As global markets navigate a period of volatility marked by fluctuating corporate earnings and geopolitical uncertainties, small-cap stocks have experienced mixed performance with indices like the Russell 2000 showing slight declines. In this environment, identifying promising small-cap companies requires an eye for those with strong fundamentals and innovative potential that can weather broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| DoshishaLtd | NA | 2.43% | 2.36% | ★★★★★★ |

| NOROO PAINT & COATINGS | 12.38% | 4.96% | 8.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 0.74% | 13.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wan Hwa Enterprise | NA | -7.43% | -7.24% | ★★★★★★ |

| First Copper Technology | 17.03% | 3.07% | 19.66% | ★★★★★★ |

| New Asia Construction & Development | 65.89% | 5.34% | 12.05% | ★★★★★☆ |

| Nippon Sharyo | 59.09% | -1.22% | -12.92% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Sunny Loan TopLtd (SHSE:600830)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sunny Loan Top Co., Ltd. offers investment and financing services both in China and internationally, with a market capitalization of CN¥4.40 billion.

Operations: Sunny Loan Top Ltd. generates revenue through its investment and financing services across China and international markets. The company's financial performance is reflected in a market capitalization of CN¥4.40 billion, indicating its scale in the industry.

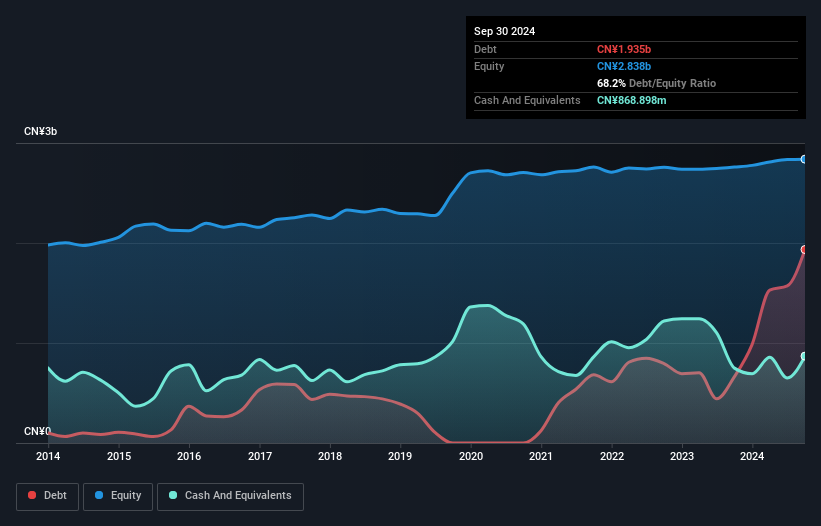

Sunny Loan Top Ltd. is making waves with a remarkable earnings growth of 335% over the past year, outpacing the Consumer Finance industry's 13%. The company seems to handle its interest payments comfortably, suggesting a solid financial footing. Despite this, free cash flow remains negative, which could be a concern for some investors. The net debt to equity ratio stands at 37.6%, deemed satisfactory by industry standards, although it has risen from 0% to 68% in five years. High levels of non-cash earnings add another layer of complexity but indicate potential resilience in operations.

- Dive into the specifics of Sunny Loan TopLtd here with our thorough health report.

Assess Sunny Loan TopLtd's past performance with our detailed historical performance reports.

Fujian Yuanli Active CarbonLtd (SZSE:300174)

Simply Wall St Value Rating: ★★★★★★

Overview: Fujian Yuanli Active Carbon Co., Ltd. specializes in the production and sale of activated carbon within China, with a market capitalization of CN¥5.68 billion.

Operations: The company generates revenue primarily from the manufacture and sale of activated carbon products in China. It has a market capitalization of CN¥5.68 billion.

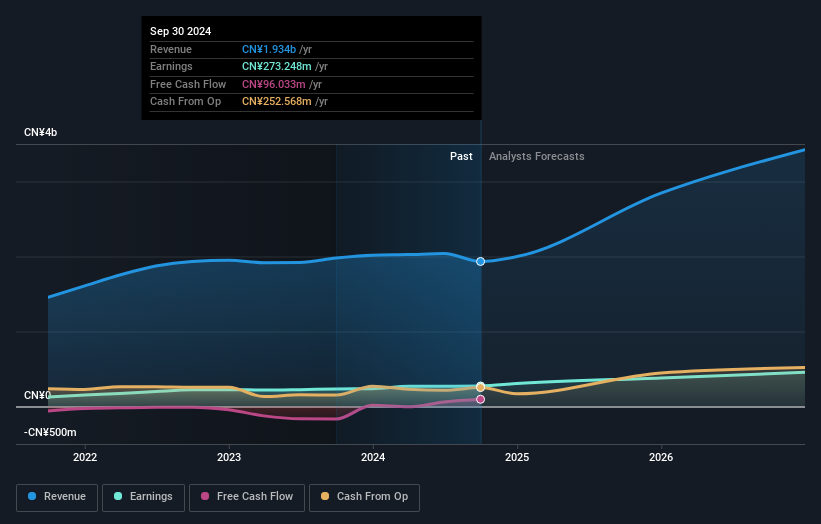

Fujian Yuanli Active Carbon, a smaller player in the market, has shown promising financial health with its debt to equity ratio dropping from 41.1% to 9.4% over five years, indicating robust financial management. Its price-to-earnings ratio of 20.8x is attractive compared to the broader Chinese market's 34.9x, suggesting potential undervaluation. The company recently announced a special dividend of CNY 1 per 10 shares and completed a buyback of approximately CNY 49.99 million worth of shares, reflecting shareholder-friendly policies and confidence in its ongoing performance amidst an industry where it outpaced average growth by achieving a notable earnings increase of 16.8%.

- Click here to discover the nuances of Fujian Yuanli Active CarbonLtd with our detailed analytical health report.

Understand Fujian Yuanli Active CarbonLtd's track record by examining our Past report.

Taiwan Paiho (TWSE:9938)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Taiwan Paiho Limited is a company that manufactures and sells various textile-related products, including touch fasteners, digital woven fabrics, and shoelaces, both in Taiwan and internationally, with a market cap of NT$21.30 billion.

Operations: The company's revenue streams are primarily derived from its Main Sub-Materials and Accessories Segment, generating NT$14.67 billion, while the Construction Sector contributes NT$85.98 million.

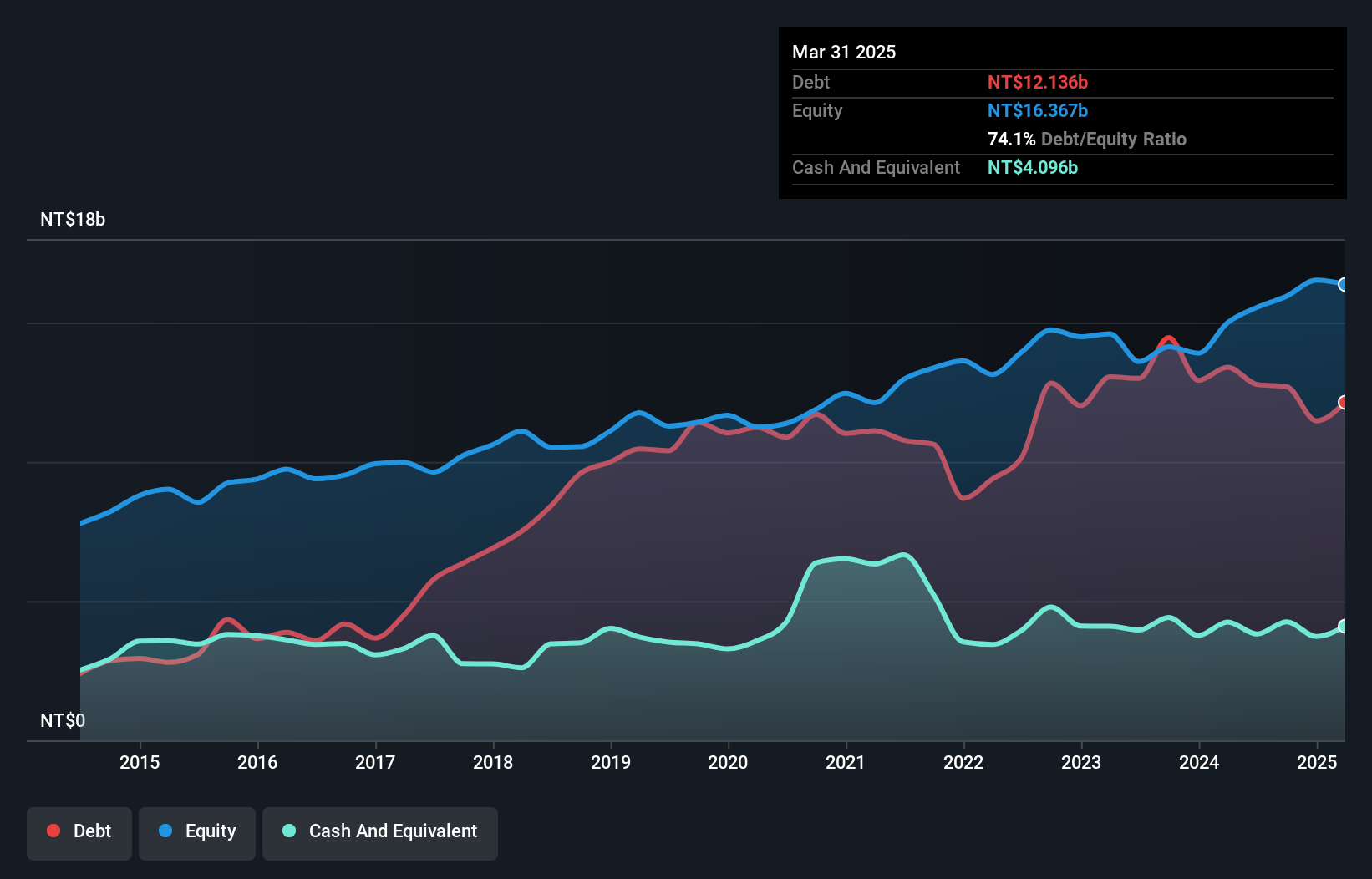

Taiwan Paiho, with its robust earnings growth of 124.6% last year, showcases potential in the textile industry. Its net sales for 2024 reached TWD 15.46 billion from TWD 12.45 billion in the previous year, indicating strong market demand and operational efficiency. The company seems to have improved profitability, as evidenced by a jump in net income to TWD 1.14 billion over nine months ending September compared to TWD 462 million previously. Despite a high net debt-to-equity ratio of 52.9%, interest payments are well covered at a multiple of 4.5 times EBIT, reflecting financial stability amidst expansion efforts.

- Click here and access our complete health analysis report to understand the dynamics of Taiwan Paiho.

Explore historical data to track Taiwan Paiho's performance over time in our Past section.

Turning Ideas Into Actions

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4724 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300174

Fujian Yuanli Active CarbonLtd

Manufactures and sells activated carbon in China.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives