- China

- /

- Consumer Durables

- /

- SZSE:301187

Three Companies That Might Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate a mixed landscape with major indexes like the S&P 500 and Nasdaq hitting record highs while others such as the Russell 2000 decline, investors are keenly observing the divergence between growth and value stocks. Amid this complex environment, identifying stocks that may be undervalued can present unique opportunities for those looking to capitalize on potential market inefficiencies. A good stock in this context is one that shows strong fundamentals but is currently priced below its estimated intrinsic value due to temporary market conditions or sector-specific challenges.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Round One (TSE:4680) | ¥1264.00 | ¥2527.25 | 50% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.26 | US$99.93 | 49.7% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.7% |

| West Bancorporation (NasdaqGS:WTBA) | US$23.32 | US$46.38 | 49.7% |

| EnomotoLtd (TSE:6928) | ¥1441.00 | ¥2877.97 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP289.40 | CLP576.08 | 49.8% |

| Nidaros Sparebank (OB:NISB) | NOK99.60 | NOK198.62 | 49.9% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.10 | HK$54.00 | 49.8% |

| Zalando (XTRA:ZAL) | €34.70 | €69.28 | 49.9% |

| Akeso (SEHK:9926) | HK$66.35 | HK$131.88 | 49.7% |

Let's dive into some prime choices out of the screener.

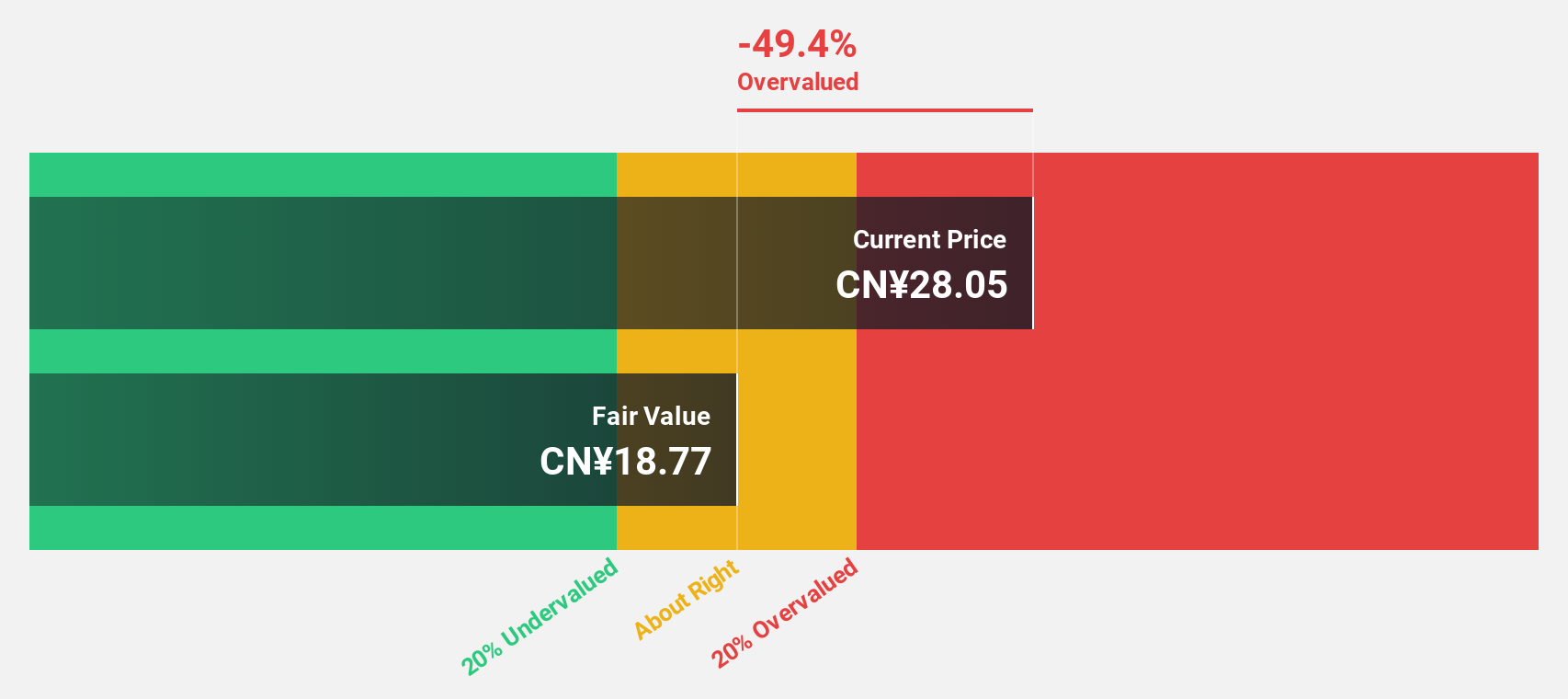

Suzhou Alton Electrical & Mechanical Industry (SZSE:301187)

Overview: Suzhou Alton Electrical & Mechanical Industry Co., Ltd. operates in the electrical and mechanical sector, with a market cap of CN¥5.64 billion.

Operations: Suzhou Alton Electrical & Mechanical Industry Co., Ltd. derives its revenue from various segments within the electrical and mechanical sector.

Estimated Discount To Fair Value: 29.1%

Suzhou Alton Electrical & Mechanical Industry Co., Ltd. is trading at CNY 31.19, significantly below its estimated fair value of CNY 44.01, highlighting its potential undervaluation based on discounted cash flows. Recent earnings show strong growth with net income rising to CNY 184.58 million for the nine months ended September 2024, up from CNY 124.75 million a year ago, while revenue forecasts suggest continued robust expansion at over 20% annually despite high share price volatility and low dividend coverage by earnings or free cash flows.

- Our growth report here indicates Suzhou Alton Electrical & Mechanical Industry may be poised for an improving outlook.

- Navigate through the intricacies of Suzhou Alton Electrical & Mechanical Industry with our comprehensive financial health report here.

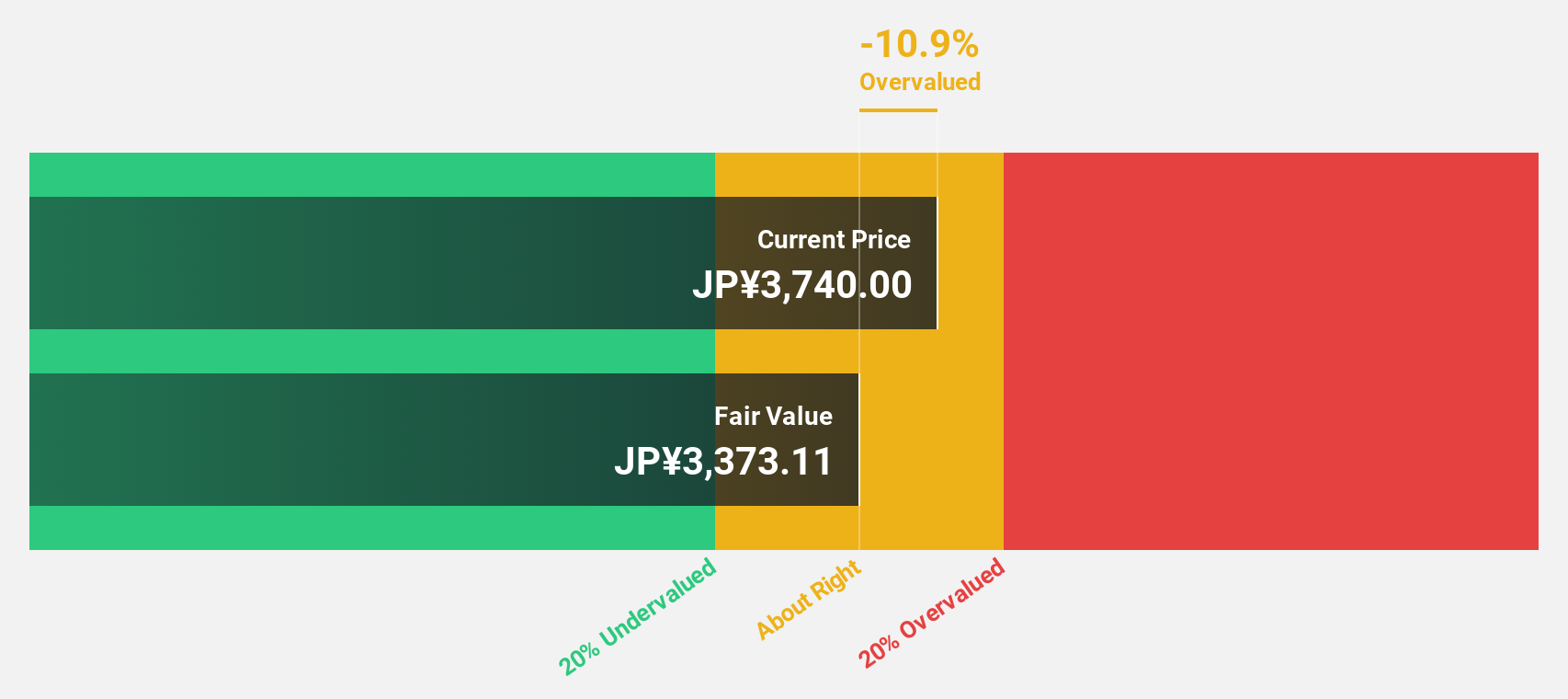

freee K.K (TSE:4478)

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market cap of ¥192.61 billion.

Operations: The company generates revenue primarily from its Platform Business, which accounted for ¥27.09 billion.

Estimated Discount To Fair Value: 40.3%

freee K.K. is trading at ¥3,275, notably below its fair value estimate of ¥5,481.86, suggesting undervaluation based on discounted cash flows. Despite recent share price volatility, the company is poised for significant growth with earnings expected to increase by 73.97% annually and become profitable within three years—outpacing market averages. Revenue growth is projected at 18.3% per year, further supporting its potential as an undervalued investment opportunity in Japan's market landscape.

- Our comprehensive growth report raises the possibility that freee K.K is poised for substantial financial growth.

- Get an in-depth perspective on freee K.K's balance sheet by reading our health report here.

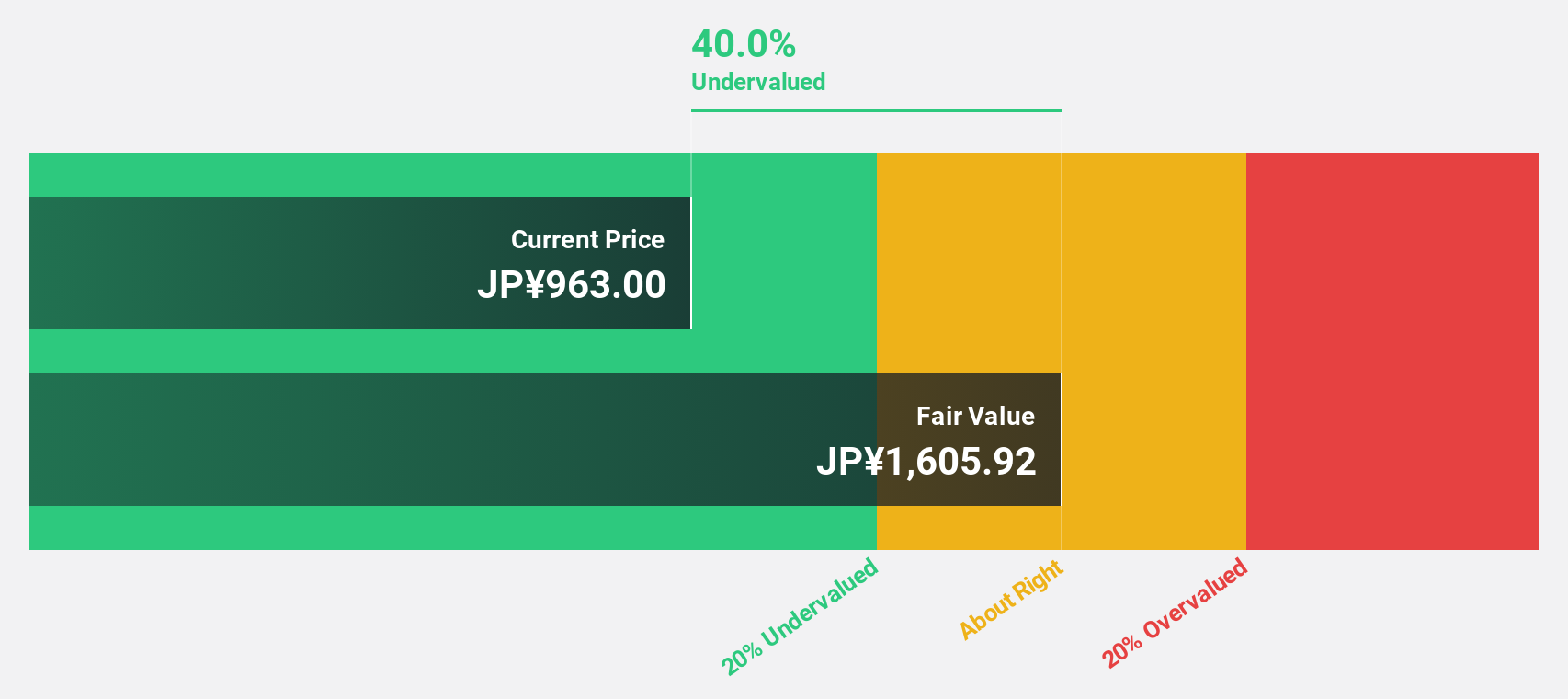

Insource (TSE:6200)

Overview: Insource Co., Ltd. offers lecturer dispatch type training, open lectures, and other services in Japan with a market cap of ¥99.69 billion.

Operations: The company generates revenue of ¥12.47 billion from its Education Service Business segment.

Estimated Discount To Fair Value: 28.4%

Insource Co., Ltd. is trading at ¥1,188, significantly below its estimated fair value of ¥1,659.64, highlighting its potential as an undervalued stock based on cash flows. Forecasted earnings growth of 18.2% annually surpasses the Japanese market average and is bolstered by recent strategic partnerships like the DX Human Resource Development Program with MUFG Bank. Despite revenue growth projections of 15.1% per year being below significant levels, Insource remains a compelling investment prospect due to strong cash flow valuation metrics and strategic initiatives in digital transformation training programs.

- Our earnings growth report unveils the potential for significant increases in Insource's future results.

- Click here to discover the nuances of Insource with our detailed financial health report.

Where To Now?

- Navigate through the entire inventory of 890 Undervalued Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301187

Suzhou Alton Electrical & Mechanical Industry

Suzhou Alton Electrical & Mechanical Industry Co., Ltd.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives