- China

- /

- Food and Staples Retail

- /

- SHSE:603883

LBX Pharmacy Chain Joint Stock Company's (SHSE:603883) Price Is Right But Growth Is Lacking After Shares Rocket 30%

LBX Pharmacy Chain Joint Stock Company (SHSE:603883) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.6% in the last twelve months.

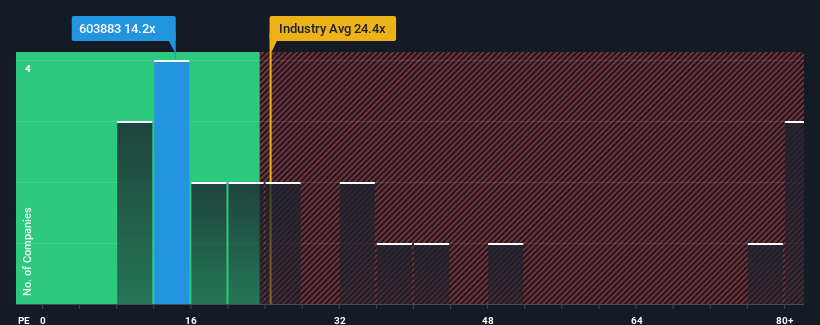

Although its price has surged higher, LBX Pharmacy Chain may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 14.2x, since almost half of all companies in China have P/E ratios greater than 28x and even P/E's higher than 52x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, LBX Pharmacy Chain has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for LBX Pharmacy Chain

What Are Growth Metrics Telling Us About The Low P/E?

LBX Pharmacy Chain's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a worthy increase of 13%. This was backed up an excellent period prior to see EPS up by 32% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 16% per annum as estimated by the twelve analysts watching the company. That's shaping up to be materially lower than the 20% each year growth forecast for the broader market.

In light of this, it's understandable that LBX Pharmacy Chain's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

LBX Pharmacy Chain's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that LBX Pharmacy Chain maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for LBX Pharmacy Chain that you should be aware of.

You might be able to find a better investment than LBX Pharmacy Chain. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603883

Undervalued with adequate balance sheet and pays a dividend.