- China

- /

- Capital Markets

- /

- SHSE:600155

The five-year shareholder returns and company earnings persist lower as Huachuang Yunxin Digital Technology (SHSE:600155) stock falls a further 5.8% in past week

Ideally, your overall portfolio should beat the market average. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Huachuang Yunxin Digital Technology Co., Ltd. (SHSE:600155), since the last five years saw the share price fall 48%.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Huachuang Yunxin Digital Technology

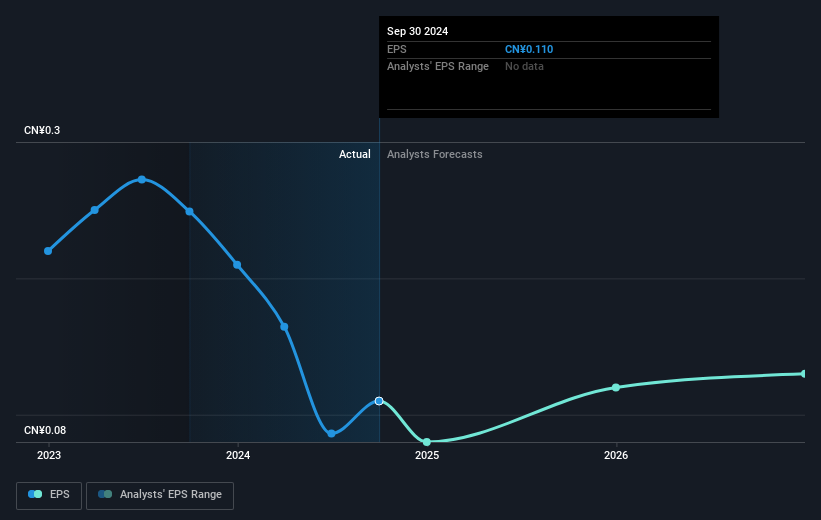

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Huachuang Yunxin Digital Technology's share price and EPS declined; the latter at a rate of 5.0% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 12% per year, over the period. This implies that the market is more cautious about the business these days. Of course, with a P/E ratio of 65.86, the market remains optimistic.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Huachuang Yunxin Digital Technology's earnings, revenue and cash flow.

A Different Perspective

Huachuang Yunxin Digital Technology shareholders are down 10% for the year, but the market itself is up 18%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 8% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Huachuang Yunxin Digital Technology that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Huachuang Yunxin Digital Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600155

Huachuang Yunxin Digital Technology

Huachuang Yunxin Digital Technology Co., Ltd.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives