- China

- /

- Electrical

- /

- SZSE:002706

3 Global Growth Companies With Up To 38% Insider Ownership

Reviewed by Simply Wall St

In a global market environment marked by renewed U.S.-China trade tensions and concerns over a prolonged U.S. government shutdown, investors are increasingly seeking stability and growth potential. Companies with high insider ownership often signal strong confidence from those who know the business best, making them attractive candidates for those looking to navigate current economic uncertainties while aiming for long-term growth.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| KebNi (OM:KEBNI B) | 36.3% | 74% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 97.7% |

| CD Projekt (WSE:CDR) | 29.7% | 43.1% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's dive into some prime choices out of the screener.

OCI Holdings (KOSE:A010060)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OCI Holdings Company Ltd., along with its subsidiaries, offers a range of chemical products and energy solutions across South Korea, the United States, China, other parts of Asia, Europe, and globally with a market capitalization of approximately ₩1.65 trillion.

Operations: The company's revenue is primarily derived from the Chemical Materials Sector at ₩2.24 trillion, followed by the Urban Development Business Division at ₩510.12 billion, Energy Solutions at ₩491.95 billion, and New and Renewable Energy at ₩319.58 billion.

Insider Ownership: 29.3%

OCI Holdings is trading significantly below its estimated fair value and is expected to see revenue growth of 10.7% annually, outpacing the broader market. Despite a recent net loss of KRW 76,622.5 million for Q2 2025, analysts forecast profitability within three years with earnings growth projected at over 100% per year. However, its dividend yield of 2.29% lacks coverage by current earnings and the stock has experienced high volatility recently without notable insider trading activity.

- Navigate through the intricacies of OCI Holdings with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that OCI Holdings is priced lower than what may be justified by its financials.

Shanghai Liangxin ElectricalLTD (SZSE:002706)

Simply Wall St Growth Rating: ★★★★☆☆

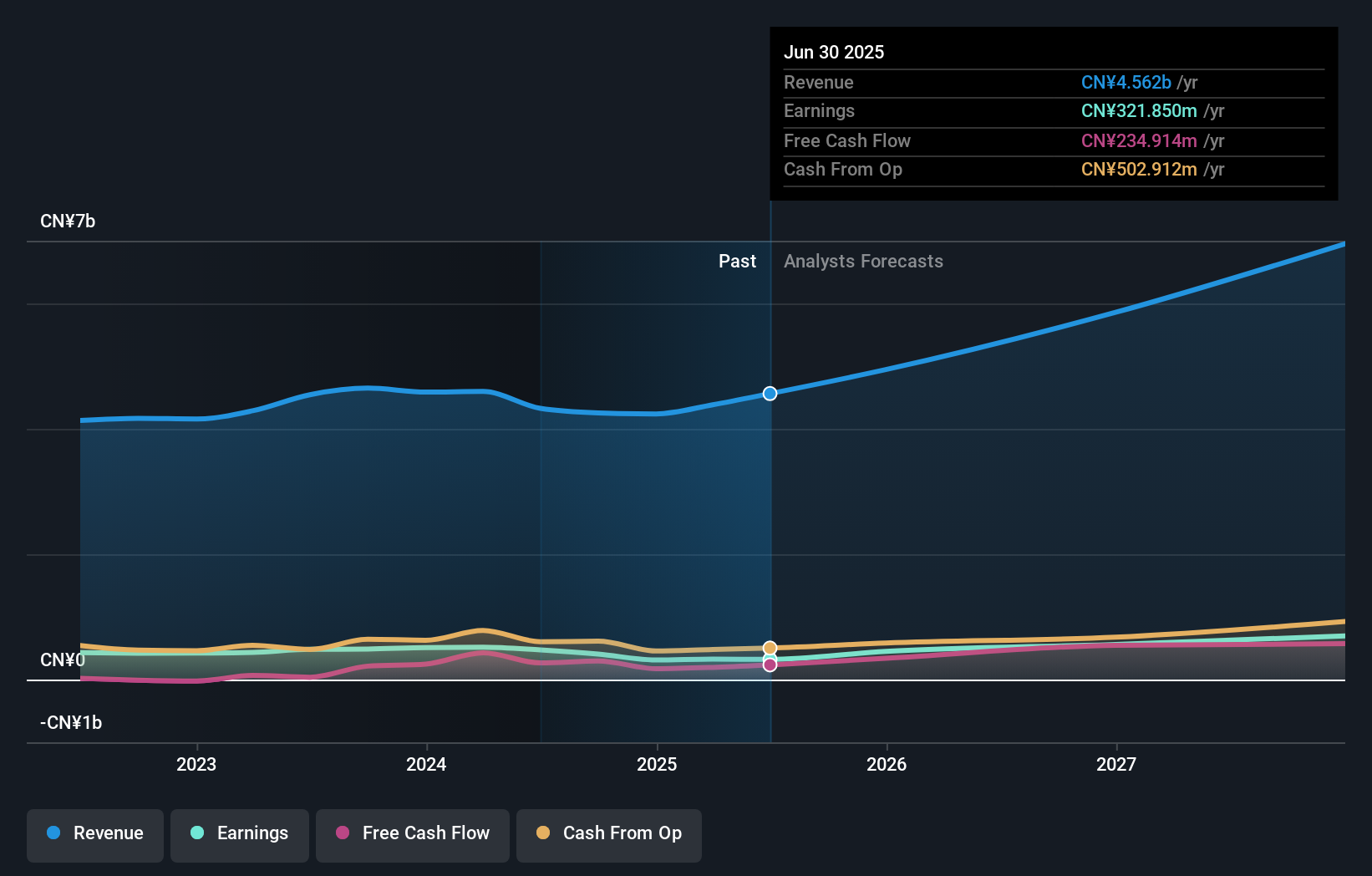

Overview: Shanghai Liangxin Electrical Co., LTD. engages in the research, development, production, and sale of low-voltage electrical apparatus both in China and internationally, with a market cap of CN¥12.20 billion.

Operations: The company's revenue segments are comprised of Control Appliance at CN¥548.54 million, Smart Electrician at CN¥132.57 million, Terminal Appliance at CN¥892.55 million, and Power Distribution Appliance at CN¥2.96 billion.

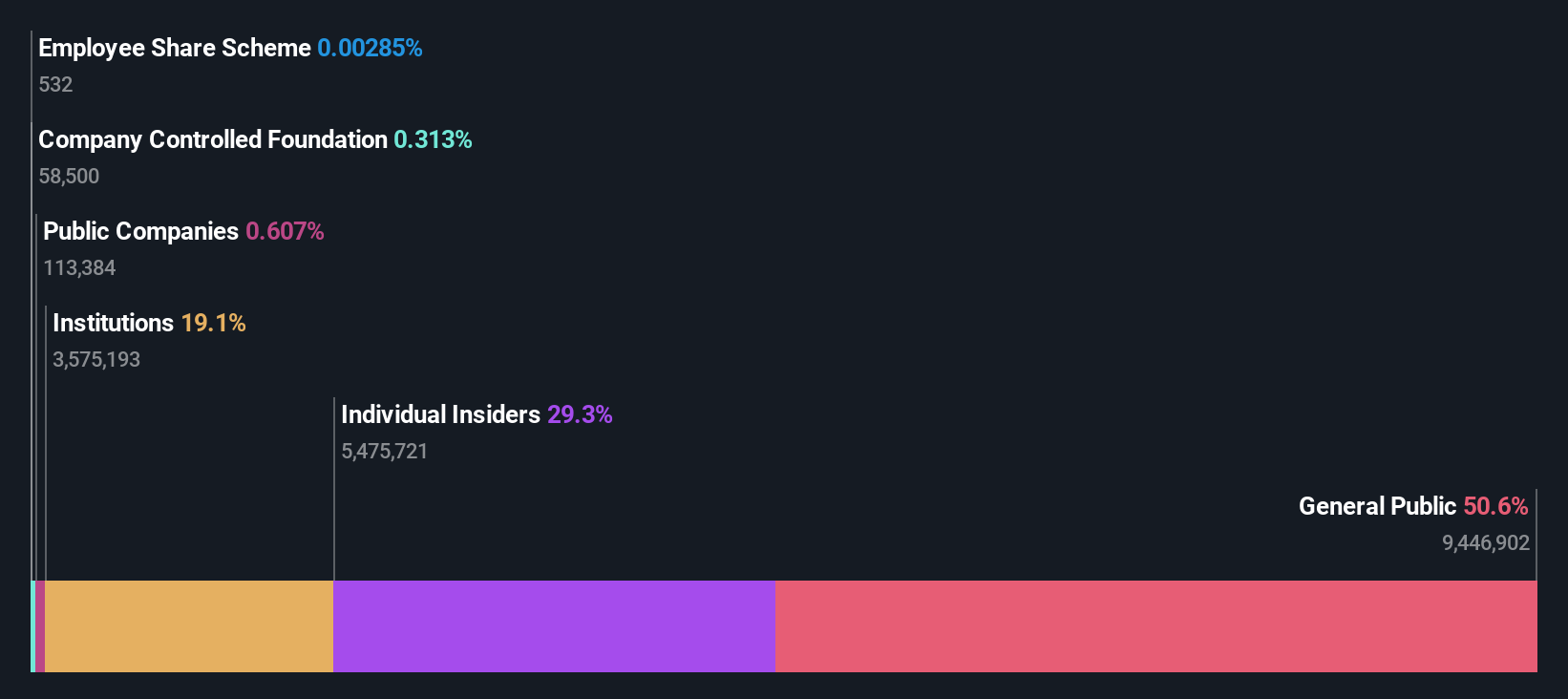

Insider Ownership: 28.8%

Shanghai Liangxin Electrical is poised for growth with revenue expected to increase by 17.1% annually, surpassing the broader CN market. Earnings are forecasted to grow significantly at 28.2% per year, although recent profit margins have declined from last year. Despite a volatile share price and a dividend yield of 1.78% not well covered by free cash flows, insider ownership remains high without substantial insider trading activity recently noted. Recent earnings showed improved sales and net income compared to the previous year.

- Delve into the full analysis future growth report here for a deeper understanding of Shanghai Liangxin ElectricalLTD.

- In light of our recent valuation report, it seems possible that Shanghai Liangxin ElectricalLTD is trading beyond its estimated value.

Guangzhou Ruoyuchen TechnologyLtd (SZSE:003010)

Simply Wall St Growth Rating: ★★★★★★

Overview: Guangzhou Ruoyuchen Technology Co., Ltd. offers brand integrated marketing solutions in China and has a market cap of CN¥12.71 billion.

Operations: The company generates its revenue primarily from the E-Commerce Service Industry, amounting to CN¥2.30 billion.

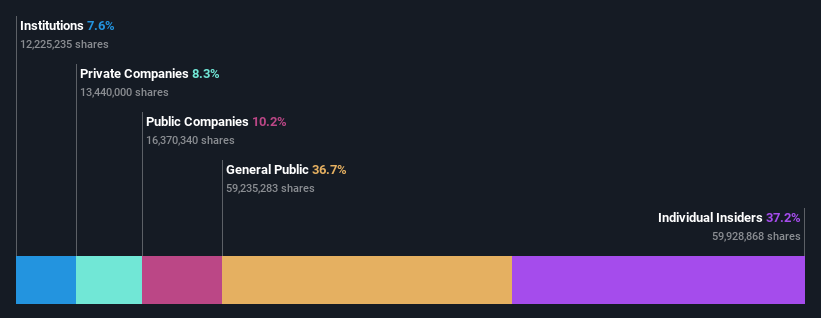

Insider Ownership: 38.8%

Guangzhou Ruoyuchen Technology is experiencing robust growth, with earnings projected to rise significantly at 35.3% annually, outpacing the CN market. Revenue is also expected to grow at a strong 25.3% per year. Despite a dividend yield of 0.93% not fully supported by earnings, insider ownership remains high without significant insider trading activity recently noted. The company was added to the S&P Global BMI Index and reported substantial revenue and net income increases for the first half of 2025 compared to last year.

- Get an in-depth perspective on Guangzhou Ruoyuchen TechnologyLtd's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Guangzhou Ruoyuchen TechnologyLtd's share price might be on the expensive side.

Key Takeaways

- Navigate through the entire inventory of 813 Fast Growing Global Companies With High Insider Ownership here.

- Ready For A Different Approach? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002706

Shanghai Liangxin ElectricalLTD

Research, develops, produces, and sells low-voltage electrical apparatus in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives