- China

- /

- Consumer Durables

- /

- SHSE:603313

Top Insider-Owned Growth Stocks For October 2024

Reviewed by Simply Wall St

As global markets navigate a mix of economic signals, with the S&P 500 advancing and European indices buoyed by rate cuts, investors are keenly observing sectors like utilities and real estate that have shown resilience. In such an environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

Let's dive into some prime choices out of the screener.

HealthcareLtd (SHSE:603313)

Simply Wall St Growth Rating: ★★★★☆☆

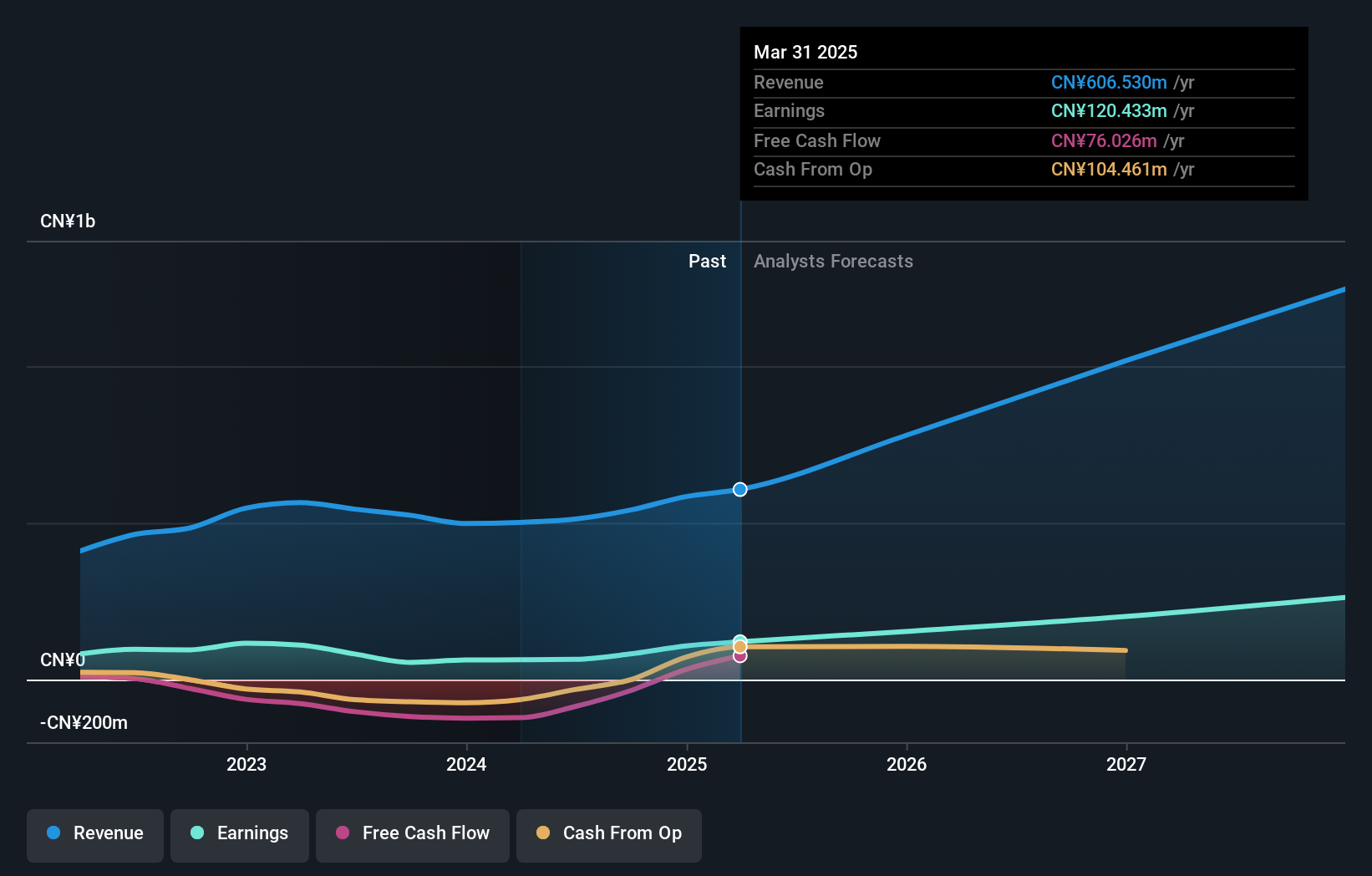

Overview: Healthcare Co.,Ltd. engages in the research, development, production, and sale of memory foam mattresses, pillows, sofas, and other household products in China with a market cap of CN¥3.86 billion.

Operations: The company's revenue segment primarily consists of household products, generating CN¥8.32 billion.

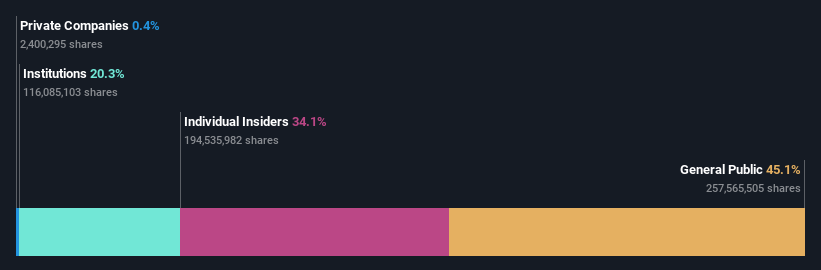

Insider Ownership: 34.1%

Revenue Growth Forecast: 14.4% p.a.

HealthcareLtd has demonstrated robust revenue growth, with recent half-year sales reaching CNY 3.84 billion, up from CNY 3.50 billion the previous year. However, net income declined to CNY 52.59 million from CNY 97.62 million, indicating profitability challenges despite strong projected earnings growth of over 65% annually—well above the market average of 23.8%. While insider trading activity is minimal recently, shareholder dilution has occurred in the past year.

- Navigate through the intricacies of HealthcareLtd with our comprehensive analyst estimates report here.

- Our valuation report here indicates HealthcareLtd may be overvalued.

Anhui Ronds Science & Technology (SHSE:688768)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anhui Ronds Science & Technology Incorporated Company offers solutions for machinery condition monitoring in the predictive maintenance field in China, with a market cap of CN¥2.65 billion.

Operations: Anhui Ronds Science & Technology generates revenue through its solutions for machinery condition monitoring, focusing on predictive maintenance within the Chinese market.

Insider Ownership: 29.3%

Revenue Growth Forecast: 22.5% p.a.

Anhui Ronds Science & Technology shows promising growth potential, with earnings expected to rise by 34.59% annually, surpassing the Chinese market average of 23.8%. Recent half-year results highlight a shift from a net loss to a modest profit of CNY 0.66 million, alongside revenue growth from CNY 206.04 million to CNY 219.94 million. Despite low insider trading activity and a high price-to-earnings ratio of 41.2x, its revenue is projected to grow at an impressive rate of over 22% annually.

- Get an in-depth perspective on Anhui Ronds Science & Technology's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Anhui Ronds Science & Technology's share price might be too optimistic.

New Huadu Technology (SZSE:002264)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: New Huadu Technology Co., Ltd. operates in the Internet marketing sector in China with a market capitalization of CN¥3.76 billion.

Operations: New Huadu Technology Co., Ltd. generates revenue primarily from its Internet marketing activities in China.

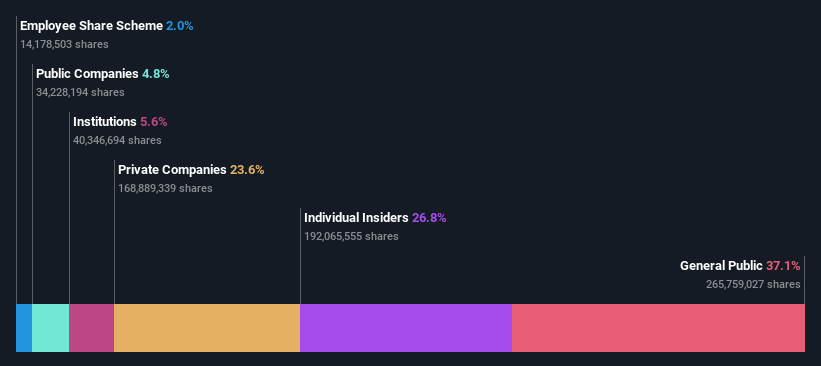

Insider Ownership: 26.8%

Revenue Growth Forecast: 21.8% p.a.

New Huadu Technology is positioned for substantial growth, with revenue expected to increase by 21.8% annually, outpacing the Chinese market's 13.5%. The company's earnings are projected to grow significantly at 23.09% per year, though slightly below the market average of 23.8%. Recent earnings show a strong performance with sales rising to CNY 1.94 billion and net income reaching CNY 145.45 million, indicating robust financial health despite low insider trading activity recently noted.

- Dive into the specifics of New Huadu Technology here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, New Huadu Technology's share price might be too pessimistic.

Where To Now?

- Click here to access our complete index of 1487 Fast Growing Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HealthcareLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603313

HealthcareLtd

Research, develops, produces, and sells memory foam mattresses, pillows, sofas, and other household products in China.

Reasonable growth potential and fair value.