- China

- /

- Food and Staples Retail

- /

- SHSE:601116

Sanjiang Shopping Club Co.,Ltd (SHSE:601116) May Have Run Too Fast Too Soon With Recent 28% Price Plummet

The Sanjiang Shopping Club Co.,Ltd (SHSE:601116) share price has softened a substantial 28% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 12% share price drop.

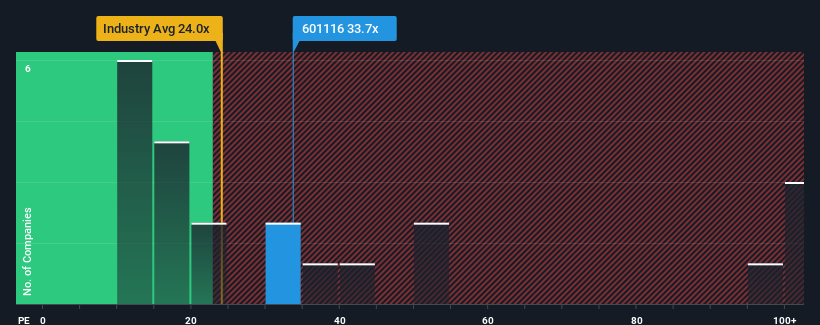

Even after such a large drop in price, there still wouldn't be many who think Sanjiang Shopping ClubLtd's price-to-earnings (or "P/E") ratio of 33.7x is worth a mention when the median P/E in China is similar at about 33x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

For example, consider that Sanjiang Shopping ClubLtd's financial performance has been pretty ordinary lately as earnings growth is non-existent. One possibility is that the P/E is moderate because investors think this benign earnings growth rate might not be enough to outperform the broader market in the near future. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

View our latest analysis for Sanjiang Shopping ClubLtd

How Is Sanjiang Shopping ClubLtd's Growth Trending?

The only time you'd be comfortable seeing a P/E like Sanjiang Shopping ClubLtd's is when the company's growth is tracking the market closely.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow EPS by an impressive 91% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 38% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it interesting that Sanjiang Shopping ClubLtd is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Final Word

With its share price falling into a hole, the P/E for Sanjiang Shopping ClubLtd looks quite average now. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Sanjiang Shopping ClubLtd currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 1 warning sign for Sanjiang Shopping ClubLtd that you should be aware of.

Of course, you might also be able to find a better stock than Sanjiang Shopping ClubLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601116

Sanjiang Shopping ClubLtd

Operates a chain of food supermarkets in Zhejiang province, the People’s Republic of China.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives