- China

- /

- Food and Staples Retail

- /

- SHSE:600833

Private companies in Shanghai No.1 Pharmacy Co.,Ltd. (SHSE:600833) are its biggest bettors, and their bets paid off as stock gained 10% last week

Key Insights

- Shanghai No.1 PharmacyLtd's significant private companies ownership suggests that the key decisions are influenced by shareholders from the larger public

- A total of 3 investors have a majority stake in the company with 51% ownership

- Past performance of a company along with ownership data serve to give a strong idea about prospects for a business

If you want to know who really controls Shanghai No.1 Pharmacy Co.,Ltd. (SHSE:600833), then you'll have to look at the makeup of its share registry. The group holding the most number of shares in the company, around 46% to be precise, is private companies. Put another way, the group faces the maximum upside potential (or downside risk).

As a result, private companies collectively scored the highest last week as the company hit CN¥3.3b market cap following a 10% gain in the stock.

Let's delve deeper into each type of owner of Shanghai No.1 PharmacyLtd, beginning with the chart below.

See our latest analysis for Shanghai No.1 PharmacyLtd

What Does The Institutional Ownership Tell Us About Shanghai No.1 PharmacyLtd?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

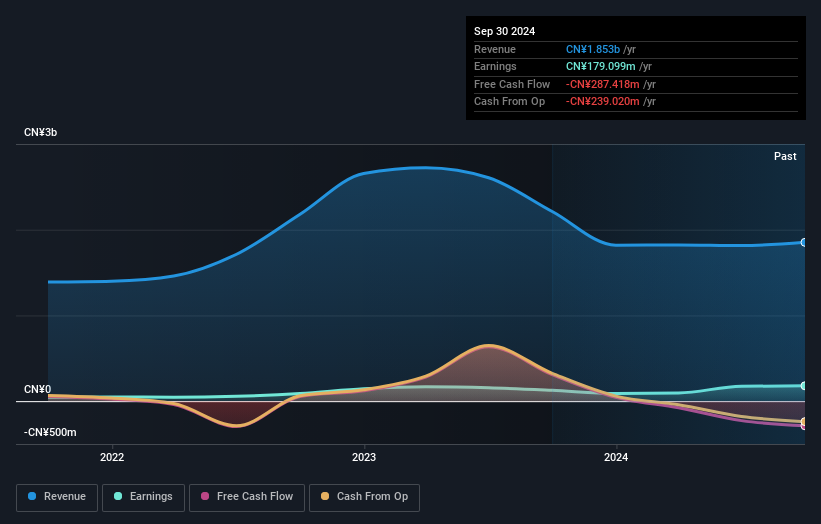

We can see that Shanghai No.1 PharmacyLtd does have institutional investors; and they hold a good portion of the company's stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Shanghai No.1 PharmacyLtd's historic earnings and revenue below, but keep in mind there's always more to the story.

Hedge funds don't have many shares in Shanghai No.1 PharmacyLtd. Bailian Group Co.,Ltd. is currently the largest shareholder, with 45% of shares outstanding. With 4.9% and 1.5% of the shares outstanding respectively, Jilin Aodong Pharmaceutical Group Co., Ltd. and China Southern Asset Management Co., Ltd. are the second and third largest shareholders.

To make our study more interesting, we found that the top 3 shareholders have a majority ownership in the company, meaning that they are powerful enough to influence the decisions of the company.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Shanghai No.1 PharmacyLtd

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our data cannot confirm that board members are holding shares personally. It is unusual not to have at least some personal holdings by board members, so our data might be flawed. A good next step would be to check how much the CEO is paid.

General Public Ownership

The general public, who are usually individual investors, hold a 43% stake in Shanghai No.1 PharmacyLtd. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

We can see that Private Companies own 46%, of the shares on issue. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Public Company Ownership

Public companies currently own 4.9% of Shanghai No.1 PharmacyLtd stock. It's hard to say for sure but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Be aware that Shanghai No.1 PharmacyLtd is showing 2 warning signs in our investment analysis , and 1 of those is concerning...

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you're looking to trade Shanghai No.1 PharmacyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600833

Shanghai No.1 PharmacyLtd

Engages in the retail and wholesale of pharmaceutical products in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives