- China

- /

- Consumer Durables

- /

- SZSE:300616

We Think That There Are Some Issues For Guangzhou Shangpin Home Collection (SZSE:300616) Beyond Its Promising Earnings

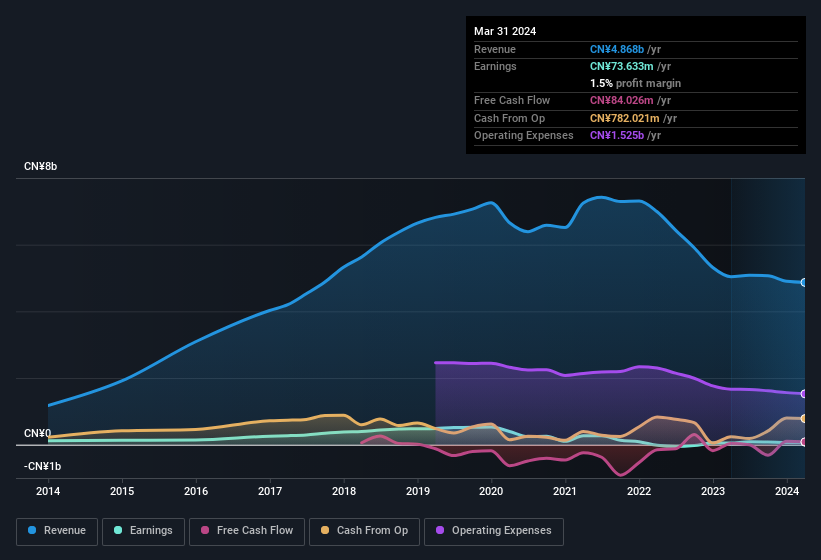

The recent earnings posted by Guangzhou Shangpin Home Collection Co., Ltd. (SZSE:300616) were solid, but the stock didn't move as much as we expected. However the statutory profit number doesn't tell the whole story, and we have found some factors which might be of concern to shareholders.

Check out our latest analysis for Guangzhou Shangpin Home Collection

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Guangzhou Shangpin Home Collection issued 13% more new shares over the last year. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Guangzhou Shangpin Home Collection's historical EPS growth by clicking on this link.

A Look At The Impact Of Guangzhou Shangpin Home Collection's Dilution On Its Earnings Per Share (EPS)

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. On the bright side, in the last twelve months it grew profit by 44%. But EPS was less impressive, up only 44% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So Guangzhou Shangpin Home Collection shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Guangzhou Shangpin Home Collection's Profit Performance

Each Guangzhou Shangpin Home Collection share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Therefore, it seems possible to us that Guangzhou Shangpin Home Collection's true underlying earnings power is actually less than its statutory profit. The good news is that, its earnings per share increased by 44% in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. You'd be interested to know, that we found 2 warning signs for Guangzhou Shangpin Home Collection and you'll want to know about them.

Today we've zoomed in on a single data point to better understand the nature of Guangzhou Shangpin Home Collection's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you're looking to trade Guangzhou Shangpin Home Collection, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300616

Guangzhou Shangpin Home Collection

Guangzhou Shangpin Home Collection Co., Ltd.

Adequate balance sheet and fair value.

Market Insights

Community Narratives