- China

- /

- Consumer Services

- /

- SZSE:000526

Even though Xueda (Xiamen) Education Technology Group (SZSE:000526) has lost CN¥490m market cap in last 7 days, shareholders are still up 248% over 1 year

When you buy shares in a company, there is always a risk that the price drops to zero. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Xueda (Xiamen) Education Technology Group Co., Ltd (SZSE:000526) share price has soared 248% return in just a single year. It's also up 14% in about a month. But the price may well have benefitted from a buoyant market, since stocks have gained 9.9% in the last thirty days. Also impressive, the stock is up 52% over three years, making long term shareholders happy, too.

Since the long term performance has been good but there's been a recent pullback of 6.2%, let's check if the fundamentals match the share price.

Check out our latest analysis for Xueda (Xiamen) Education Technology Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Xueda (Xiamen) Education Technology Group grew its earnings per share, moving from a loss to a profit.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

However the year on year revenue growth of 15% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

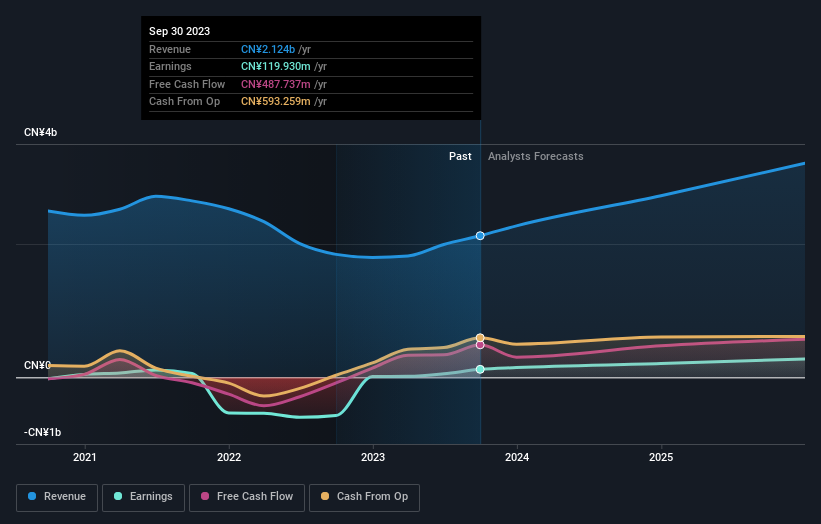

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Xueda (Xiamen) Education Technology Group

A Different Perspective

It's good to see that Xueda (Xiamen) Education Technology Group has rewarded shareholders with a total shareholder return of 248% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 20% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Xueda (Xiamen) Education Technology Group that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000526

Xueda (Xiamen) Education Technology Group

Xueda (Xiamen) Education Technology Group Co., Ltd.

Outstanding track record with high growth potential.

Market Insights

Community Narratives