- China

- /

- Consumer Services

- /

- SHSE:600636

China Reform Culture Holdings Co., Ltd. (SHSE:600636) May Have Run Too Fast Too Soon With Recent 26% Price Plummet

The China Reform Culture Holdings Co., Ltd. (SHSE:600636) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 14% in that time.

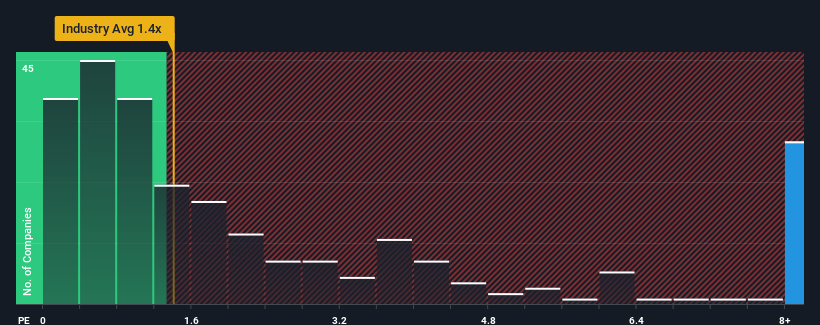

Even after such a large drop in price, given around half the companies in China's Consumer Services industry have price-to-sales ratios (or "P/S") below 3.6x, you may still consider China Reform Culture Holdings as a stock to avoid entirely with its 8.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for China Reform Culture Holdings

What Does China Reform Culture Holdings' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, China Reform Culture Holdings has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think China Reform Culture Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For China Reform Culture Holdings?

The only time you'd be truly comfortable seeing a P/S as steep as China Reform Culture Holdings' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. Still, lamentably revenue has fallen 42% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 4.2% over the next year. With the industry predicted to deliver 21% growth, the company is positioned for a weaker revenue result.

In light of this, it's alarming that China Reform Culture Holdings' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does China Reform Culture Holdings' P/S Mean For Investors?

Even after such a strong price drop, China Reform Culture Holdings' P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've concluded that China Reform Culture Holdings currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for China Reform Culture Holdings that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600636

China Reform Culture Holdings

Develops and sells educational recording and broadcasting software and hardware in China.

Flawless balance sheet with moderate growth potential.