Undiscovered Gems These 3 Global Stocks with Strong Foundations

Reviewed by Simply Wall St

As global markets react positively to the recent U.S.-China tariff suspension, with indices like the Nasdaq Composite and S&P 500 witnessing substantial gains, investors are keenly observing how these developments might influence small-cap stocks. Amidst this backdrop of easing trade tensions and cooling inflation rates, identifying stocks with strong foundations becomes crucial; such companies often exhibit resilience and potential for growth even in fluctuating market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 77.35% | 3.64% | 7.13% | ★★★★★★ |

| Changjiu Holdings | NA | 11.55% | 10.44% | ★★★★★★ |

| PSC | 15.34% | 1.17% | 10.86% | ★★★★★★ |

| Kerevitas Gida Sanayi ve Ticaret | 42.60% | 43.79% | 39.15% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.00% | 46.96% | 55.76% | ★★★★★★ |

| Alfa Solar Enerji Sanayi ve Ticaret | 38.29% | 5.19% | -13.40% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 8.11% | 55.10% | 73.88% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.68% | 12.49% | 49.63% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

GAON CABLE (KOSE:A000500)

Simply Wall St Value Rating: ★★★★☆☆

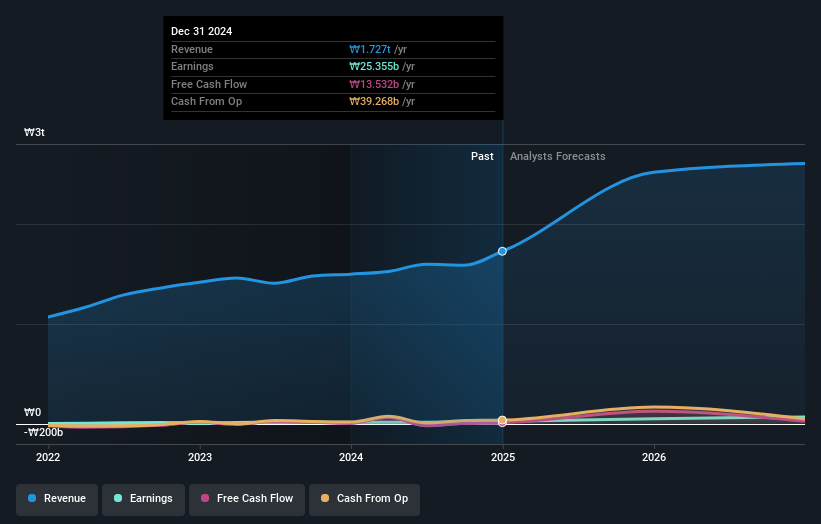

Overview: GAON CABLE Co., Ltd. is a South Korean company specializing in industrial power cables with a market capitalization of ₩1.09 trillion.

Operations: The primary revenue stream for GAON CABLE comes from its Power Line Division, generating approximately ₩1.73 trillion. The Telecommunications Line Division contributes an additional ₩225.09 billion to the company's revenue.

GAON CABLE, a relatively small player in the market, has shown impressive growth with earnings surging by 41.7% over the past year, outpacing its industry peers. The company's net income for 2024 reached KRW 25.36 billion, up from KRW 17.9 billion in the previous year, reflecting its robust performance. Despite a volatile share price recently, GAON maintains well-covered interest payments at 6.2 times EBIT and holds a satisfactory net debt to equity ratio of 26.2%. With basic earnings per share rising to KRW 3,270 from KRW 2,907 last year, it seems poised for continued expansion in its sector.

- Navigate through the intricacies of GAON CABLE with our comprehensive health report here.

Evaluate GAON CABLE's historical performance by accessing our past performance report.

MCLON JEWELLERYLtd (SZSE:300945)

Simply Wall St Value Rating: ★★★★★☆

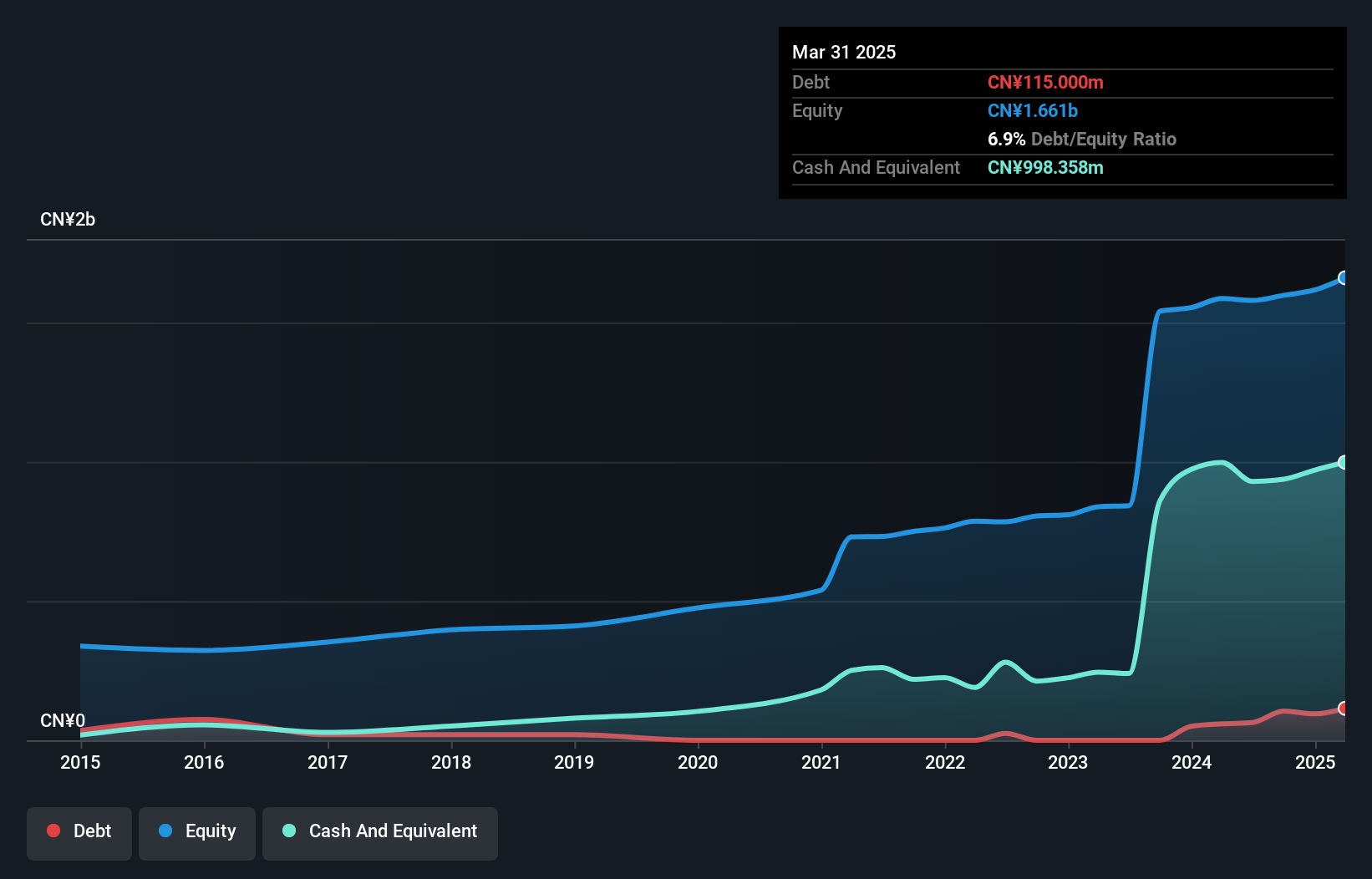

Overview: MCLON JEWELLERY Co., Ltd. engages in jewelry retail both within China and internationally, with a market cap of CN¥4.40 billion.

Operations: The company generates revenue primarily from its jewelry retail operations in China and international markets. It has a market capitalization of CN¥4.40 billion.

MCLON Jewellery, a small player in the luxury sector, has shown impressive growth with earnings surging 20% over the past year, outpacing its industry. Its sales climbed to CNY 2.36 billion from CNY 1.92 billion last year, while net income increased to CNY 96.13 million from CNY 80.09 million. The company also declared a final cash dividend of CNY 1.40 per ten shares for 2024, indicating robust profitability and shareholder returns. Despite having a volatile share price recently, MCLON's high-quality earnings and strong interest coverage suggest solid financial health moving forward.

- Click here and access our complete health analysis report to understand the dynamics of MCLON JEWELLERYLtd.

Explore historical data to track MCLON JEWELLERYLtd's performance over time in our Past section.

Shinkong Textile (TWSE:1419)

Simply Wall St Value Rating: ★★★★★☆

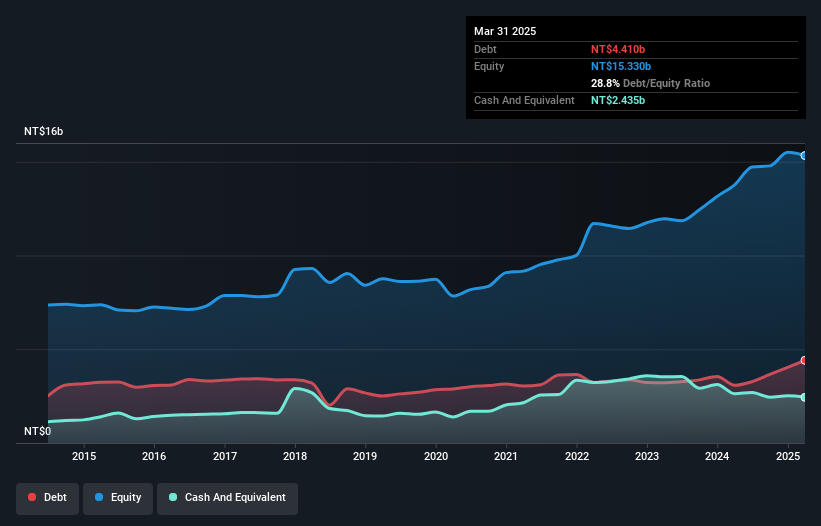

Overview: Shinkong Textile Co., Ltd. is involved in the production and sale of synthetic fibers, fabrics, and finished fabrics both in Taiwan and internationally, with a market cap of NT$15.68 billion.

Operations: Shinkong Textile generates revenue primarily from the sale of synthetic fibers, fabrics, and finished fabrics. The company's financial performance includes a focus on cost management to optimize profitability. A notable aspect is its gross profit margin, which reflects the efficiency in managing production costs relative to sales.

Shinkong Textile, a modest player in the textile industry, has shown promising financial health. Over the past year, earnings surged by 35.4%, outpacing the luxury industry's growth of 10.2%. This robust performance is complemented by a satisfactory net debt to equity ratio of 12.9% and a reduction in debt from 36.8% to 28.8% over five years, indicating prudent financial management. Recent reports highlight first-quarter sales reaching TWD 1,063 million from TWD 862 million last year and net income climbing to TWD 98.7 million from TWD 89.73 million, showcasing consistent revenue growth and profitability improvements for this small entity.

Taking Advantage

- Unlock our comprehensive list of 3199 Global Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Shinkong Textile, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1419

Shinkong Textile

Engages in the production and sale of various synthetic fibers, fabrics, and finished fabrics in Taiwan and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives