- China

- /

- Consumer Durables

- /

- SHSE:603657

Jinhua Chunguang Technology Co.,Ltd (SHSE:603657) Stock Rockets 67% But Many Are Still Ignoring The Company

Jinhua Chunguang Technology Co.,Ltd (SHSE:603657) shareholders would be excited to see that the share price has had a great month, posting a 67% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 32% in the last year.

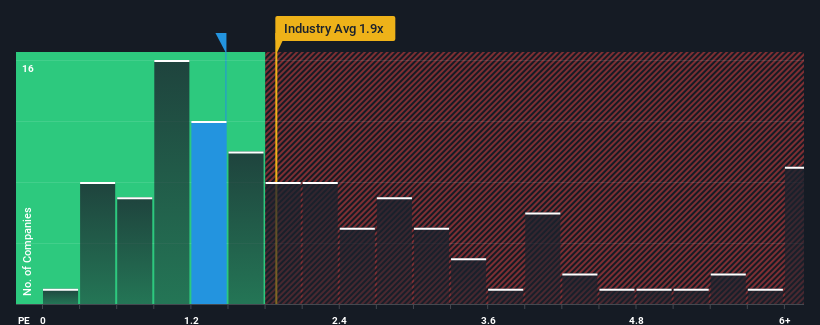

In spite of the firm bounce in price, there still wouldn't be many who think Jinhua Chunguang TechnologyLtd's price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S in China's Consumer Durables industry is similar at about 1.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Jinhua Chunguang TechnologyLtd

How Has Jinhua Chunguang TechnologyLtd Performed Recently?

Jinhua Chunguang TechnologyLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Jinhua Chunguang TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Jinhua Chunguang TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 5.3% decrease to the company's top line. Still, the latest three year period has seen an excellent 113% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 13% each year during the coming three years according to the sole analyst following the company. With the industry only predicted to deliver 8.7% per annum, the company is positioned for a stronger revenue result.

In light of this, it's curious that Jinhua Chunguang TechnologyLtd's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Jinhua Chunguang TechnologyLtd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Jinhua Chunguang TechnologyLtd's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 4 warning signs for Jinhua Chunguang TechnologyLtd (1 is a bit unpleasant!) that you need to take into consideration.

If you're unsure about the strength of Jinhua Chunguang TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603657

Jinhua Chunguang TechnologyLtd

Engages in the research and development, production, and sales of cleaning appliance hoses accessories and complete machine ODM/OEM products in China and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026