- China

- /

- Consumer Durables

- /

- SZSE:300885

Jiangxi Xinyu Guoke Technology And 2 Other Promising Small Caps To Consider In Asia

Reviewed by Simply Wall St

In the current global market landscape, investors are navigating a mixed bag of economic signals, with U.S. stocks experiencing gains despite uncertainties around interest rates and inflation expectations. Amid this backdrop, small-cap stocks in Asia present intriguing opportunities as they often offer unique growth potential and resilience to broader market fluctuations. Identifying promising small caps involves assessing their innovation capabilities, financial health, and ability to capitalize on regional economic trends—qualities that can position them well in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| VICOM | NA | 5.01% | 2.30% | ★★★★★★ |

| PSC | 15.34% | 1.17% | 10.86% | ★★★★★★ |

| Shanghai Guangdian Electric Group | NA | -0.32% | -30.00% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Woori Technology Investment | NA | 25.42% | -1.59% | ★★★★★★ |

| Tibet Development | 51.47% | -1.07% | 56.62% | ★★★★★★ |

| Suzhou Nanomicro Technology | 7.29% | 23.88% | -2.17% | ★★★★★★ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 31.26% | 0.80% | 0.71% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Jiangxi Xinyu Guoke Technology (SZSE:300722)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Xinyu Guoke Technology Co., Ltd specializes in the manufacturing and sale of military products, with a market capitalization of CN¥8.48 billion.

Operations: Xinyu Guoke Technology generates revenue primarily from the sale of military products. The company has a market capitalization of CN¥8.48 billion.

Jiangxi Xinyu Guoke Technology, a nimble player in the Aerospace & Defense sector, is debt-free and boasts high-quality earnings. Over the past year, its earnings grew by 7%, outpacing the industry average of -11%. This growth trajectory seems supported by positive free cash flow, which stood at US$91.02 million as of September 2024. The company has consistently managed capital expenditures effectively, with recent figures showing US$14.17 million spent in September 2024. With no debt concerns and robust financials, it appears well-positioned within its industry context for potential future value creation.

Yangzhou Seashine New MaterialsLtd (SZSE:300885)

Simply Wall St Value Rating: ★★★★★★

Overview: Yangzhou Seashine New Materials Co., Ltd. specializes in the design, production, and marketing of powder metallurgy structural parts in China, with a market capitalization of CN¥4.23 billion.

Operations: Yangzhou Seashine New Materials Co., Ltd. generates revenue primarily through the sale of powder metallurgy structural parts. The company has a market capitalization of CN¥4.23 billion, reflecting its presence in the Chinese market.

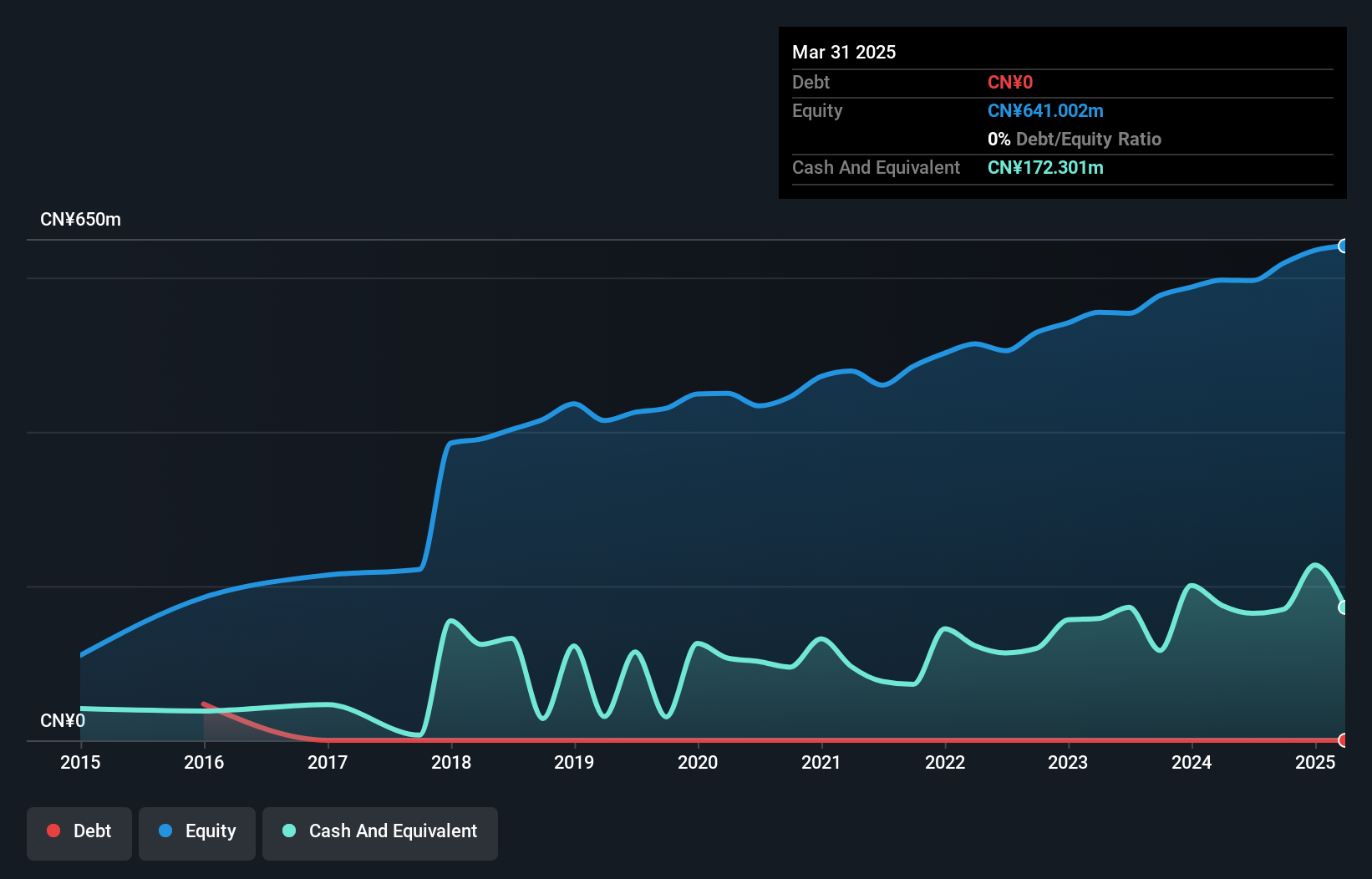

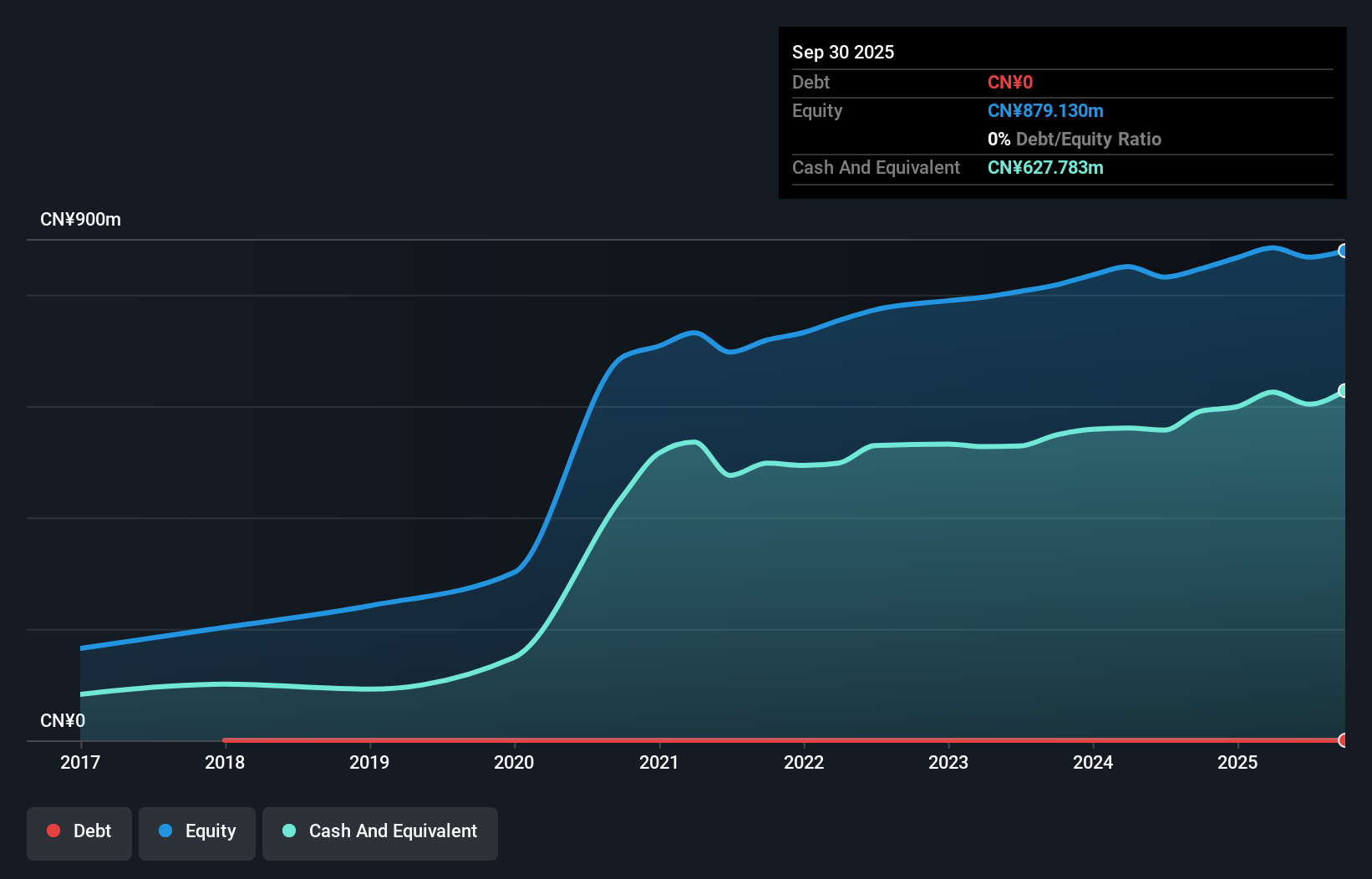

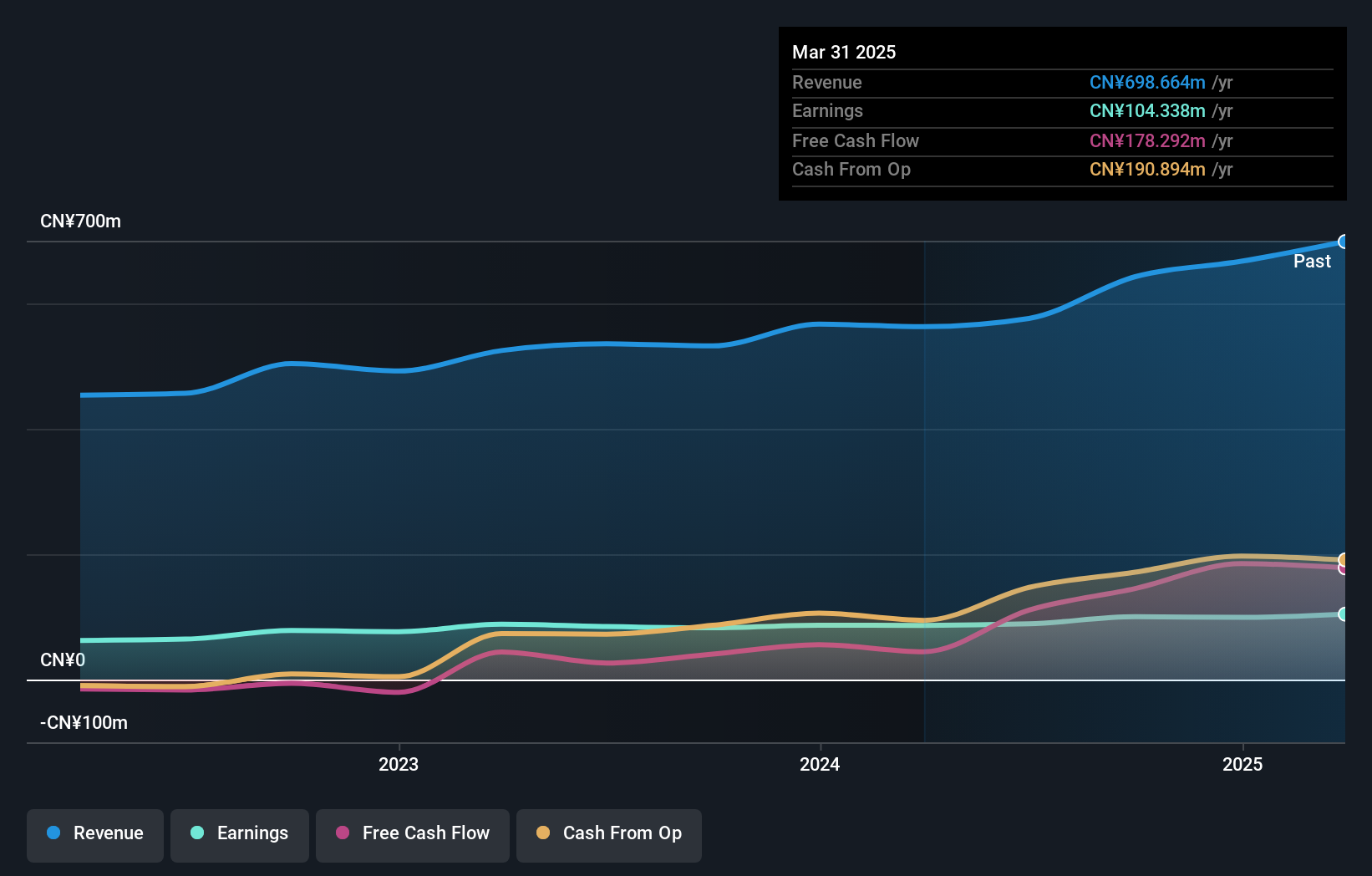

Yangzhou Seashine, a nimble player in the materials sector, has shown impressive financial health with no debt over the past five years. The company reported an 84% surge in earnings last year, outpacing its industry peers who saw a -2.1% change. Despite this growth, earnings have decreased by 9% annually over the last five years. Their recent share repurchase program completed with 2.65 million shares bought back for CNY 20 million, reflecting confidence in their valuation. With revenue expected to grow by about 20% annually, Yangzhou Seashine seems poised for further expansion despite recent stock volatility.

- Click to explore a detailed breakdown of our findings in Yangzhou Seashine New MaterialsLtd's health report.

Understand Yangzhou Seashine New MaterialsLtd's track record by examining our Past report.

Dezhou United Petroleum TechnologyLtd (SZSE:301158)

Simply Wall St Value Rating: ★★★★★★

Overview: Dezhou United Petroleum Technology Co., Ltd. operates in the petroleum technology sector and has a market capitalization of approximately CN¥3.08 billion.

Operations: Dezhou United generates revenue primarily from its petroleum technology services. The company's cost structure includes expenses related to service delivery and technological development. It has demonstrated a notable net profit margin trend, which is an important indicator of profitability in the industry.

Dezhou United Petroleum Technology, a compact player in the energy services sector, has shown robust financial health with its debt to equity ratio dropping from 3.6% to 0.1% over five years, indicating improved financial stability. The company posted earnings growth of 14.5%, outpacing the industry's 10.9%, and reported net income of CNY 99.35 million for the last fiscal year, up from CNY 86.73 million previously. With a price-to-earnings ratio of 31x below the CN market average of 38x, it seems attractively valued while maintaining high-quality earnings and positive free cash flow dynamics.

Make It Happen

- Click this link to deep-dive into the 2652 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300885

Yangzhou Seashine New MaterialsLtd

Engages in the design, production, and marketing of various powder metallurgy structural parts in China.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives