- China

- /

- Electronic Equipment and Components

- /

- SZSE:002947

Discover Suzhou Hengmingda Electronic Technology And 2 Other Promising Small Caps With Strong Foundations

Reviewed by Simply Wall St

As global markets show signs of resilience, with U.S. indexes nearing record highs and small-cap stocks outperforming their larger counterparts, investors are increasingly focusing on the potential of lesser-known companies amidst a backdrop of encouraging economic indicators such as low jobless claims and rising home sales. In this environment, identifying stocks with strong foundations becomes crucial; these are companies that demonstrate robust fundamentals and the ability to thrive despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| CTCI Advanced Systems | 30.56% | 24.10% | 29.97% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Suzhou Hengmingda Electronic Technology (SZSE:002947)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Hengmingda Electronic Technology Co., Ltd. operates in the electronic technology sector and has a market capitalization of approximately CN¥8.65 billion.

Operations: The company generates revenue primarily from its electronic technology products. Its financial performance is highlighted by a market capitalization of approximately CN¥8.65 billion, reflecting its position in the sector.

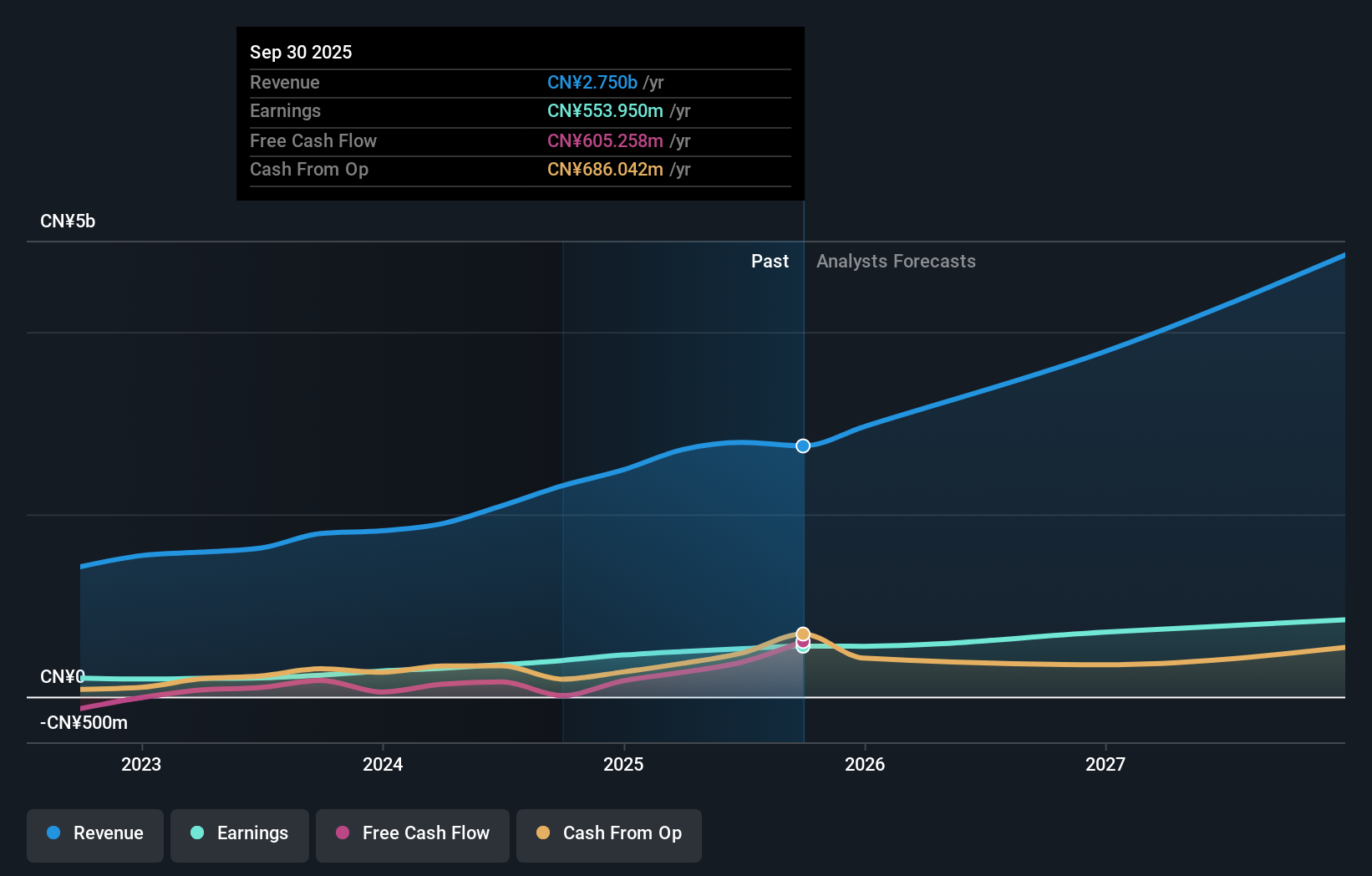

Suzhou Hengmingda Electronic Technology, a smaller player in the electronics sector, has shown impressive growth with earnings surging by 67.8% over the past year, outpacing the industry's 1.8%. The company reported sales of CNY 1.70 billion for nine months ending September 2024, up from CNY 1.20 billion a year earlier, and net income rose to CNY 310.81 million from CNY 195.11 million. Despite recent shareholder dilution, its price-to-earnings ratio of 21.7x remains attractive compared to the CN market's average of 35.4x, suggesting potential value for investors seeking under-the-radar opportunities in this dynamic industry segment.

Yanpai Filtration Technology (SZSE:301081)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yanpai Filtration Technology Co., Ltd. focuses on the research, development, production, and sale of filter materials both in China and internationally, with a market cap of CN¥1.85 billion.

Operations: Yanpai Filtration Technology generates revenue primarily through the sale of filter materials both domestically and internationally. The company's cost structure includes expenses related to research, development, and production. Its financial performance is reflected in a market cap of CN¥1.85 billion.

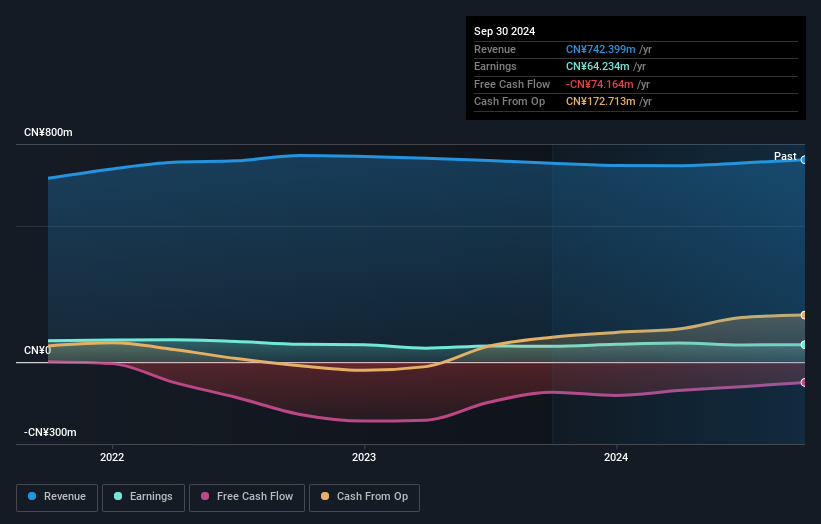

Yanpai Filtration Technology, a smaller player in the market, has seen its debt to equity ratio rise to 66.3% over five years, indicating increased leverage. Despite this, it remains profitable with high-quality earnings and a satisfactory net debt to equity ratio of 10.7%. The company's price-to-earnings ratio of 30x is attractive compared to the broader CN market's 35.4x. Recent earnings show revenue at CNY 557 million for nine months ending September 2024, up from CNY 537 million year-on-year; however, net income slightly dipped to CNY 42 million from CNY 43 million last year.

Kameda SeikaLtd (TSE:2220)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kameda Seika Co., Ltd. is engaged in the manufacturing and sale of rice crackers and snacks both domestically in Japan and internationally, with a market capitalization of ¥86.97 billion.

Operations: Kameda Seika generates revenue primarily from its Domestic Rice Cracker segment, which accounts for ¥68.50 billion. The Overseas segment also contributes significantly with ¥17.47 billion in revenue.

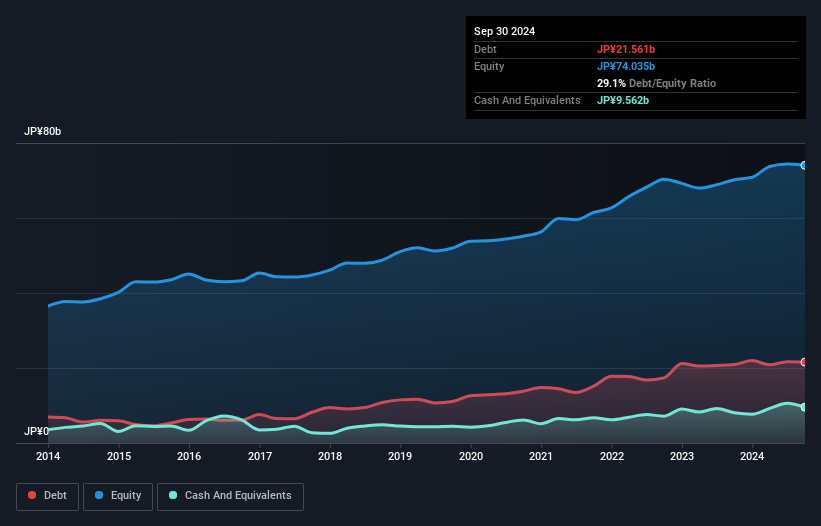

Kameda Seika, a notable player in the food industry, has shown impressive earnings growth of 105.7% over the past year, outpacing the industry's 20.1%. The company seems to have managed its debt well with a net debt to equity ratio of 16.2%, which is considered satisfactory. However, a one-off loss of ¥1.7 billion has impacted recent financial results as of September 2024. On a positive note, Kameda Seika revised its earnings guidance upwards for fiscal year ending March 2025 and continues to pay dividends consistently at ¥15 per share for six months ended September 30, 2024.

- Click here to discover the nuances of Kameda SeikaLtd with our detailed analytical health report.

Gain insights into Kameda SeikaLtd's past trends and performance with our Past report.

Next Steps

- Access the full spectrum of 4634 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002947

Suzhou Hengmingda Electronic Technology

Suzhou Hengmingda Electronic Technology Co., Ltd.

Excellent balance sheet with proven track record.