- China

- /

- Consumer Durables

- /

- SHSE:603615

Even though Chahua Modern Housewares (SHSE:603615) has lost CN¥791m market cap in last 7 days, shareholders are still up 216% over 3 years

Chahua Modern Housewares Co., Ltd. (SHSE:603615) shareholders might be concerned after seeing the share price drop 12% in the last week. But in three years the returns have been great. The share price marched upwards over that time, and is now 212% higher than it was. So the recent fall in the share price should be viewed in that context. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

While this past week has detracted from the company's three-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

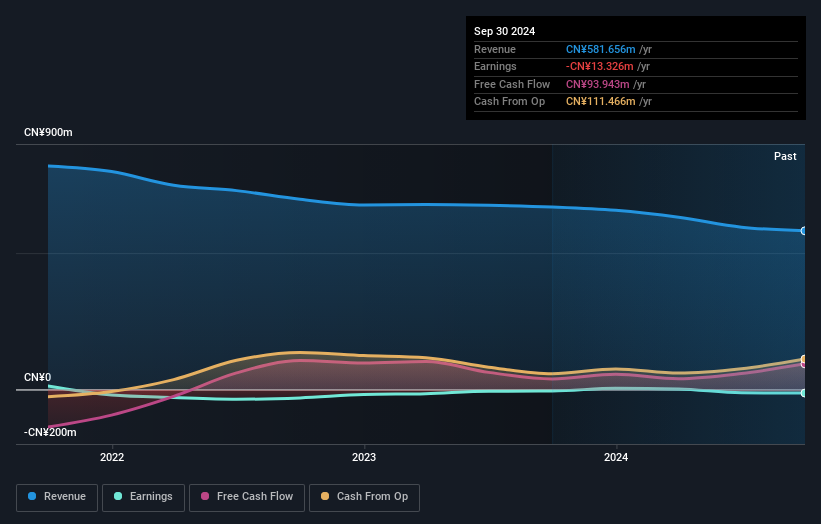

Given that Chahua Modern Housewares didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last 3 years Chahua Modern Housewares saw its revenue shrink by 10% per year. So we wouldn't have expected the share price to gain 46% per year, but it has. It's fair to say shareholders are definitely counting on a bright future.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Chahua Modern Housewares stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Chahua Modern Housewares' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Chahua Modern Housewares shareholders, and that cash payout contributed to why its TSR of 216%, over the last 3 years, is better than the share price return.

A Different Perspective

We're pleased to report that Chahua Modern Housewares shareholders have received a total shareholder return of 31% over one year. That's better than the annualised return of 27% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Chahua Modern Housewares you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603615

Chahua Modern Housewares

Engages in the design, development, production, and sale of various plastic housewares in China.

Mediocre balance sheet with minimal risk.

Market Insights

Community Narratives