As global markets navigate a complex landscape, recent developments have seen the S&P 500 advance while small-cap indices like the Russell 2000 and S&P MidCap 400 outperform, suggesting renewed interest in smaller companies. Amid these dynamics, identifying undiscovered gems can enhance a portfolio by leveraging opportunities that align with current market trends and economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.07% | 32.89% | -17.68% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Suzhou Hengmingda Electronic Technology (SZSE:002947)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Hengmingda Electronic Technology Co., Ltd. is a company focused on electronic technology operations with a market capitalization of CN¥9.96 billion.

Operations: Hengmingda generates revenue through its electronic technology operations. The company's market capitalization is CN¥9.96 billion, reflecting its standing in the industry.

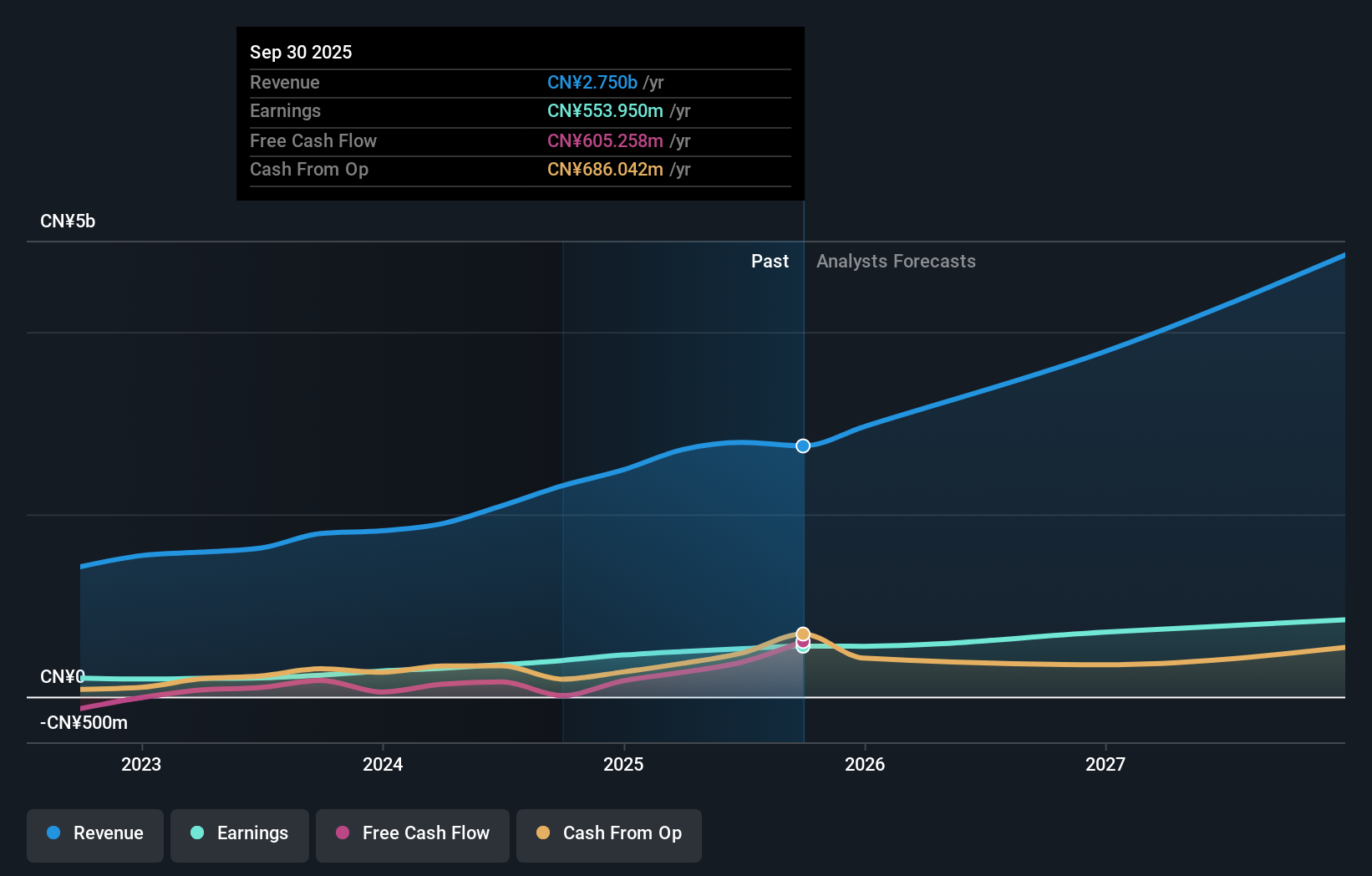

Suzhou Hengmingda Electronic Technology, a smaller player in the electronics sector, has shown impressive growth with earnings increasing by 69.6% over the past year, outpacing the industry average of -2.8%. The company reported half-year sales of CNY 929.3 million and net income of CNY 163.85 million, reflecting solid operational performance. With a price-to-earnings ratio of 27.8x below the CN market average of 33.5x, it presents a favorable valuation for investors seeking value opportunities within this niche market segment. Recent private placements raised substantial funds amounting to approximately CNY 756 million, signaling strong investor confidence and potential for future expansion.

- Take a closer look at Suzhou Hengmingda Electronic Technology's potential here in our health report.

Toread Holdings Group (SZSE:300005)

Simply Wall St Value Rating: ★★★★★☆

Overview: Toread Holdings Group Co., Ltd. focuses on the research, development, operation, and sales of outdoor products in China with a market cap of CN¥6.75 billion.

Operations: Toread generates revenue primarily from the sales of outdoor products in China. The company's cost structure includes expenses related to research, development, and operations. It is important to note that Toread's financial performance is influenced by these operational costs and its ability to manage them effectively.

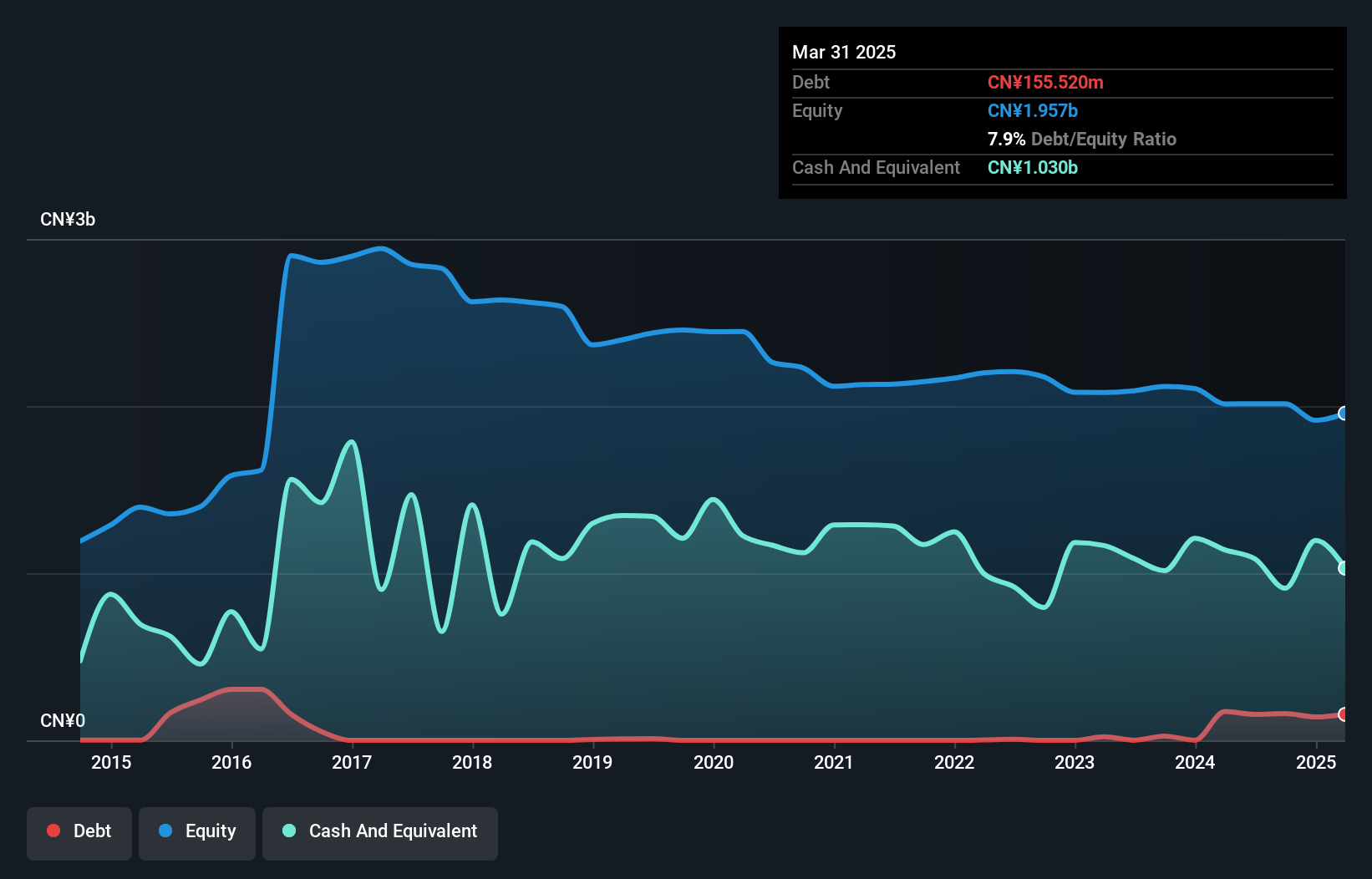

Toread Holdings Group, a nimble player in its field, has shown impressive growth with earnings surging by 92% over the past year, outpacing the Leisure industry's 5% benchmark. For the half-year ending June 2024, sales reached CNY 692.21 million from CNY 548.52 million previously, while net income soared to CNY 85.5 million from CNY 21.61 million last year. Despite a volatile share price recently, Toread's financial health appears robust with more cash than debt and high-quality earnings reported; however, its debt-to-equity ratio has risen from 0.4 to 7.7 over five years which may warrant attention moving forward.

- Get an in-depth perspective on Toread Holdings Group's performance by reading our health report here.

Evaluate Toread Holdings Group's historical performance by accessing our past performance report.

Zhejiang Cayi Vacuum Container (SZSE:301004)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Cayi Vacuum Container Co., Ltd. specializes in the research, development, design, production, and sale of beverage and food containers made from various materials in China with a market capitalization of CN¥11.77 billion.

Operations: Zhejiang Cayi generates revenue primarily through the sale of beverage and food containers. The company's net profit margin stands at 15.3%, indicating the proportion of revenue that translates into profit after expenses.

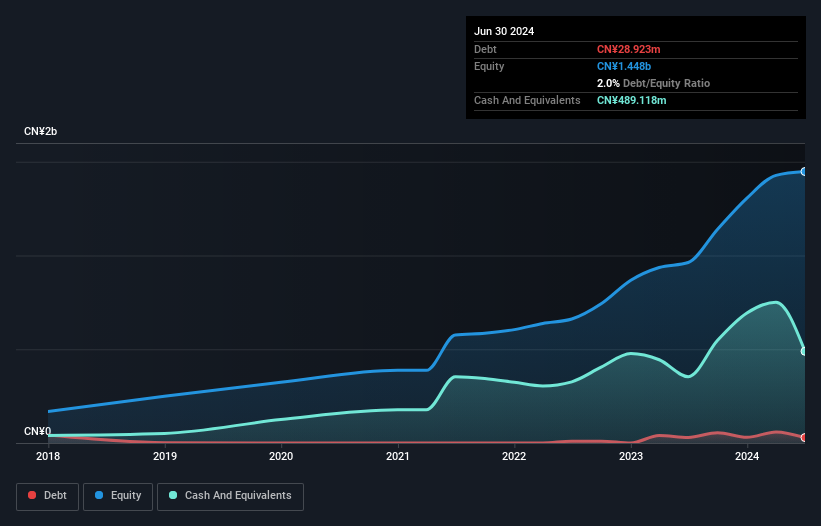

Zhejiang Cayi Vacuum Container seems to be on a promising trajectory, with recent earnings showing significant growth. For the half year ending June 2024, sales jumped to CNY 1.13 billion from CNY 631 million the previous year, while net income rose to CNY 317 million from CNY 163 million. The company's earnings per share also improved notably, reaching CNY 3.13 from last year's CNY 1.63. Despite an increase in its debt-to-equity ratio over five years, it holds more cash than total debt and trades at approximately 60% below estimated fair value, suggesting potential for future appreciation in value relative to peers and industry standards.

- Click to explore a detailed breakdown of our findings in Zhejiang Cayi Vacuum Container's health report.

Understand Zhejiang Cayi Vacuum Container's track record by examining our Past report.

Next Steps

- Click through to start exploring the rest of the 4752 Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toread Holdings Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300005

Toread Holdings Group

Engages in the research, development, operation, and sales of outdoor products in China.

Excellent balance sheet with moderate growth potential.