- China

- /

- Capital Markets

- /

- SZSE:300059

What East Money Information Co.,Ltd.'s (SZSE:300059) 35% Share Price Gain Is Not Telling You

East Money Information Co.,Ltd. (SZSE:300059) shares have continued their recent momentum with a 35% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 83%.

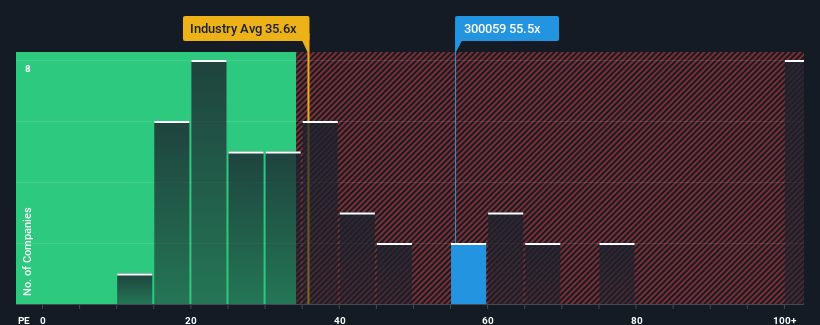

Following the firm bounce in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 36x, you may consider East Money InformationLtd as a stock to avoid entirely with its 55.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

There hasn't been much to differentiate East Money InformationLtd's and the market's retreating earnings lately. It might be that many expect the company's earnings to strengthen positively despite the tough market conditions, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for East Money InformationLtd

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as East Money InformationLtd's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Likewise, not much has changed from three years ago as earnings have been stuck during that whole time. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

Looking ahead now, EPS is anticipated to climb by 16% during the coming year according to the analysts following the company. That's shaping up to be materially lower than the 41% growth forecast for the broader market.

In light of this, it's alarming that East Money InformationLtd's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On East Money InformationLtd's P/E

Shares in East Money InformationLtd have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of East Money InformationLtd's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for East Money InformationLtd that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if East Money InformationLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300059

East Money InformationLtd

Provides Internet-based financial information, data, and other services in China.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives