- China

- /

- Oil and Gas

- /

- SHSE:601872

Investors Aren't Entirely Convinced By China Merchants Energy Shipping Co., Ltd.'s (SHSE:601872) Earnings

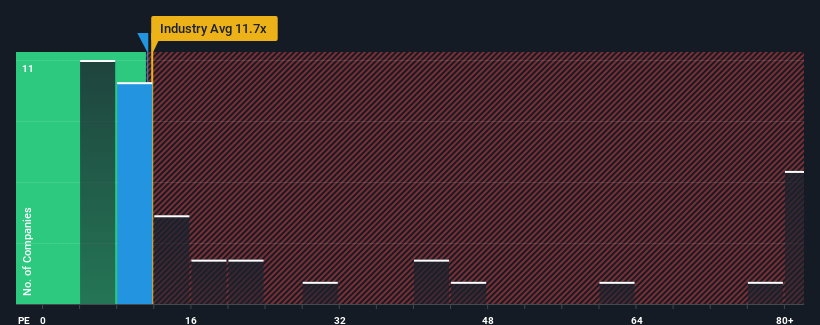

With a price-to-earnings (or "P/E") ratio of 11.2x China Merchants Energy Shipping Co., Ltd. (SHSE:601872) may be sending very bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 55x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

China Merchants Energy Shipping's negative earnings growth of late has neither been better nor worse than most other companies. It might be that many expect the company's earnings performance to degrade further, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

Check out our latest analysis for China Merchants Energy Shipping

Is There Any Growth For China Merchants Energy Shipping?

The only time you'd be truly comfortable seeing a P/E as depressed as China Merchants Energy Shipping's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 1.6%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 37% as estimated by the seven analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 41%, which is not materially different.

With this information, we find it odd that China Merchants Energy Shipping is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From China Merchants Energy Shipping's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of China Merchants Energy Shipping's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

It is also worth noting that we have found 2 warning signs for China Merchants Energy Shipping that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

If you're looking to trade China Merchants Energy Shipping, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601872

China Merchants Energy Shipping

China Merchants Energy Shipping Co., Ltd.

Average dividend payer and fair value.