- China

- /

- Consumer Services

- /

- SHSE:600636

China Reform Culture Holdings Co., Ltd.'s (SHSE:600636) 26% Share Price Surge Not Quite Adding Up

China Reform Culture Holdings Co., Ltd. (SHSE:600636) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Looking further back, the 17% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

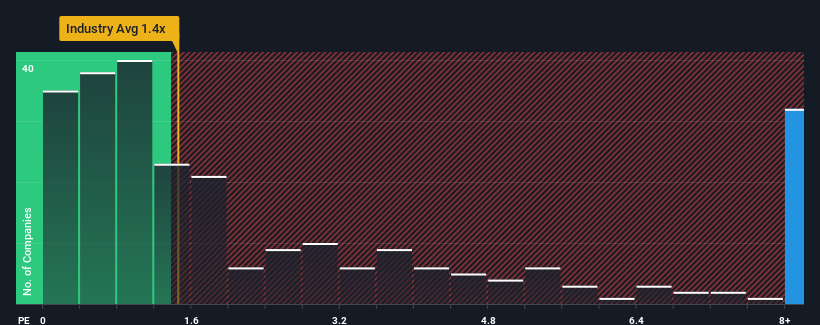

Since its price has surged higher, when almost half of the companies in China's Consumer Services industry have price-to-sales ratios (or "P/S") below 3.7x, you may consider China Reform Culture Holdings as a stock not worth researching with its 11.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for China Reform Culture Holdings

How China Reform Culture Holdings Has Been Performing

China Reform Culture Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on China Reform Culture Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For China Reform Culture Holdings?

In order to justify its P/S ratio, China Reform Culture Holdings would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 42% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 4.2% during the coming year according to the sole analyst following the company. That's shaping up to be materially lower than the 27% growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that China Reform Culture Holdings' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On China Reform Culture Holdings' P/S

China Reform Culture Holdings' P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've concluded that China Reform Culture Holdings currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with China Reform Culture Holdings (at least 1 which can't be ignored), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600636

China Reform Culture Holdings

Develops and sells educational recording and broadcasting software and hardware in China.

Flawless balance sheet with moderate growth potential.