- China

- /

- Oil and Gas

- /

- SZSE:000159

Take Care Before Jumping Onto Xinjiang International Industry Co.,Ltd (SZSE:000159) Even Though It's 25% Cheaper

Xinjiang International Industry Co.,Ltd (SZSE:000159) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 15% in that time.

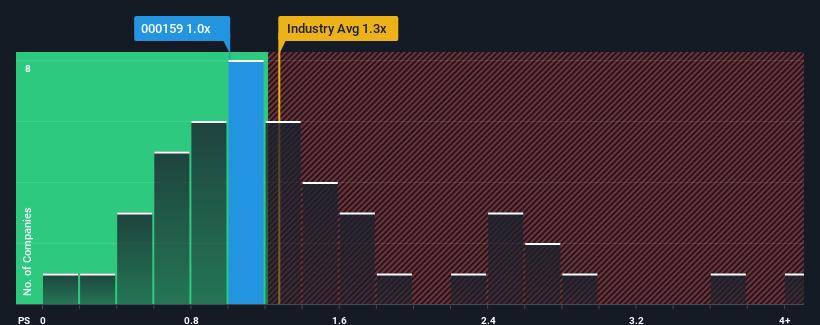

Even after such a large drop in price, there still wouldn't be many who think Xinjiang International IndustryLtd's price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in China's Oil and Gas industry is similar at about 1.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Xinjiang International IndustryLtd

What Does Xinjiang International IndustryLtd's Recent Performance Look Like?

For example, consider that Xinjiang International IndustryLtd's financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Xinjiang International IndustryLtd will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Xinjiang International IndustryLtd?

Xinjiang International IndustryLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 49% decrease to the company's top line. Still, the latest three year period has seen an excellent 211% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 6.3% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Xinjiang International IndustryLtd is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Xinjiang International IndustryLtd looks to be in line with the rest of the Oil and Gas industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Xinjiang International IndustryLtd currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Xinjiang International IndustryLtd (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000159

Xinjiang International IndustryLtd

Engages in the oil and petrochemical, real estate, international trade, and investment businesses in China and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives