- China

- /

- Auto Components

- /

- SHSE:600609

Discover 3 Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets grapple with cautious Fed commentary and political uncertainties, U.S. stocks have experienced a decline, particularly impacting smaller-cap indexes like the S&P 600. Despite these challenges, the economic backdrop of robust consumer spending and job growth suggests potential opportunities for discerning investors willing to explore less prominent stocks. In this environment, identifying promising stocks often involves looking beyond immediate market volatility to uncover companies with strong fundamentals and growth potential that may not yet be widely recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| Bharat Rasayan | 5.93% | -0.27% | -7.65% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Likhami Consulting | NA | 1.68% | -12.74% | ★★★★★★ |

| TechNVision Ventures | 14.35% | 20.69% | 63.60% | ★★★★★☆ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Commercial Bank International P.S.C (ADX:CBI)

Simply Wall St Value Rating: ★★★★☆☆

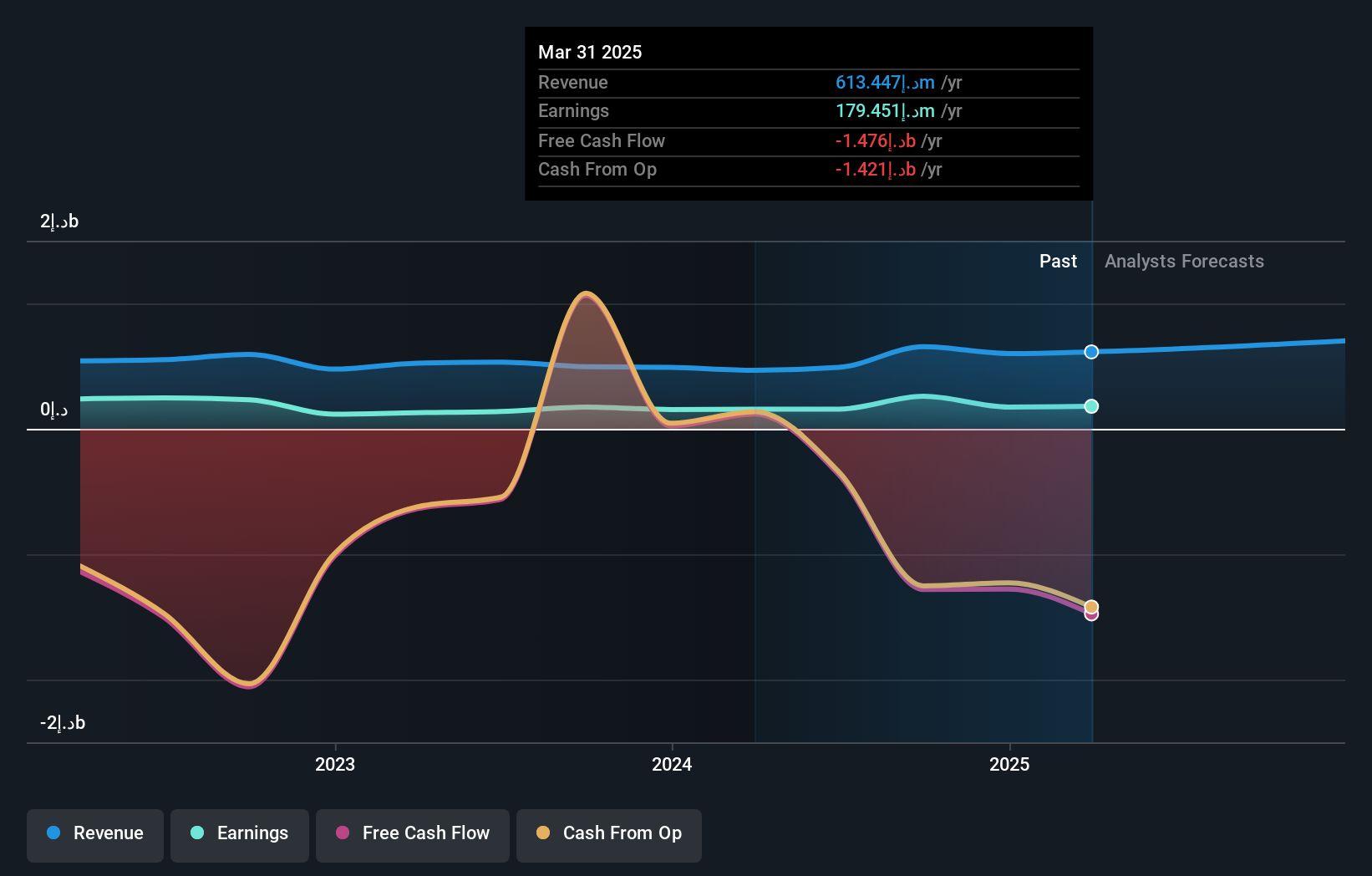

Overview: Commercial Bank International P.S.C., along with its subsidiaries, offers a range of banking products and services to individuals and businesses in the United Arab Emirates, with a market capitalization of AED1.37 billion.

Operations: CBI generates revenue primarily from wholesale banking (AED392.60 million) and real estate (AED148.07 million), with additional contributions from retail banking and treasury activities.

CBI, with AED21 billion in assets and AED3.1 billion in equity, has shown significant earnings growth of 49.3% over the past year, outpacing the banking industry's 23.5%. Despite a volatile share price recently, it maintains primarily low-risk funding sources, as 94% of its liabilities are customer deposits. However, CBI faces challenges with a high level of bad loans at 16.1%, although its allowance for bad loans is relatively low at 35%. The bank's price-to-earnings ratio stands attractively at six times compared to the market's 13.1 times, suggesting potential value for investors seeking opportunities in this sector.

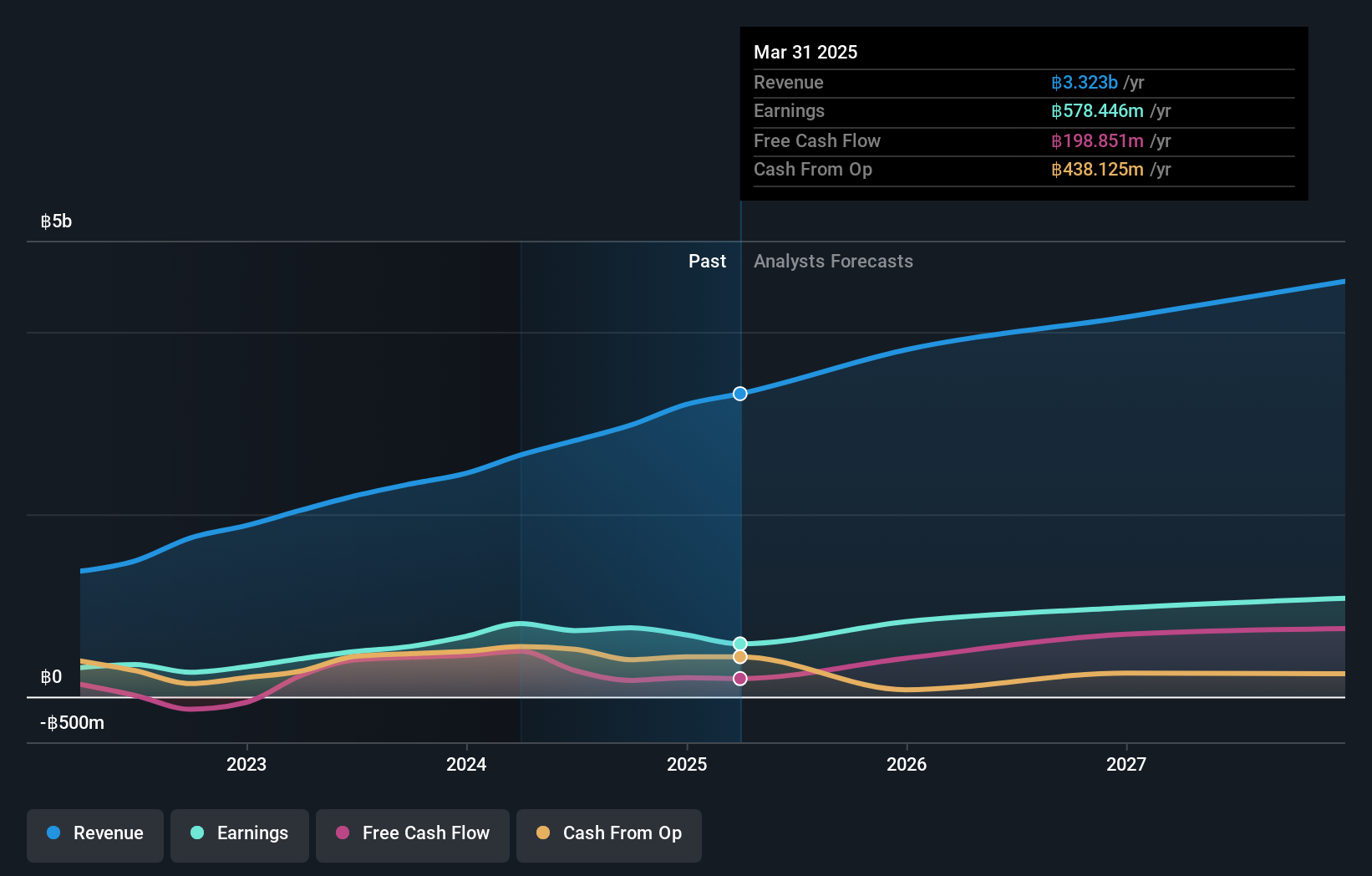

Karmarts (SET:KAMART)

Simply Wall St Value Rating: ★★★★★★

Overview: Karmarts Public Company Limited, with a market cap of THB14.37 billion, operates in Thailand through its manufacturing, packaging, import, and distribution of cosmetics and consumer products.

Operations: Karmarts generates revenue primarily from the manufacture and distribution of consumer products, contributing THB2.96 billion. The company also earns income from warehouse rental amounting to THB26.15 million.

Karmarts, a player in the personal products sector, has shown notable financial resilience and growth. With earnings increasing by 37% over the past year, it outpaced the industry average of -3.6%. The company's debt-to-equity ratio improved significantly from 30.1% to 18.5% over five years, indicating prudent financial management. Karmarts also reported third-quarter sales of THB 807 million compared to THB 634 million last year and a net income rise to THB 174 million from THB 144 million. Despite its volatile share price recently, its P/E ratio of 19x suggests it's valued attractively against industry peers at an average of 26x.

- Get an in-depth perspective on Karmarts' performance by reading our health report here.

Assess Karmarts' past performance with our detailed historical performance reports.

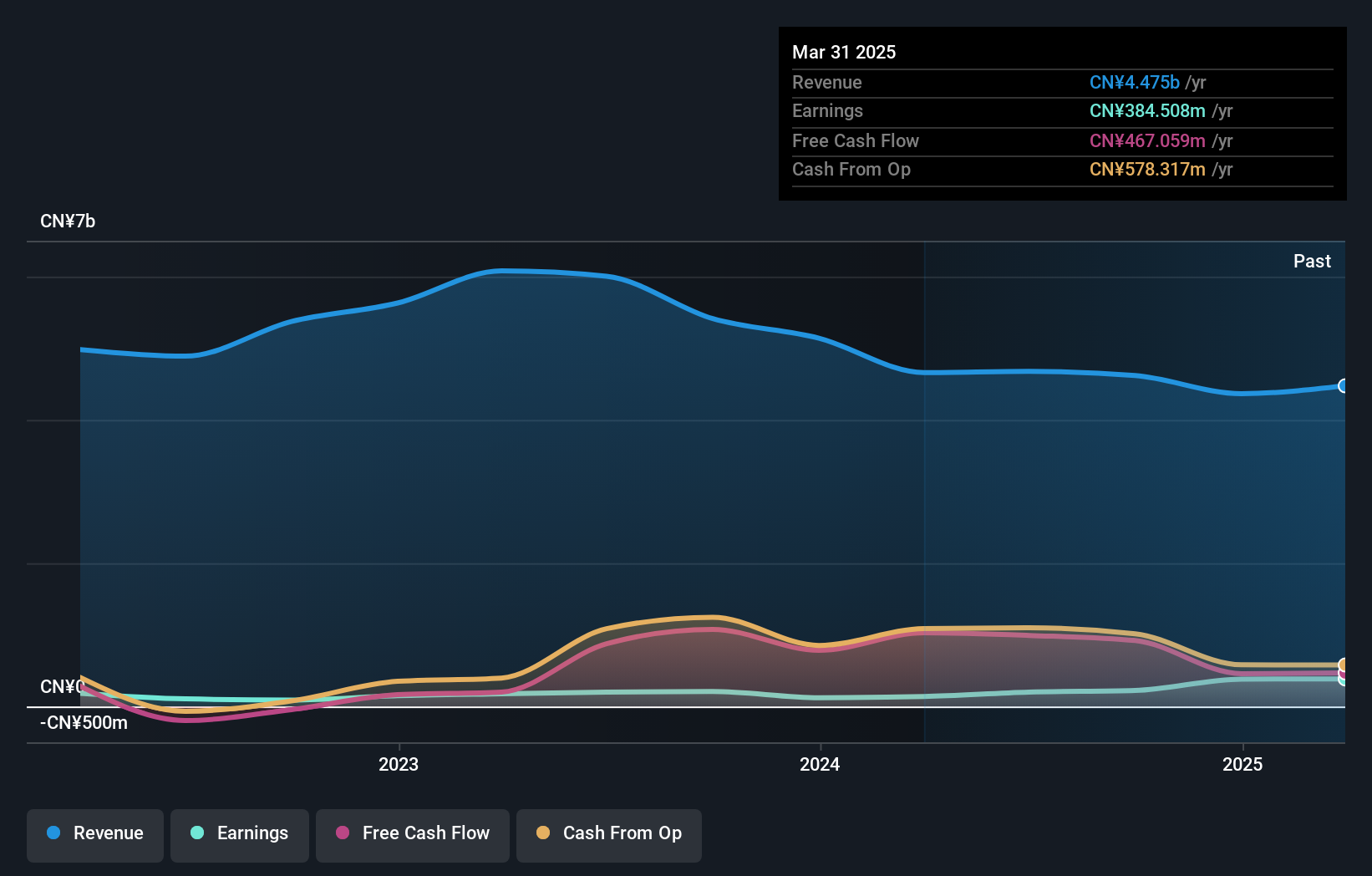

Shenyang Jinbei Automotive (SHSE:600609)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenyang Jinbei Automotive Company Limited focuses on the design, production, and sale of auto parts in China with a market cap of CN¥10 billion.

Operations: Jinbei Automotive generates revenue primarily from the sale of auto parts in China. The company's financial performance is highlighted by a net profit margin that has shown notable variation over recent periods, reflecting changes in cost management and pricing strategies.

Jinbei Auto, a smaller player in the automotive sector, has shown resilience with its earnings growing at 36.9% annually over the past five years. Despite a dip in revenue to CNY 3.43 billion from CNY 3.95 billion year-on-year, net income rose to CNY 291.69 million from CNY 190.85 million, indicating improved profitability with basic EPS climbing to CNY 0.222 from CNY 0.146. The company has also significantly reduced its debt-to-equity ratio from an alarming 273% to a manageable 25.6%, suggesting better financial health and positioning it as an intriguing opportunity for investors seeking undervalued prospects in this industry space.

Key Takeaways

- Embark on your investment journey to our 4622 Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600609

Shenyang Jinbei Automotive

Engages in the design, production, and sale of auto parts in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives