- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:1919

3 Asian Dividend Stocks Yielding Over 4.7% To Boost Your Portfolio

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and geopolitical uncertainties, Asian markets have shown resilience, with some indices maintaining steady performance amid these challenges. In this environment, dividend stocks in Asia present an appealing opportunity for investors seeking stable income streams; selecting stocks with strong fundamentals and consistent payout histories can be particularly advantageous.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.19% | ★★★★★★ |

| NCD (TSE:4783) | 4.44% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.78% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.07% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.99% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.49% | ★★★★★★ |

| Daicel (TSE:4202) | 4.58% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.44% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.38% | ★★★★★★ |

Click here to see the full list of 1092 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

COSCO SHIPPING Holdings (SEHK:1919)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: COSCO SHIPPING Holdings Co., Ltd. is an investment holding company involved in container shipping across the United States, Europe, the Asia Pacific, Mainland China, and internationally, with a market cap of approximately HK$240.49 billion.

Operations: COSCO SHIPPING Holdings Co., Ltd. generates revenue primarily through its container shipping operations across various regions, including the United States, Europe, the Asia Pacific, and Mainland China.

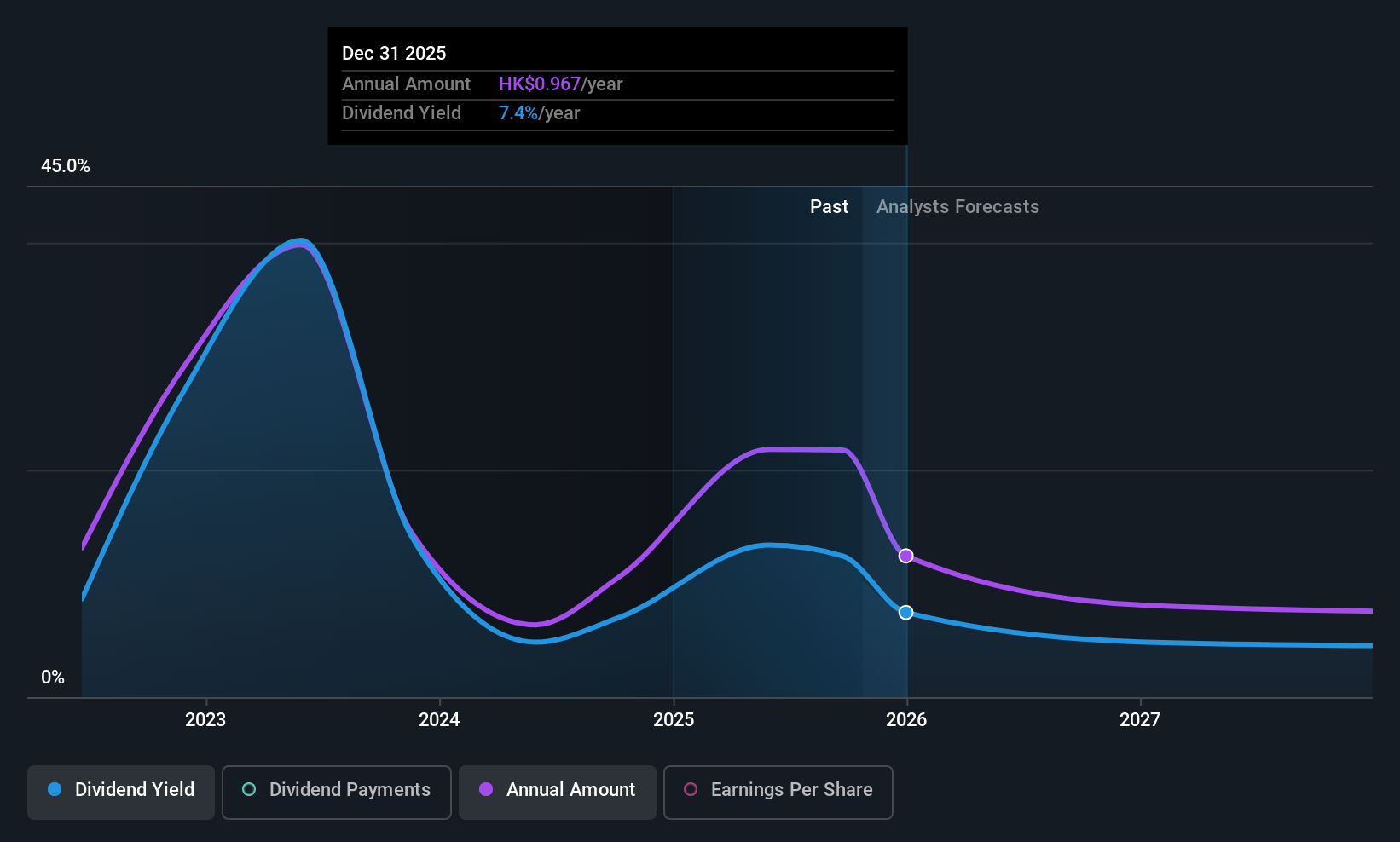

Dividend Yield: 13.4%

COSCO SHIPPING Holdings recently announced a cash dividend of HKD 0.613944 per share, with an ex-dividend date on September 23, 2025. Despite having a volatile dividend history over the past four years, the payout is well-covered by earnings and cash flows, with payout ratios of 50.3% and 49.2%, respectively. The company also completed a significant share buyback program worth HKD 2.15 billion in September, which may positively impact future dividends by reducing outstanding shares.

- Click here to discover the nuances of COSCO SHIPPING Holdings with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of COSCO SHIPPING Holdings shares in the market.

Shaanxi Coal Industry (SHSE:601225)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shaanxi Coal Industry Company Limited, along with its subsidiaries, is engaged in the mining, production, washing, processing, and sale of coal both in China and internationally with a market capitalization of approximately CN¥206.79 billion.

Operations: Shaanxi Coal Industry Company Limited generates revenue through its core activities of coal mining, production, processing, and sales in both domestic and international markets.

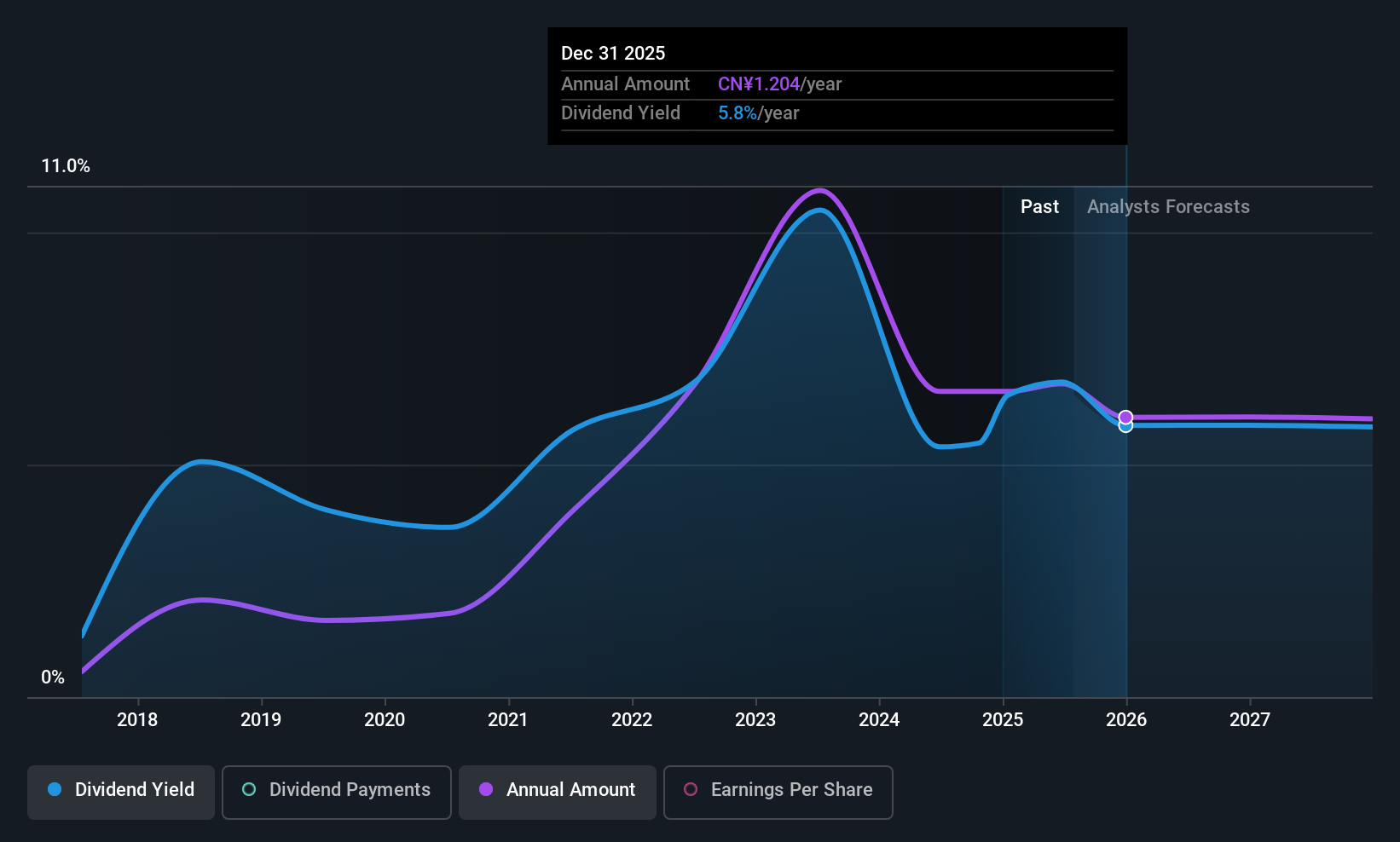

Dividend Yield: 6.3%

Shaanxi Coal Industry's dividend yield of 6.32% ranks in the top 25% of Chinese dividend payers, supported by a payout ratio of 65.2%, indicating coverage by earnings and cash flows. Despite trading at a significant discount to estimated fair value, the company's dividends have been unreliable over the past decade with volatility exceeding annual drops of 20%. Recent financials show decreased sales and net income for H1 2025, impacting overall stability.

- Take a closer look at Shaanxi Coal Industry's potential here in our dividend report.

- The analysis detailed in our Shaanxi Coal Industry valuation report hints at an deflated share price compared to its estimated value.

Central China Land MediaLTD (SZSE:000719)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Central China Land Media CO., LTD, with a market cap of CN¥12.87 billion, operates in China through its subsidiaries by engaging in the editing, production, and marketing of publications.

Operations: Central China Land Media CO., LTD generates revenue from its operations in the editing, production, and marketing of publications within China.

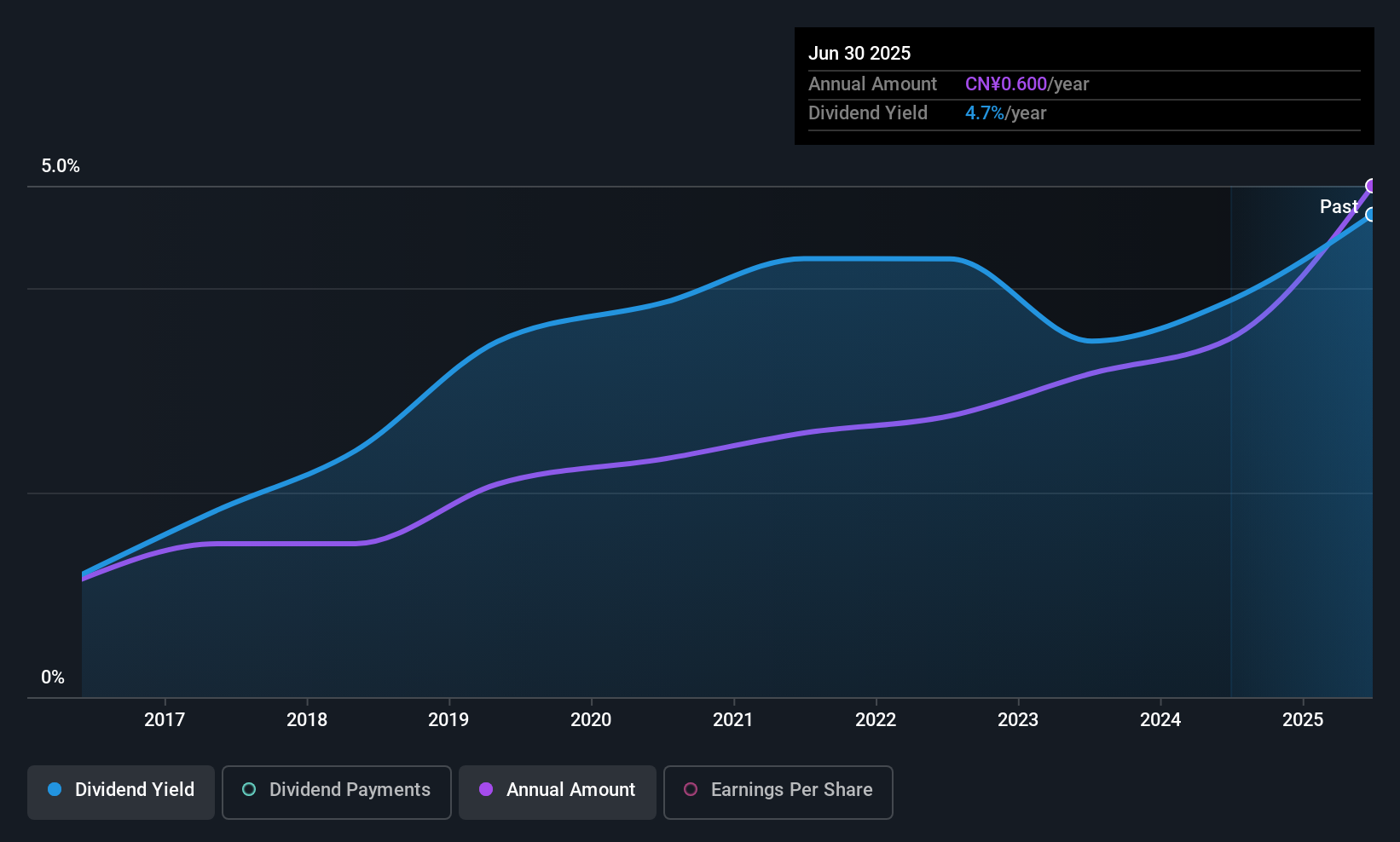

Dividend Yield: 4.8%

Central China Land Media offers a dividend yield of 4.77%, placing it among the top 25% of Chinese dividend payers. The dividends are well-supported by earnings and cash flows, with payout ratios of 51% and 59.6%, respectively, highlighting sustainability. Over the past decade, dividends have grown steadily without volatility. Recent financials show improved performance with net income rising to CNY 531.74 million for H1 2025, enhancing its dividend reliability further.

- Click to explore a detailed breakdown of our findings in Central China Land MediaLTD's dividend report.

- Upon reviewing our latest valuation report, Central China Land MediaLTD's share price might be too pessimistic.

Summing It All Up

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1089 more companies for you to explore.Click here to unveil our expertly curated list of 1092 Top Asian Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1919

COSCO SHIPPING Holdings

An investment holding company, engages in the container shipping in the United States, Europe, the Asia Pacific, Mainland China, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives