- China

- /

- Consumer Durables

- /

- SZSE:002571

Investors bid Anhui Deli Household Glass (SZSE:002571) up CN¥451m despite increasing losses YoY, taking five-year CAGR to 6.7%

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Anhui Deli Household Glass share price has climbed 39% in five years, easily topping the market return of 21% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 27% in the last year.

Since it's been a strong week for Anhui Deli Household Glass shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Anhui Deli Household Glass

Because Anhui Deli Household Glass made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Anhui Deli Household Glass saw its revenue grow at 15% per year. That's a fairly respectable growth rate. While the share price has beat the market, compounding at 7% yearly, over five years, there's certainly some potential that the market hasn't fully considered the growth track record. If revenue growth can maintain for long enough, it's likely profits will flow. Lack of earnings means you have to project further into the future justify the valuation on the basis of future free cash flow.

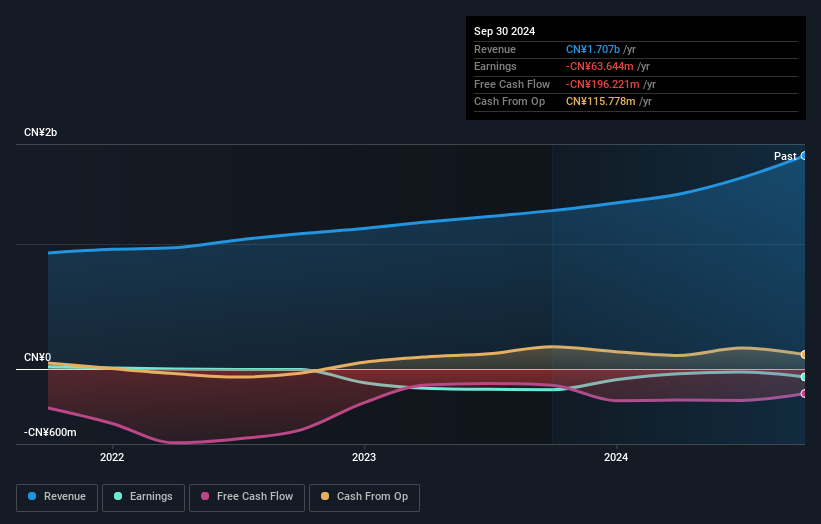

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Anhui Deli Household Glass' earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Anhui Deli Household Glass shareholders have received a total shareholder return of 27% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 7% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Anhui Deli Household Glass you should be aware of, and 2 of them are significant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002571

Anhui Deli Household Glass

Researches, develops, manufactures and sells glass tableware and kitchenware products in China and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives