Global markets have shown resilience, with U.S. indexes approaching record highs and smaller-cap stocks outperforming their larger counterparts, despite geopolitical tensions and economic uncertainties. In this context, the appeal of penny stocks remains significant as they often represent smaller or newer companies that can offer growth potential at lower price points. While the term "penny stocks" might seem outdated, these investments can still be attractive when backed by strong financials and sound fundamentals, offering a unique opportunity for investors to discover promising under-the-radar companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR343.4M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.41B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.58 | A$68.57M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR293.77M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.225 | £838.3M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.59 | £68.47M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.205 | £418.21M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$146.79M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.89 | £67.4M | ★★★★★★ |

Click here to see the full list of 5,778 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

V V Food & BeverageLtd (SHSE:600300)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: V V Food & Beverage Co., Ltd operates in the research, development, production, and sale of food and beverage products both in China and internationally, with a market cap of approximately CN¥4.69 billion.

Operations: No specific revenue segments have been reported for V V Food & Beverage Co., Ltd.

Market Cap: CN¥4.69B

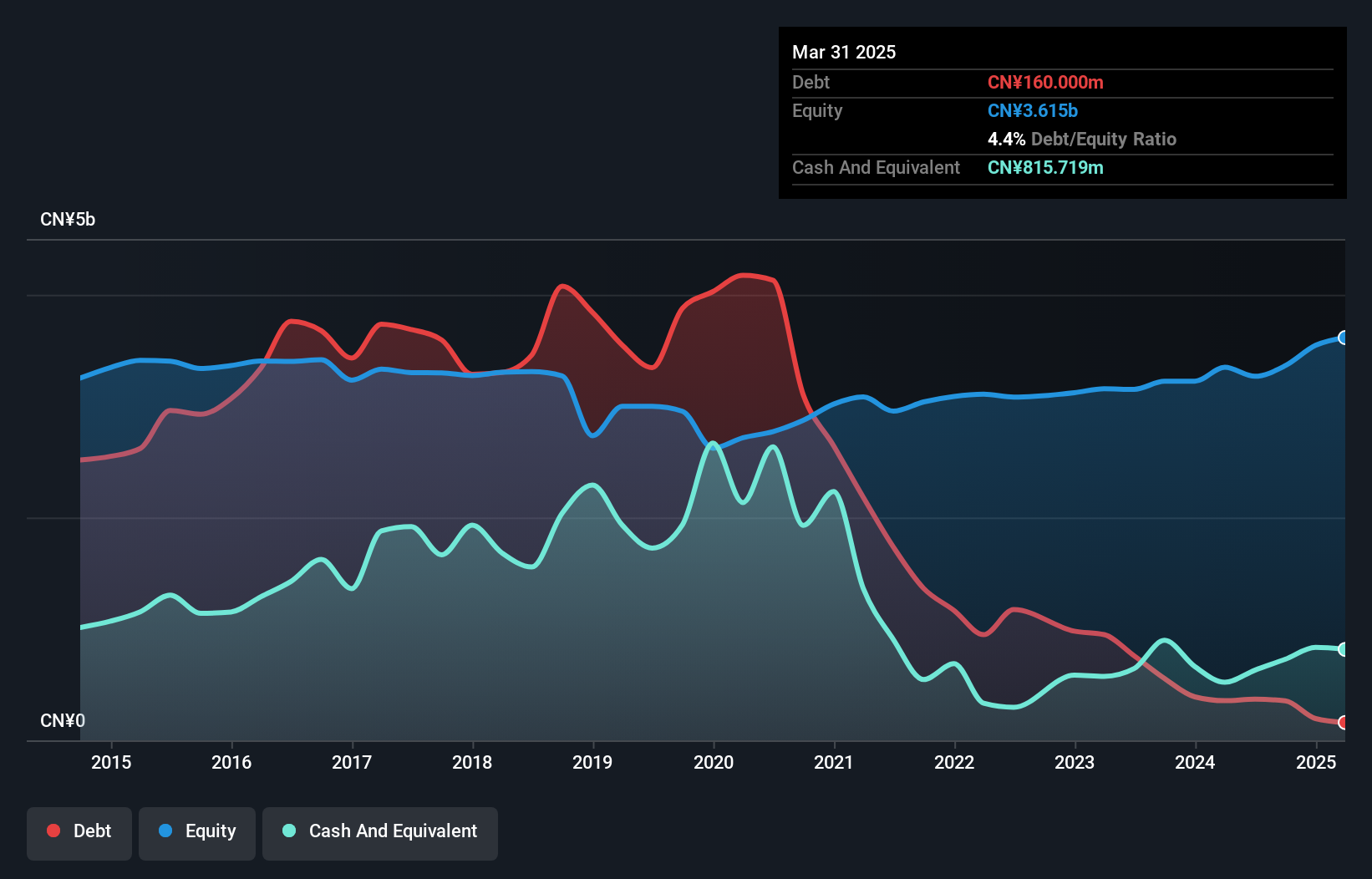

V V Food & Beverage Co., Ltd has demonstrated significant earnings growth, with a 146% increase over the past year, outperforming the broader food industry's decline. Despite this impressive growth, it's important to note that recent financial results were influenced by a large one-off gain of CN¥149.6 million. The company maintains a strong balance sheet with short-term assets exceeding both short- and long-term liabilities, and it holds more cash than its total debt. However, its operating cash flow does not adequately cover its debt levels, and dividends are not well supported by free cash flows.

- Navigate through the intricacies of V V Food & BeverageLtd with our comprehensive balance sheet health report here.

- Learn about V V Food & BeverageLtd's historical performance here.

Sunvim GroupLtd (SZSE:002083)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sunvim Group Co., Ltd is a company that manufactures and sells home textile products across various regions including China, Asia, Europe, the Americas, Australia, and the Middle East with a market capitalization of approximately CN¥4.30 billion.

Operations: Sunvim Group Co., Ltd does not report specific revenue segments.

Market Cap: CN¥4.3B

Sunvim Group Co., Ltd has shown robust earnings growth of 71.4% over the past year, outpacing the luxury industry's average. The company reported a net income of CN¥336.54 million for the first nine months of 2024, up from CN¥245.76 million a year ago, reflecting improved profit margins from 4.2% to 7%. Despite having high debt levels with a net debt to equity ratio of 44.7%, its operating cash flow covers debt well at 27.5%. However, shareholders experienced dilution with shares outstanding increasing by 5.7%, and dividends remain unstable despite recent affirmations and buyback initiatives aimed at boosting investor confidence.

- Get an in-depth perspective on Sunvim GroupLtd's performance by reading our balance sheet health report here.

- Explore historical data to track Sunvim GroupLtd's performance over time in our past results report.

Guangdong Jialong Food (SZSE:002495)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangdong Jialong Food Co., Ltd. is engaged in the research, development, production, and sale of food products in China with a market capitalization of CN¥2.12 billion.

Operations: The company generates revenue of CN¥241.98 million from its operations in China.

Market Cap: CN¥2.12B

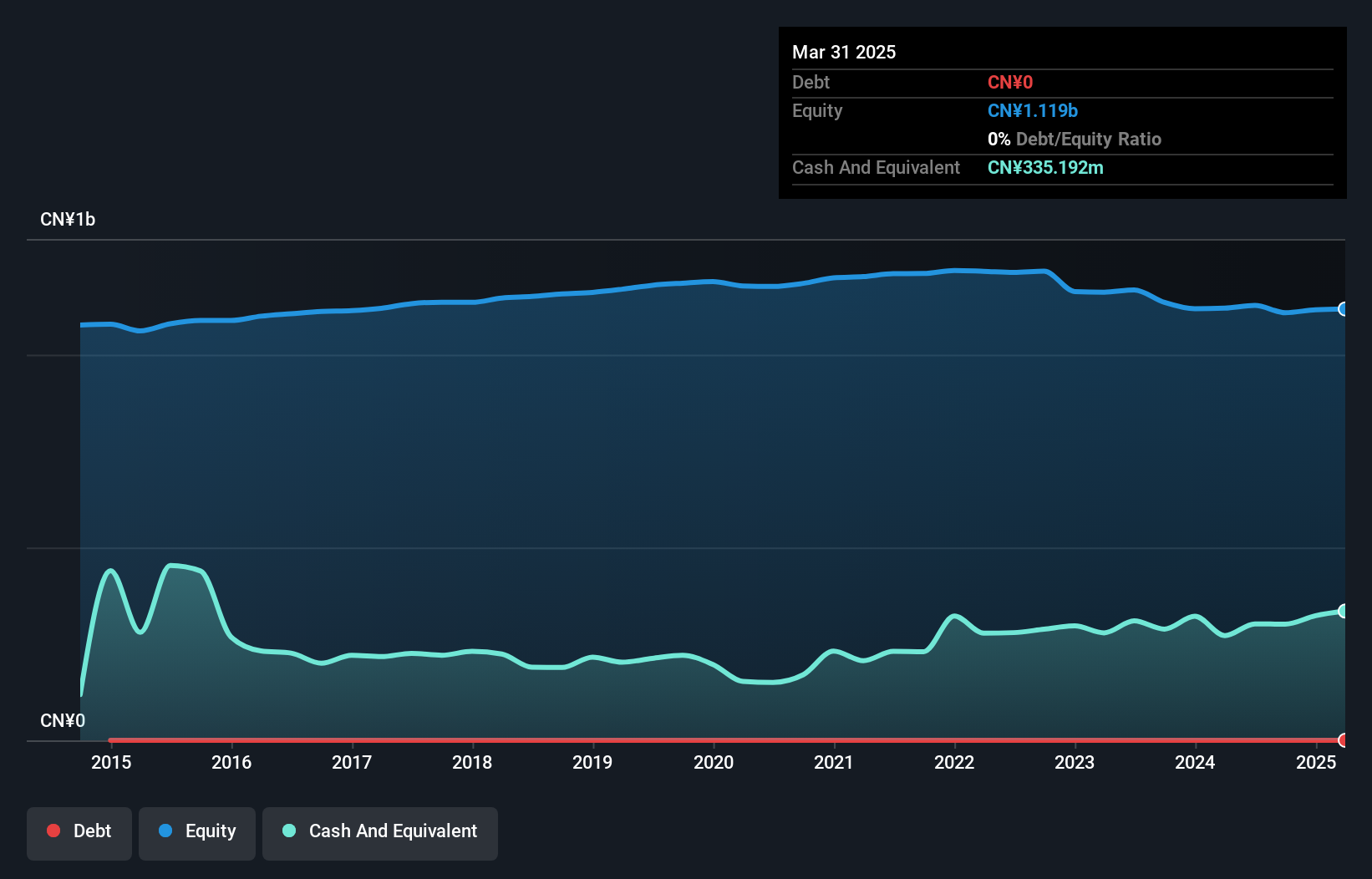

Guangdong Jialong Food Co., Ltd. has shown some improvement, reporting a net income of CN¥15.9 million for the first nine months of 2024, reversing from a net loss in the previous year. Despite this positive turn, the company remains unprofitable with negative return on equity and increasing losses over the past five years. It operates without debt, which reduces financial risk but also limits leverage opportunities for growth. Recent efforts include repurchasing 18 million shares to potentially enhance shareholder value amid stable weekly volatility and strong asset coverage of liabilities, indicating prudent financial management despite ongoing profitability challenges.

- Unlock comprehensive insights into our analysis of Guangdong Jialong Food stock in this financial health report.

- Evaluate Guangdong Jialong Food's historical performance by accessing our past performance report.

Next Steps

- Dive into all 5,778 of the Penny Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600300

V V Food & BeverageLtd

Engages in the research, development, production, and sale of food and beverage products in China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives