As we enter 2025, global markets have shown a mixed performance with U.S. stocks closing out another strong year despite some volatility, while economic indicators like the Chicago PMI signal ongoing challenges in manufacturing. In this environment of cautious optimism and selective growth, identifying companies with robust insider ownership can be a key strategy for investors seeking to align their interests with those who are deeply invested in the success of their firms.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

Let's review some notable picks from our screened stocks.

Guangzhou Hexin InstrumentLtd (SHSE:688622)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Hexin Instrument Co., Ltd. focuses on the research, development, production, sales, and technical services of mass spectrometry products in China with a market cap of CN¥4.16 billion.

Operations: The company generates revenue from its Mass Spectrometer Business, amounting to CN¥266.19 million.

Insider Ownership: 34.4%

Earnings Growth Forecast: 201.5% p.a.

Guangzhou Hexin Instrument Ltd. is poised for significant growth, with earnings forecasted to grow over 200% annually and revenue expected to rise by 67% per year, outpacing the Chinese market. Despite recent volatility in its share price, the company has not seen substantial insider trading activity recently. Recent financials show a narrowing net loss from CNY 55 million to CNY 22.15 million over nine months, indicating potential progress toward profitability within three years.

- Click here to discover the nuances of Guangzhou Hexin InstrumentLtd with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Guangzhou Hexin InstrumentLtd shares in the market.

New Huadu Technology (SZSE:002264)

Simply Wall St Growth Rating: ★★★★★☆

Overview: New Huadu Technology Co., Ltd. operates in the Internet marketing sector in China with a market capitalization of approximately CN¥4.33 billion.

Operations: New Huadu Technology Co., Ltd. generates its revenue primarily from its operations in the Internet marketing sector within China.

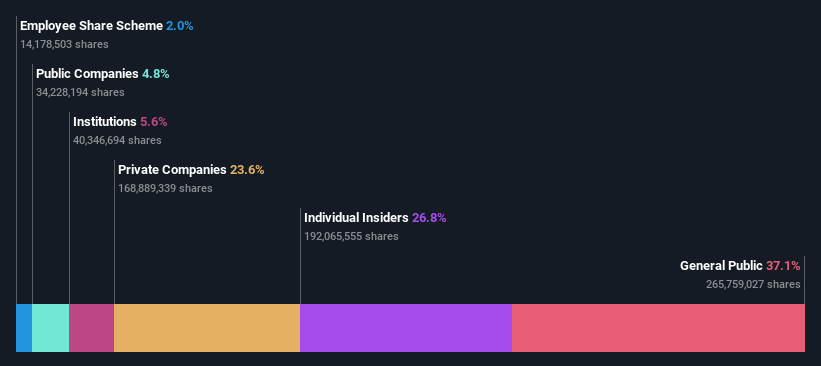

Insider Ownership: 26.8%

Earnings Growth Forecast: 27.1% p.a.

New Huadu Technology shows promising growth potential, with earnings and revenue forecasted to grow at 27.1% and 22.8% per year respectively, surpassing the Chinese market averages. Recent financial results highlight significant progress, with net income rising to CNY 190.33 million for the first nine months of 2024 from CNY 159.21 million a year earlier. The company trades at a favorable price-to-earnings ratio of 18.7x compared to the broader market's higher valuation, indicating good relative value despite no recent insider trading activity reported.

- Unlock comprehensive insights into our analysis of New Huadu Technology stock in this growth report.

- The analysis detailed in our New Huadu Technology valuation report hints at an deflated share price compared to its estimated value.

Xiamen Jihong Technology (SZSE:002803)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xiamen Jihong Technology Co., Ltd. operates in the cross-border social e-commerce sector in China with a market capitalization of CN¥4.72 billion.

Operations: Xiamen Jihong Technology Co., Ltd. generates revenue from its cross-border social e-commerce activities in China.

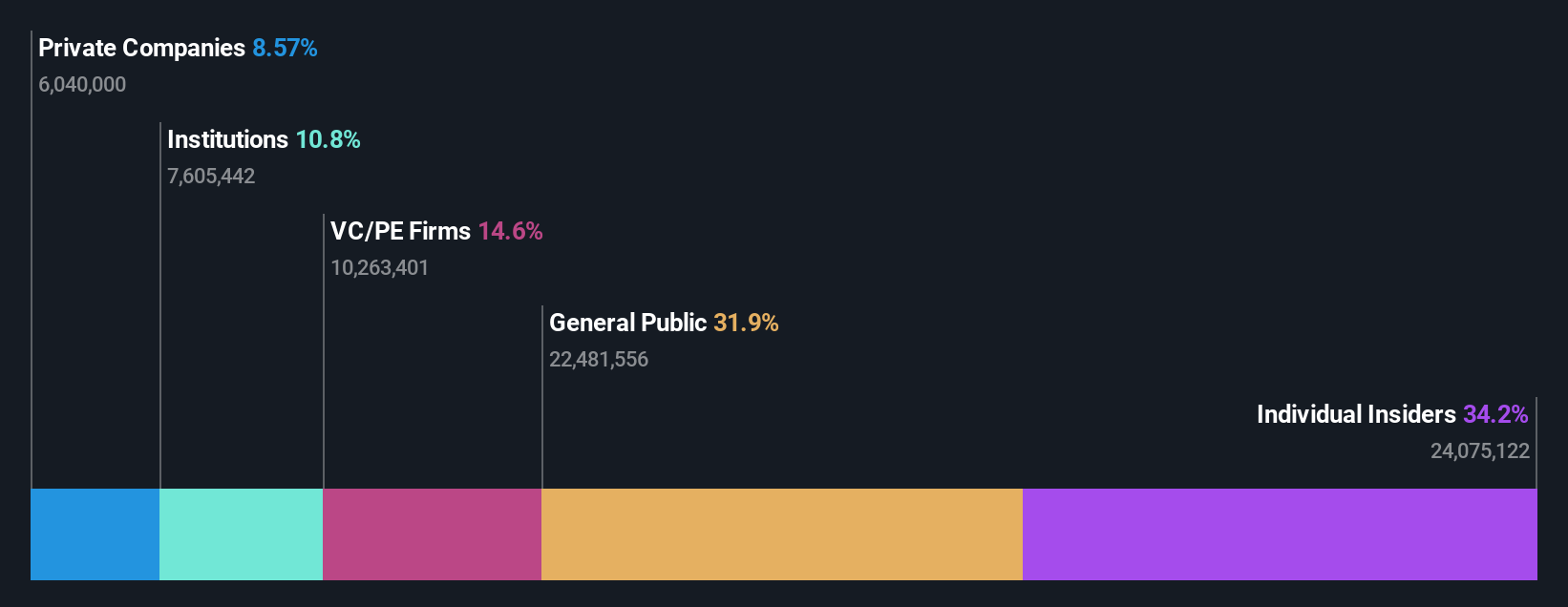

Insider Ownership: 35%

Earnings Growth Forecast: 38.1% p.a.

Xiamen Jihong Technology is positioned for substantial growth, with earnings projected to increase significantly at 38.1% annually, outpacing the Chinese market. The stock trades at a significant discount to its estimated fair value and boasts high insider ownership. Despite recent declines in revenue and profit margins, the company has initiated a share buyback program worth CNY 100 million to enhance long-term incentives and align employee interests with shareholder value.

- Navigate through the intricacies of Xiamen Jihong Technology with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Xiamen Jihong Technology shares in the market.

Next Steps

- Embark on your investment journey to our 1487 Fast Growing Companies With High Insider Ownership selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Xiamen Jihong Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002803

Xiamen Jihong Technology

Engages in the cross-border social e-commerce business in China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives