- China

- /

- Oil and Gas

- /

- SZSE:000937

Market Cool On Jizhong Energy Resources Co., Ltd.'s (SZSE:000937) Revenues

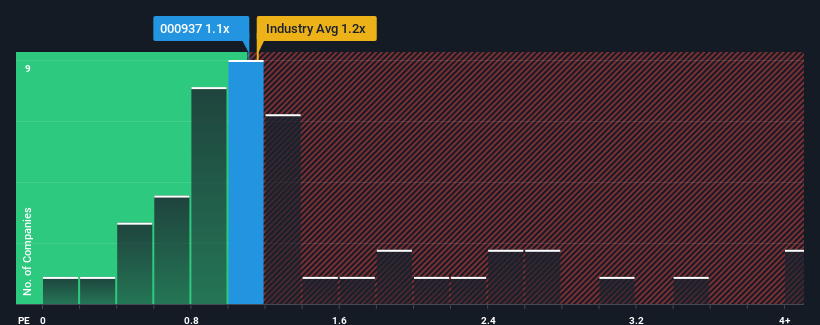

With a median price-to-sales (or "P/S") ratio of close to 1.2x in the Oil and Gas industry in China, you could be forgiven for feeling indifferent about Jizhong Energy Resources Co., Ltd.'s (SZSE:000937) P/S ratio of 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Jizhong Energy Resources

What Does Jizhong Energy Resources' P/S Mean For Shareholders?

Jizhong Energy Resources has been struggling lately as its revenue has declined faster than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. You'd much rather the company improve its revenue if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Jizhong Energy Resources will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Jizhong Energy Resources?

Jizhong Energy Resources' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 29% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 10% over the next year. That's shaping up to be materially higher than the 6.0% growth forecast for the broader industry.

In light of this, it's curious that Jizhong Energy Resources' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Jizhong Energy Resources' P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Jizhong Energy Resources currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Jizhong Energy Resources that you need to be mindful of.

If you're unsure about the strength of Jizhong Energy Resources' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000937

Moderate growth potential with imperfect balance sheet.

Market Insights

Community Narratives