As global markets grapple with renewed U.S.-China trade tensions and geopolitical uncertainties, Asian stocks present a unique landscape for discerning investors, particularly in the small-cap segment. Despite broader market volatility, opportunities abound for those who can identify companies with strong fundamentals and growth potential amidst these dynamic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Guangzhou Devotion Thermal Technology | 6.90% | -5.77% | 22.35% | ★★★★★★ |

| Shenyang Yuanda Intellectual Industry GroupLtd | NA | 10.58% | 33.69% | ★★★★★★ |

| Wholetech System Hitech | 6.48% | 14.41% | 19.21% | ★★★★★☆ |

| Shenzhen Keanda Electronic Technology | 3.22% | -6.05% | -14.83% | ★★★★★☆ |

| TOMONY Holdings | 58.71% | 8.05% | 13.43% | ★★★★★☆ |

| Nanjing Well Pharmaceutical GroupLtd | 30.76% | 10.83% | 8.47% | ★★★★★☆ |

| MNtech | 66.79% | 12.39% | -12.13% | ★★★★★☆ |

| Shanghai Material Trading | 1.95% | -9.84% | -12.61% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

| Mirai Semiconductors | 46.15% | 10.52% | 56.25% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Zhongtong Bus HoldingLTD (SZSE:000957)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhongtong Bus Holding Co., LTD specializes in the manufacture and sale of buses in China, with a market capitalization of CN¥7.45 billion.

Operations: Zhongtong Bus generates revenue primarily from its bus manufacturing segment, which amounts to CN¥6.92 billion. The company's financial performance can be analyzed through its net profit margin, a key indicator of profitability trends over time.

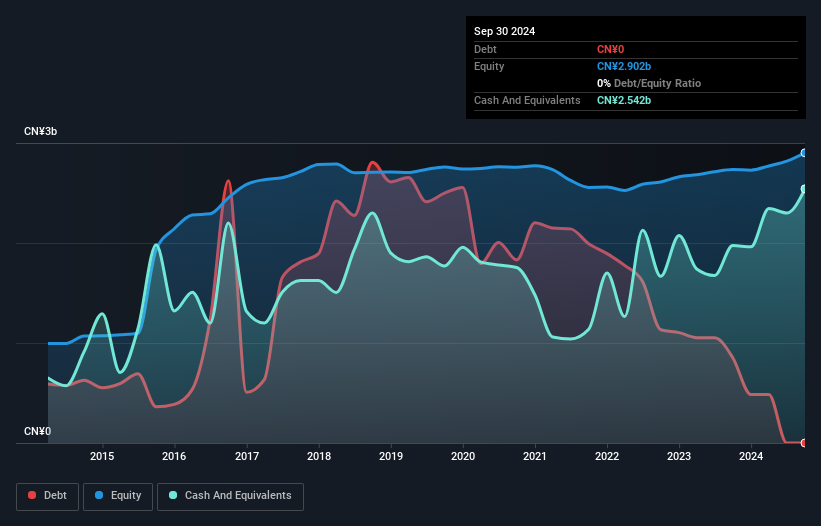

Zhongtong Bus Holding Co., a notable player in the bus manufacturing sector, has shown impressive financial performance recently. Earnings shot up by 155% over the past year, outpacing the Machinery industry's growth of 3.8%. The company's price-to-earnings ratio stands at 22.7x, significantly lower than the CN market average of 45x, indicating potential value for investors. With a debt-to-equity ratio reduced from 72.6% to just 3% over five years and more cash than total debt, Zhongtong demonstrates strong financial health. Recent buybacks saw the company repurchase shares worth CNY 73.35 million, reflecting confidence in its future prospects.

Guangzhou Ruoyuchen TechnologyLtd (SZSE:003010)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangzhou Ruoyuchen Technology Co., Ltd. offers e-commerce services to brand owners in China and has a market cap of CN¥13.99 billion.

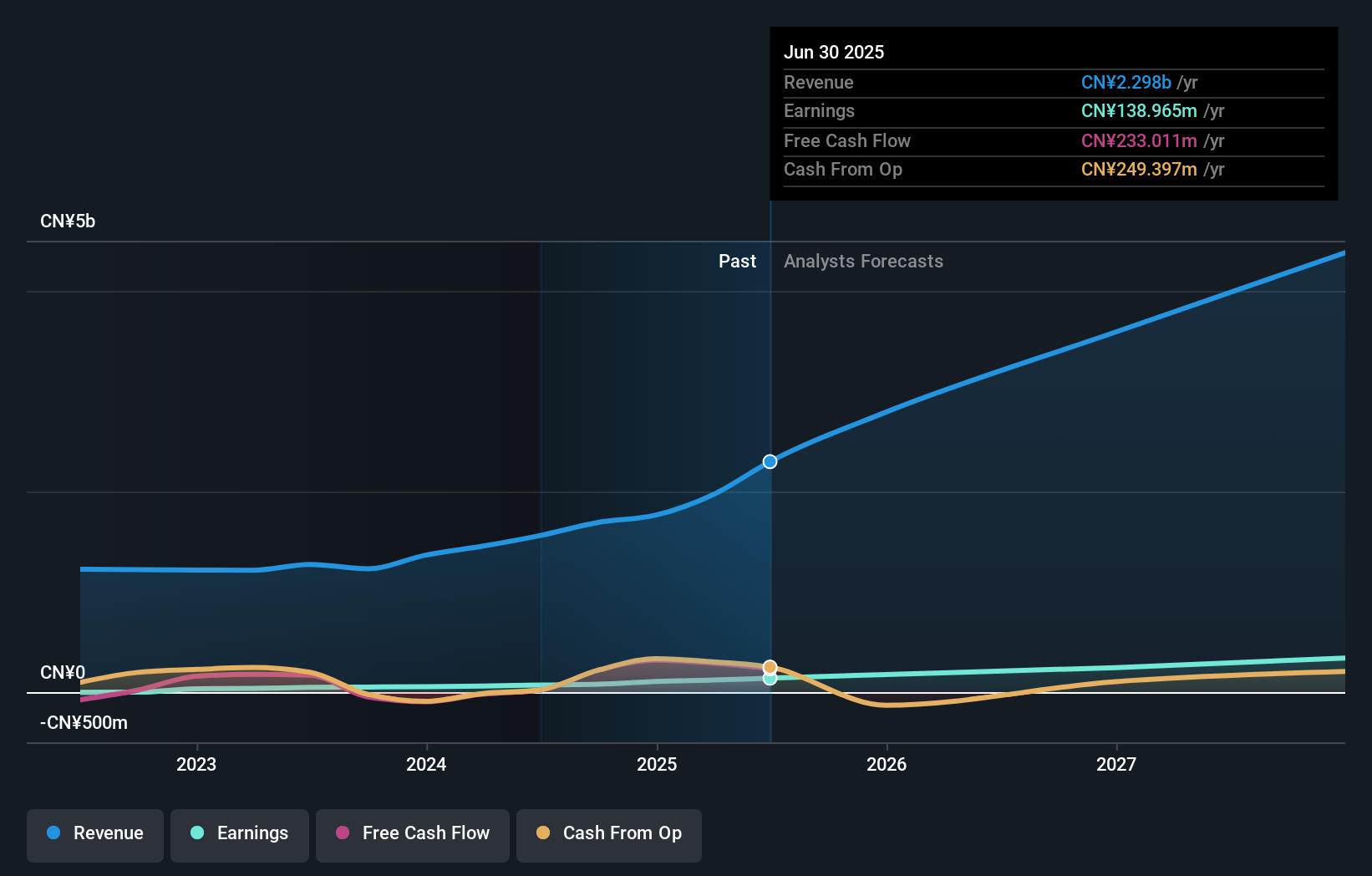

Operations: The company generates revenue primarily from its e-commerce service industry, amounting to CN¥2.30 billion.

Guangzhou Ruoyuchen Technology, a nimble player in the tech scene, has seen its earnings grow by 96.7% over the past year, outpacing the Consumer Retailing industry’s 5.7%. The company boasts more cash than total debt, indicating solid financial health despite a volatile share price recently. With net income climbing to CNY 72.26 million from CNY 38.94 million last year and basic earnings per share rising to CNY 0.23 from CNY 0.13, it reflects robust performance amid strategic moves like stock splits and dividend affirmations that could enhance shareholder value further down the line.

Wuhan Zhongyuan Huadian Science & TechnologyLtd (SZSE:300018)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuhan Zhongyuan Huadian Science & Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥5.41 billion.

Operations: The company generates revenue primarily through its technology sector operations. It has a market capitalization of CN¥5.41 billion, reflecting its position in the industry.

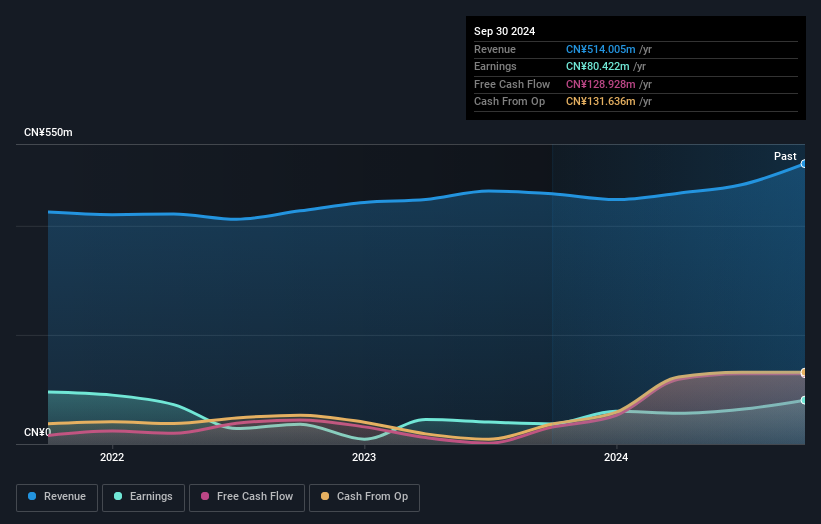

Wuhan Zhongyuan Huadian Science & Technology Ltd. is carving a niche in the electrical sector with its impressive financial health and growth metrics, standing debt-free with a notable price-to-earnings ratio of 52.7x, slightly below the industry average of 53.3x. The company reported robust earnings growth of 61.6% over the past year, significantly outperforming the industry's -0.2%. Its recent half-year results show revenue climbing to CNY 237 million from CNY 202 million last year and net income rising to CNY 58 million from CNY 33 million, highlighting strong operational performance amidst a competitive landscape.

Summing It All Up

- Explore the 2373 names from our Asian Undiscovered Gems With Strong Fundamentals screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhongtong Bus HoldingLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000957

Zhongtong Bus HoldingLTD

Engages in the manufacture and sale of buses in China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives