- China

- /

- Food and Staples Retail

- /

- SZSE:000759

Swelling losses haven't held back gains for Zhongbai Holdings GroupLtd (SZSE:000759) shareholders since they're up 129% over 1 year

When you buy shares in a company, there is always a risk that the price drops to zero. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Zhongbai Holdings Group Co.,Ltd. (SZSE:000759) share price has soared 129% return in just a single year. But it's down 8.2% in the last week. But note that the broader market is down 2.1% since last week, and this may have impacted Zhongbai Holdings GroupLtd's share price. Looking back further, the stock price is 73% higher than it was three years ago.

In light of the stock dropping 8.2% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

Zhongbai Holdings GroupLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last year Zhongbai Holdings GroupLtd saw its revenue shrink by 13%. We're a little surprised to see the share price pop 129% in the last year. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. Of course, it could be that the market expected this revenue drop.

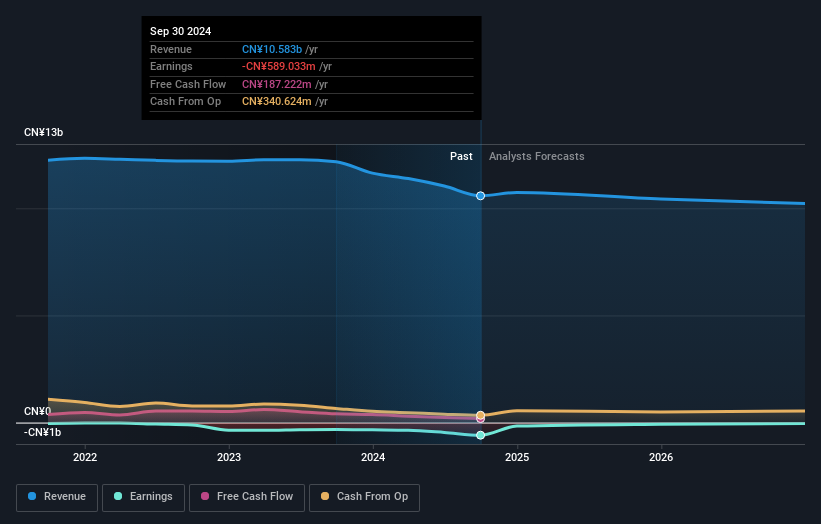

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Zhongbai Holdings GroupLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Zhongbai Holdings GroupLtd shareholders have received a total shareholder return of 129% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 5% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Zhongbai Holdings GroupLtd has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zhongbai Holdings GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000759

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives