- China

- /

- Diversified Financial

- /

- SZSE:300773

There's Reason For Concern Over Lakala Payment Co., Ltd.'s (SZSE:300773) Massive 42% Price Jump

Lakala Payment Co., Ltd. (SZSE:300773) shareholders have had their patience rewarded with a 42% share price jump in the last month. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.7% in the last twelve months.

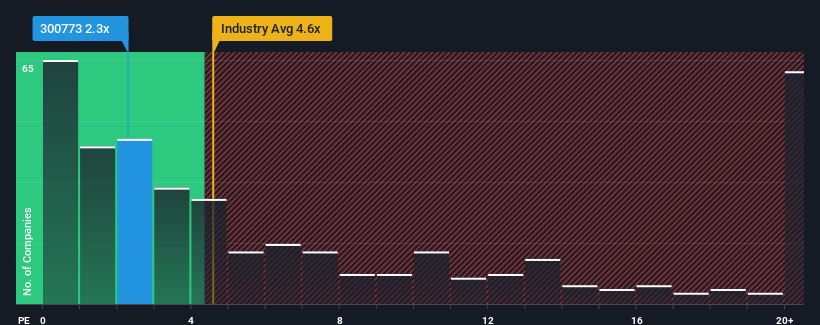

Although its price has surged higher, there still wouldn't be many who think Lakala Payment's price-to-sales (or "P/S") ratio of 2.3x is worth a mention when the median P/S in China's Diversified Financial industry is similar at about 2.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Lakala Payment

What Does Lakala Payment's Recent Performance Look Like?

Recent times have been pleasing for Lakala Payment as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Lakala Payment.How Is Lakala Payment's Revenue Growth Trending?

Lakala Payment's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 6.5% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 7.3% per annum during the coming three years according to the seven analysts following the company. With the industry predicted to deliver 11% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Lakala Payment is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

Lakala Payment's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that Lakala Payment's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Lakala Payment (of which 1 is significant!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300773

Lakala Payment

Engages in digital payment and technology service business in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives