Per Aarsleff Holding And 2 Other Undiscovered Gems With Solid Fundamentals

Reviewed by Simply Wall St

In the wake of recent market fluctuations, with U.S. stocks retreating amid policy uncertainties and interest rate expectations shifting, small-cap companies have faced a challenging landscape. Despite these hurdles, certain lesser-known stocks with robust fundamentals continue to offer potential opportunities for investors seeking stability and growth. Identifying such gems involves looking beyond short-term market noise to focus on strong financial health and promising business models, as exemplified by Per Aarsleff Holding and two other noteworthy contenders.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | NA | 13.11% | 9.95% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 12.19% | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Per Aarsleff Holding (CPSE:PAAL B)

Simply Wall St Value Rating: ★★★★★★

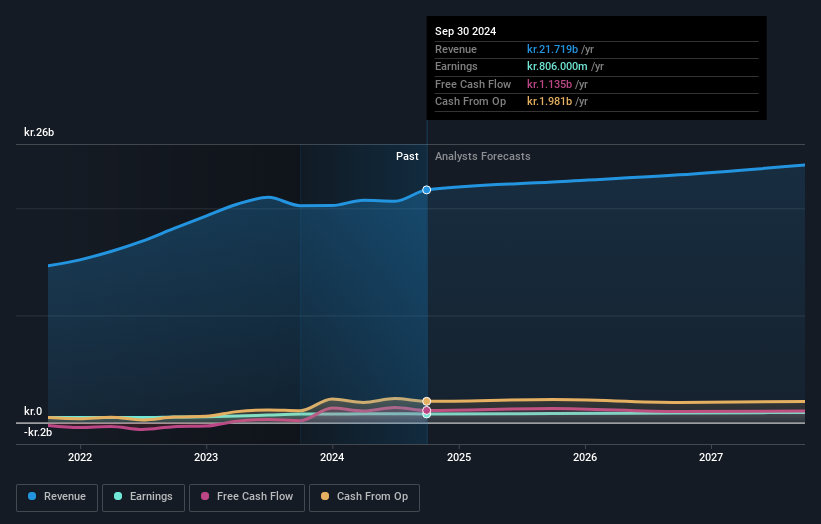

Overview: Per Aarsleff Holding A/S is involved in the construction and maintenance of infrastructure and building structures both in Denmark and internationally, with a market cap of DKK7.56 billion.

Operations: Per Aarsleff Holding generates revenue primarily from its Construction segment, which accounts for DKK9.95 billion, followed by Ground Engineering at DKK3.66 billion and Technical Solutions at DKK3.09 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability and efficiency in managing expenses relative to its total revenue streams.

Per Aarsleff Holding, a notable player in the construction sector, has shown impressive financial health with its net debt to equity ratio dropping from 24.4% to 19% over five years. The company is trading at a favorable value, being 34.6% below its estimated fair value and demonstrating high-quality earnings with a growth rate of 17%, outpacing the industry average of 10.3%. Recent corporate guidance suggests revenue could reach DKK 21 billion to DKK 21.4 billion for the year, reflecting an optimistic outlook despite slight dips in quarterly net income figures compared to last year.

- Click to explore a detailed breakdown of our findings in Per Aarsleff Holding's health report.

Understand Per Aarsleff Holding's track record by examining our Past report.

BW Offshore (OB:BWO)

Simply Wall St Value Rating: ★★★★★☆

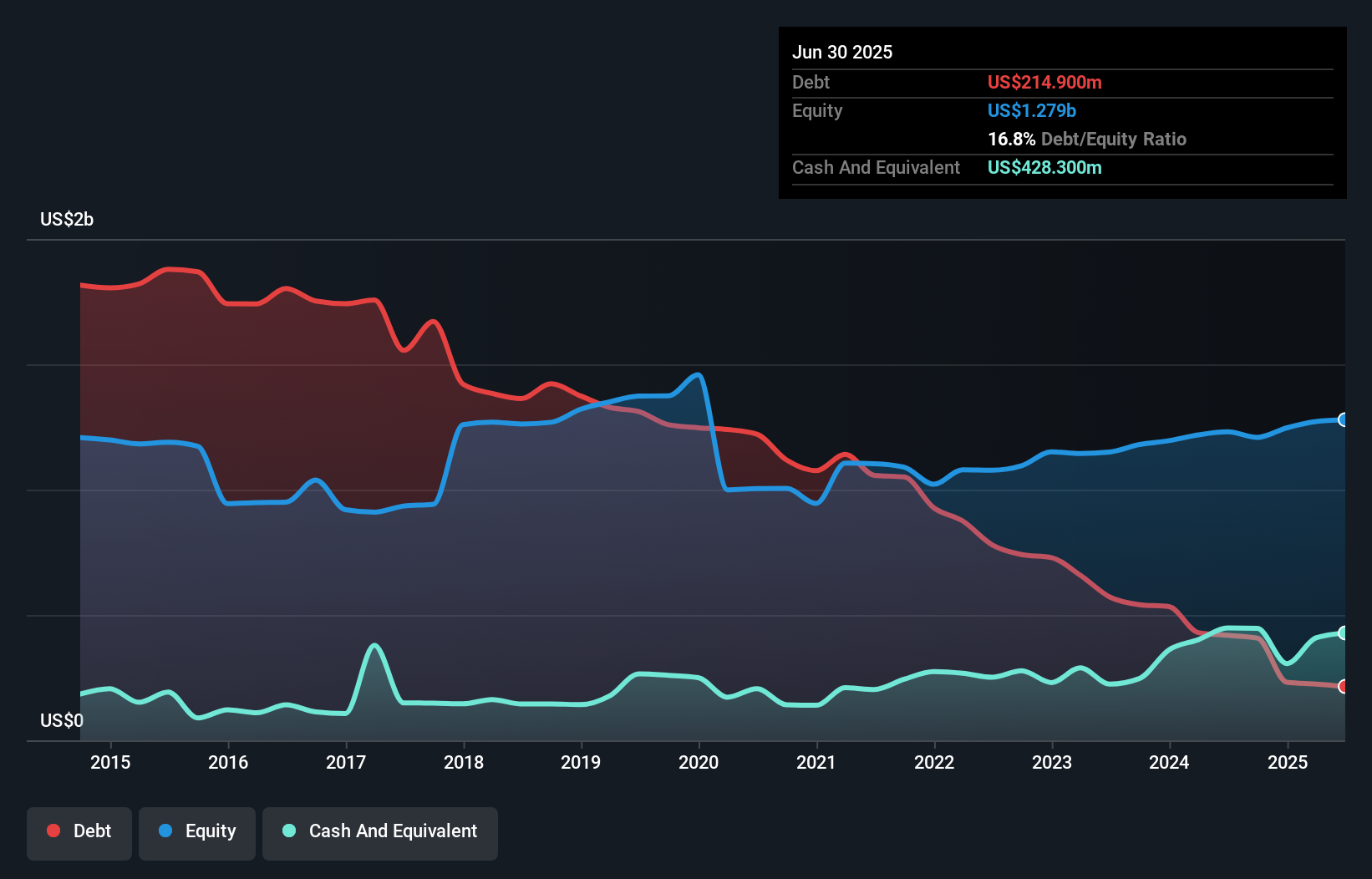

Overview: BW Offshore Limited specializes in engineering offshore production solutions across multiple continents, with a market capitalization of NOK5.12 billion.

Operations: The company generates revenue primarily from its engineering of offshore production solutions. It has a market capitalization of NOK5.12 billion.

BW Offshore, a notable player in the energy services sector, has seen its earnings grow by 50% annually over the past five years. Despite this impressive growth, recent earnings for Q3 2024 showed sales at US$150.9 million and net income at US$13.7 million, both lower than last year’s figures. The company trades significantly below its estimated fair value and boasts a reduced debt-to-equity ratio of 33.7% from 91.6% five years ago, indicating improved financial health. A strategic partnership with McDermott aims to advance offshore blue ammonia production, aligning with global low-carbon energy trends and enhancing BW Offshore's innovative edge in sustainable technologies.

- Take a closer look at BW Offshore's potential here in our health report.

Gain insights into BW Offshore's past trends and performance with our Past report.

Fujian SBS Zipper Science&Technology (SZSE:002098)

Simply Wall St Value Rating: ★★★★★★

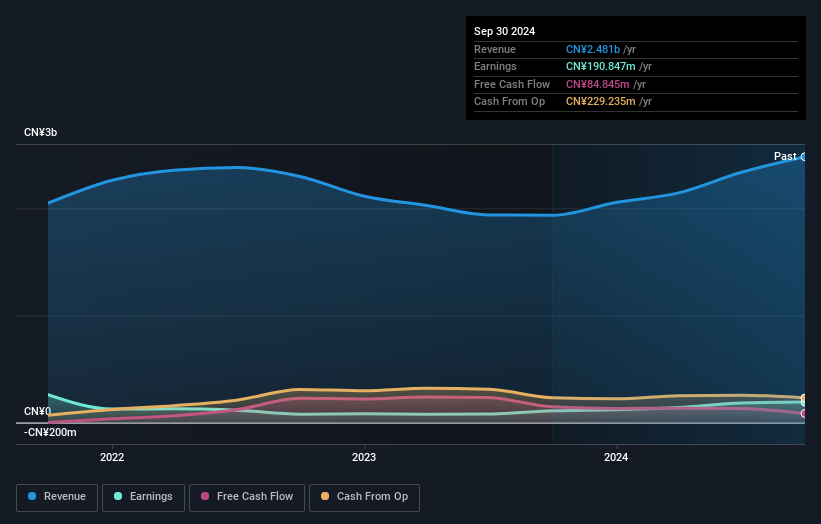

Overview: Fujian SBS Zipper Science&Technology Co., Ltd is involved in the production and sale of zippers and accessories both in China and internationally, with a market capitalization of CN¥3.06 billion.

Operations: SBS Zipper generates revenue primarily from the production and sale of zippers and accessories, catering to both domestic and international markets. The company's financial performance is highlighted by its net profit margin, which has shown notable fluctuations over recent periods.

Fujian SBS Zipper Science & Technology, a dynamic player in the luxury industry, has demonstrated impressive earnings growth of 74% over the past year, outpacing the sector's 3.3%. The company reported sales of CNY 1.87 billion for nine months ending September 2024, up from CNY 1.44 billion last year, with net income climbing to CNY 171.73 million from CNY 101.51 million. Its debt-to-equity ratio has significantly improved from 117% to just over 17% in five years, indicating robust financial health and strategic management focus on reducing leverage while maintaining high-quality earnings and strong free cash flow generation.

Next Steps

- Discover the full array of 4627 Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Fujian SBS Zipper Science&Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002098

Fujian SBS Zipper Science&Technology

Engages in the production and sale of zippers and accessories in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.