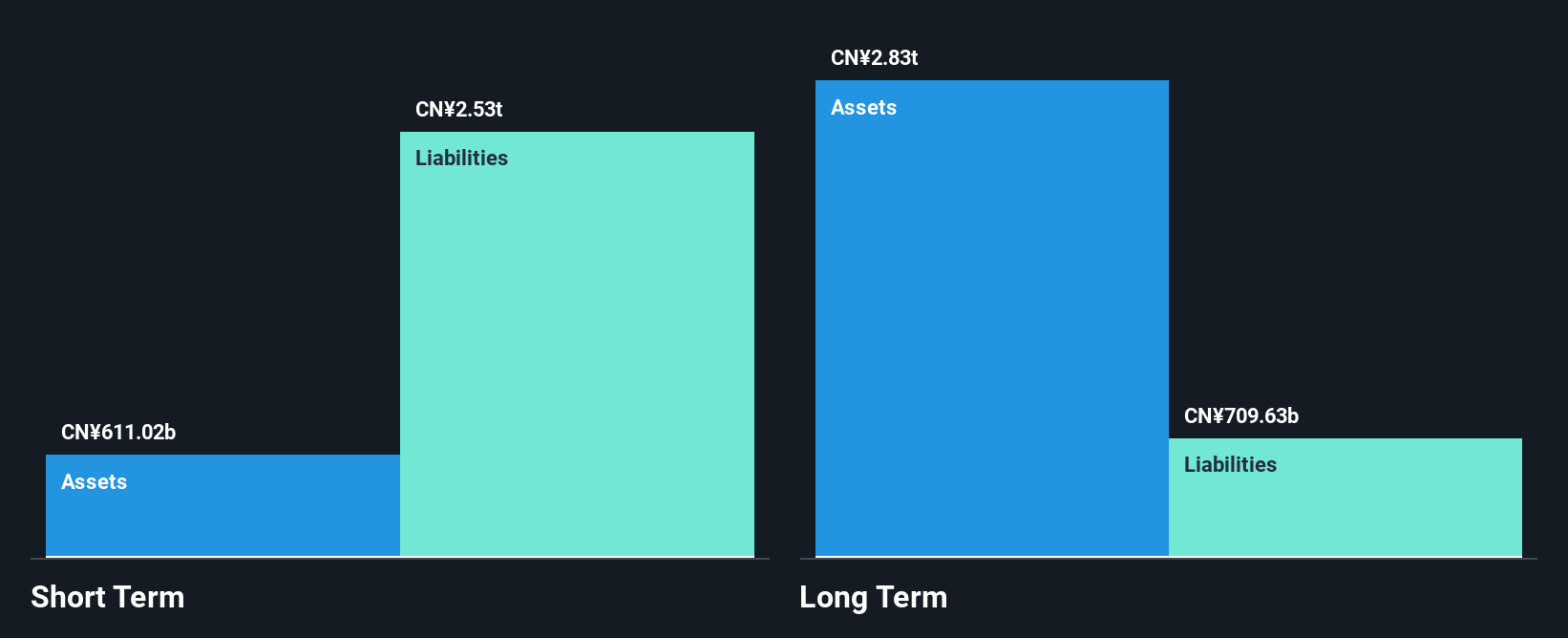

Sichuan Shengda Forestry Industry, with a market cap of CN¥1.99 billion, is focused on the LNG sector in China. Despite being unprofitable, the company has managed to reduce its losses by 64.7% annually over five years and maintains a positive free cash flow trajectory that supports a cash runway exceeding three years. Its short-term assets cover short-term liabilities but fall short against long-term obligations. While debt levels have increased to 61% from 34.8%, the company holds more cash than total debt, mitigating immediate financial risks without significant shareholder dilution recently observed.

- Dive into the specifics of Sichuan Shengda Forestry Industry here with our thorough balance sheet health report.

- Understand Sichuan Shengda Forestry Industry's track record by examining our performance history report.

Shenzhen Hemei GroupLTD (SZSE:002356)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shenzhen Hemei Group Co., LTD. operates in the sale of clothing and accessories both in China and internationally, with a market cap of CN¥3.86 billion.

Operations: Shenzhen Hemei Group Co., LTD. has not reported any specific revenue segments.

Market Cap: CN¥3.86B

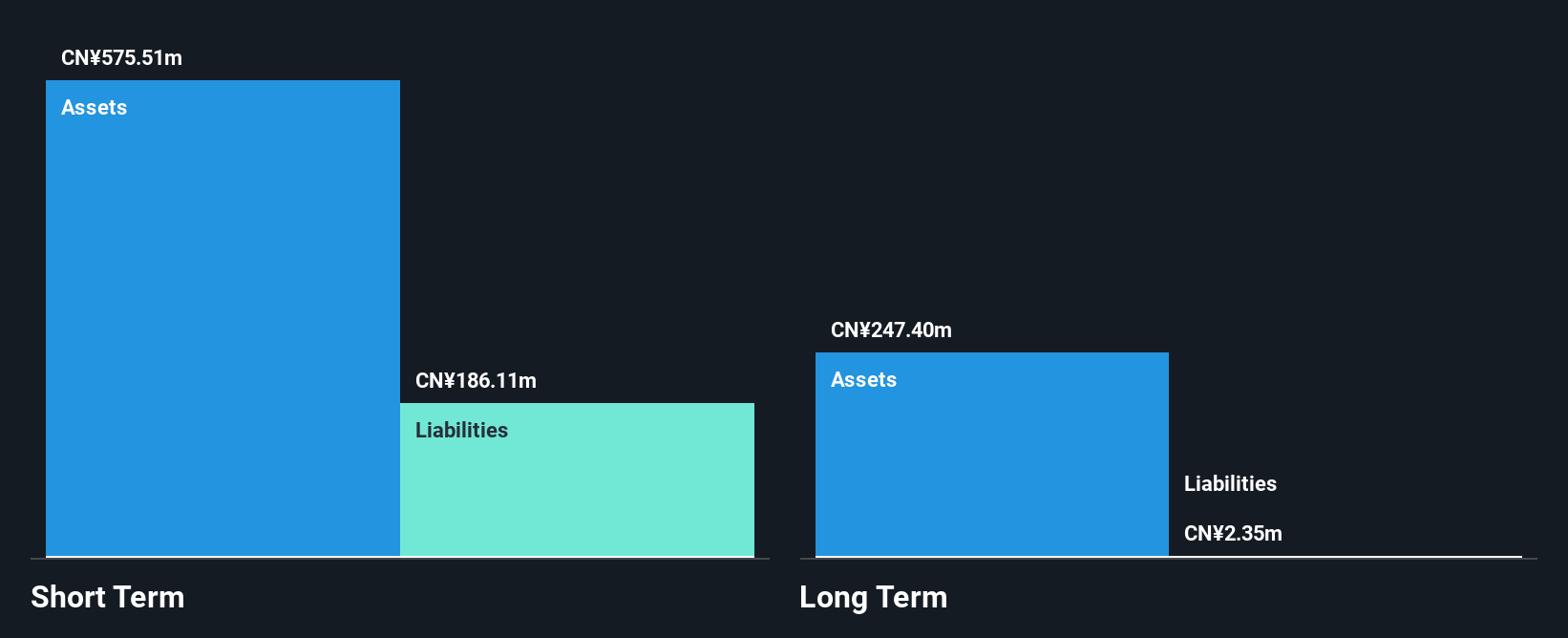

Shenzhen Hemei Group Co., LTD., with a market cap of CN¥3.86 billion, remains unprofitable but has reduced its losses by 55.7% annually over the past five years and is debt-free. The company's short-term assets of CN¥649.8 million exceed both its short-term and long-term liabilities, suggesting financial stability despite negative return on equity at -12.22%. It has a cash runway exceeding one year based on current free cash flow levels, offering some buffer against operational uncertainties. Recently, Scorpio No. 36 Private Securities Investment Fund acquired a 5% stake for approximately CN¥190 million, indicating investor interest in the company’s potential turnaround prospects.

- Navigate through the intricacies of Shenzhen Hemei GroupLTD with our comprehensive balance sheet health report here.

- Assess Shenzhen Hemei GroupLTD's previous results with our detailed historical performance reports.

Make It Happen

- Dive into all 1,152 of the Asian Penny Stocks we have identified here.

- Searching for a Fresh Perspective? Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002259

Sichuan Shengda Forestry Industry

Engages in the production and sale of liquefied natural gas (LNG) in China.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives