- China

- /

- Capital Markets

- /

- SZSE:000987

Guangzhou Yuexiu Capital Holdings Group Co., Ltd.'s (SZSE:000987) Share Price Boosted 38% But Its Business Prospects Need A Lift Too

Guangzhou Yuexiu Capital Holdings Group Co., Ltd. (SZSE:000987) shareholders have had their patience rewarded with a 38% share price jump in the last month. Notwithstanding the latest gain, the annual share price return of 3.0% isn't as impressive.

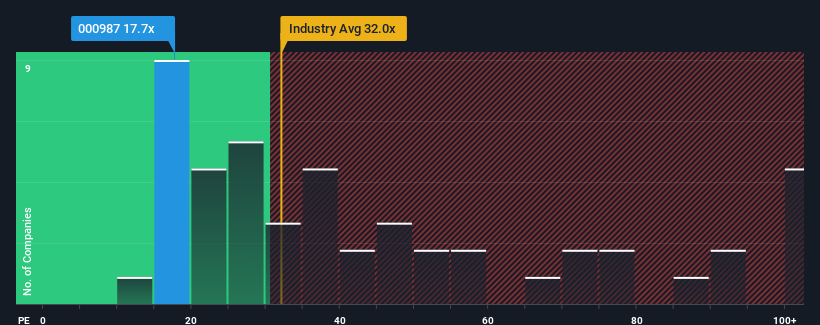

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may still consider Guangzhou Yuexiu Capital Holdings Group as an attractive investment with its 17.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Guangzhou Yuexiu Capital Holdings Group has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Guangzhou Yuexiu Capital Holdings Group

Is There Any Growth For Guangzhou Yuexiu Capital Holdings Group?

Guangzhou Yuexiu Capital Holdings Group's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 7.3% in total. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 7.1% per year as estimated by the one analyst watching the company. Meanwhile, the rest of the market is forecast to expand by 19% per annum, which is noticeably more attractive.

With this information, we can see why Guangzhou Yuexiu Capital Holdings Group is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

The latest share price surge wasn't enough to lift Guangzhou Yuexiu Capital Holdings Group's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Guangzhou Yuexiu Capital Holdings Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Guangzhou Yuexiu Capital Holdings Group (1 is a bit concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Guangzhou Yuexiu Capital Holdings Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000987

Guangzhou Yuexiu Capital Holdings Group

Guangzhou Yuexiu Capital Holdings Group Co., Ltd.

Fair value with moderate growth potential.

Market Insights

Community Narratives