- China

- /

- Electrical

- /

- SHSE:601615

Three Top Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets experience broad-based gains and U.S. indexes approach record highs, investors are closely monitoring economic indicators such as jobless claims and home sales, which have shown positive trends. In this environment of cautious optimism, growth companies with significant insider ownership can offer unique insights into potential investment opportunities, as high insider stakes often signal confidence in a company's future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 43.2% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Pharma Mar (BME:PHM) | 11.8% | 56.9% |

| Medley (TSE:4480) | 34% | 31.7% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 103.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

Here's a peek at a few of the choices from the screener.

Ming Yang Smart Energy Group (SHSE:601615)

Simply Wall St Growth Rating: ★★★★★☆

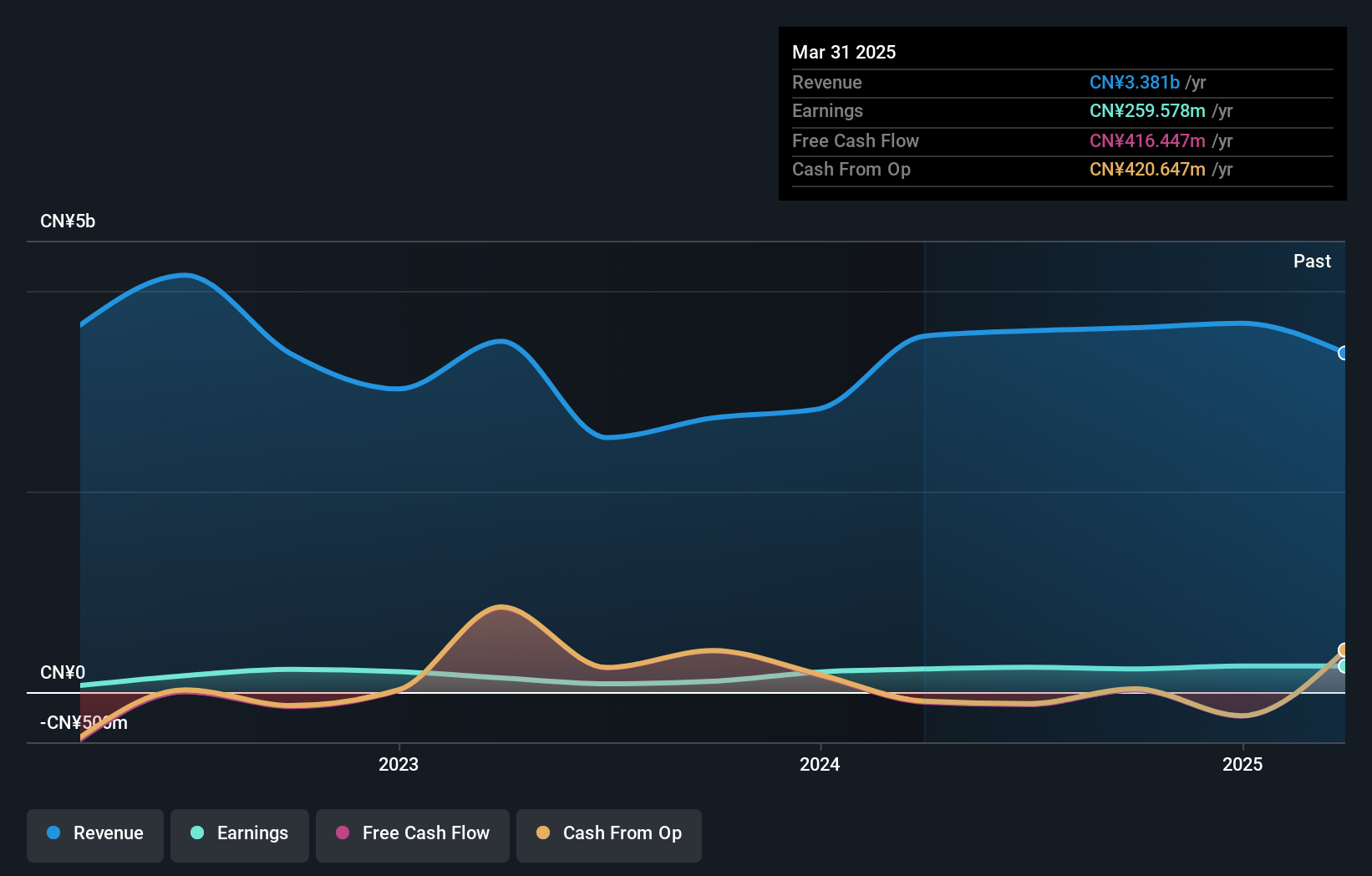

Overview: Ming Yang Smart Energy Group Limited focuses on the research, design, manufacture, sale, maintenance, and operation of energy equipment and wind turbines in China with a market cap of CN¥26.13 billion.

Operations: Ming Yang Smart Energy Group Limited generates revenue through its activities in the research and development, design, manufacture, sale, maintenance, and operation of energy equipment and wind turbines in China.

Insider Ownership: 15.8%

Revenue Growth Forecast: 22.8% p.a.

Ming Yang Smart Energy Group shows potential as a growth company with high insider ownership. Despite recent declines in net income to CNY 808.51 million for the nine months ending September 2024, its revenue is forecasted to grow at 22.8% annually, outpacing the Chinese market average of 13.8%. However, its dividend yield of 2.39% isn't well-covered by earnings or cash flow, and profitability is expected within three years with an anticipated annual profit growth above market averages.

- Get an in-depth perspective on Ming Yang Smart Energy Group's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Ming Yang Smart Energy Group's current price could be quite moderate.

New Huadu Technology (SZSE:002264)

Simply Wall St Growth Rating: ★★★★★☆

Overview: New Huadu Technology Co., Ltd. operates in the Internet marketing sector in China, with a market capitalization of CN¥4.39 billion.

Operations: New Huadu Technology Co., Ltd. generates its revenue primarily from the Internet marketing sector within China.

Insider Ownership: 26.8%

Revenue Growth Forecast: 22.8% p.a.

New Huadu Technology demonstrates strong growth potential, with earnings expected to rise significantly at 27.1% annually, surpassing the Chinese market average. Its revenue is also forecast to grow robustly at 22.8% per year. Recent financial results show a substantial increase in sales to CNY 2.77 billion for the nine months ending September 2024, up from CNY 1.97 billion a year ago, indicating solid operational performance without substantial insider trading activity recently reported.

- Click to explore a detailed breakdown of our findings in New Huadu Technology's earnings growth report.

- Our valuation report unveils the possibility New Huadu Technology's shares may be trading at a discount.

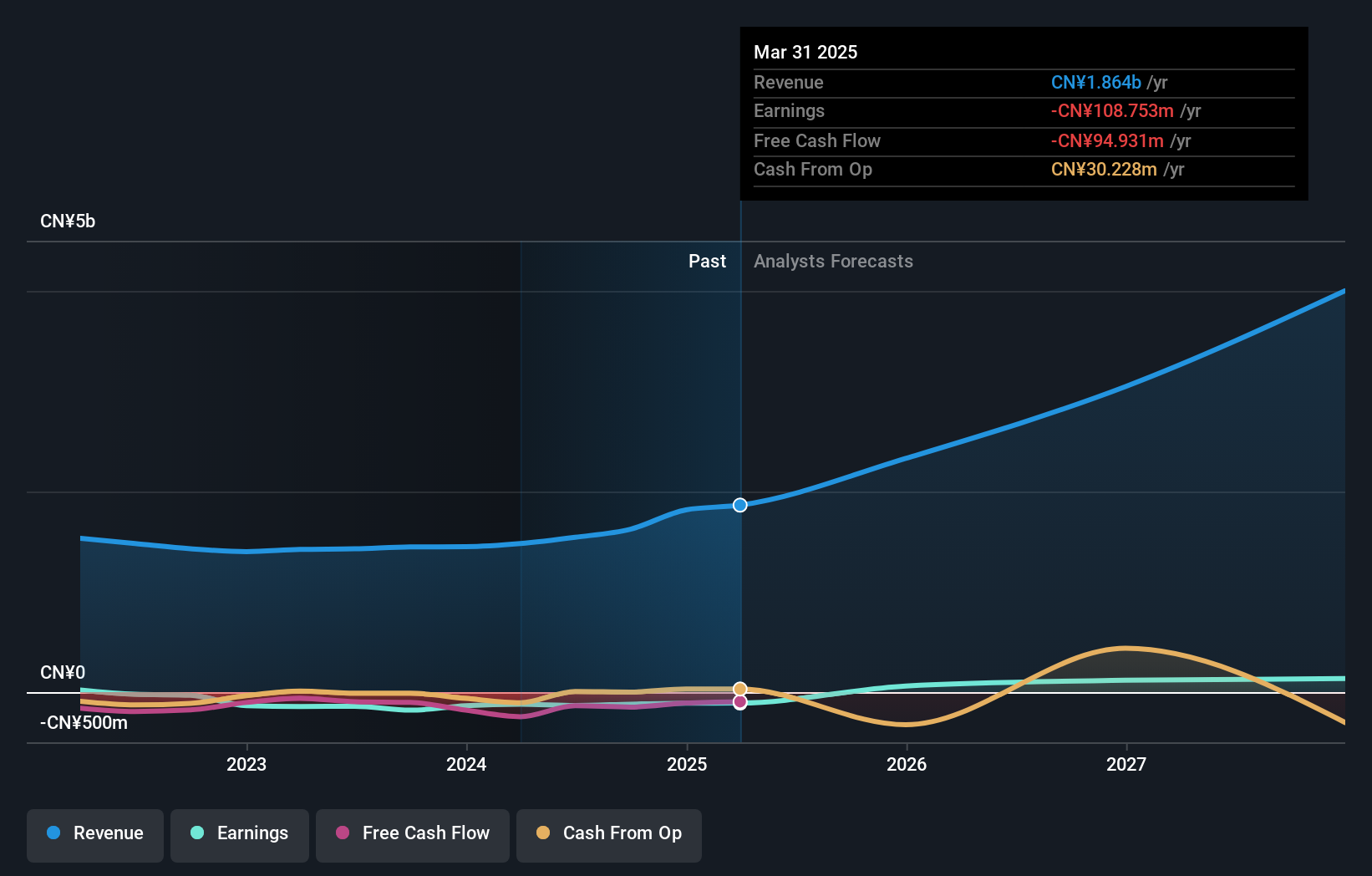

Hanwang TechnologyLtd (SZSE:002362)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hanwang Technology Co., Ltd. designs and develops handwriting recognition, optical character recognition, and handwriting input products worldwide, with a market cap of CN¥5.36 billion.

Operations: The company's revenue segments include handwriting recognition, optical character recognition, and handwriting input products.

Insider Ownership: 28.2%

Revenue Growth Forecast: 25.3% p.a.

Hanwang Technology shows promising growth prospects with revenue expected to increase by 25.3% annually, outpacing the Chinese market average. Despite current net losses, the company is projected to become profitable within three years, reflecting above-average market growth potential. Recent earnings for the nine months ending September 2024 reported sales of CNY 1.15 billion, an improvement from CNY 972.71 million a year earlier, indicating operational progress without significant recent insider trading activity.

- Unlock comprehensive insights into our analysis of Hanwang TechnologyLtd stock in this growth report.

- The valuation report we've compiled suggests that Hanwang TechnologyLtd's current price could be inflated.

Summing It All Up

- Explore the 1529 names from our Fast Growing Companies With High Insider Ownership screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601615

Ming Yang Smart Energy Group

Engages in the research and development, design, manufacture, sale, maintenance, and operation of energy equipment, wind turbines, and core components in China.

High growth potential with adequate balance sheet.