- China

- /

- Consumer Durables

- /

- SHSE:603326

Nanjing OLO Home Furnishing Co.,Ltd's (SHSE:603326) Share Price Boosted 35% But Its Business Prospects Need A Lift Too

Nanjing OLO Home Furnishing Co.,Ltd (SHSE:603326) shares have had a really impressive month, gaining 35% after a shaky period beforehand. Looking further back, the 17% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

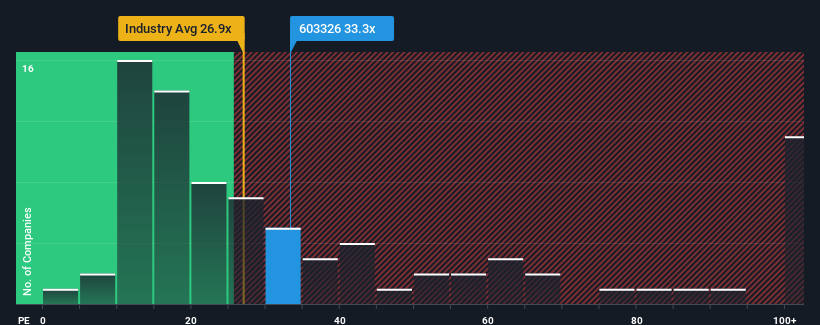

Even after such a large jump in price, Nanjing OLO Home FurnishingLtd's price-to-earnings (or "P/E") ratio of 33.3x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 39x and even P/E's above 77x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

As an illustration, earnings have deteriorated at Nanjing OLO Home FurnishingLtd over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Nanjing OLO Home FurnishingLtd

Is There Any Growth For Nanjing OLO Home FurnishingLtd?

Nanjing OLO Home FurnishingLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 60% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 58% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 37% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that Nanjing OLO Home FurnishingLtd's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Key Takeaway

Despite Nanjing OLO Home FurnishingLtd's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Nanjing OLO Home FurnishingLtd revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Nanjing OLO Home FurnishingLtd (of which 1 can't be ignored!) you should know about.

Of course, you might also be able to find a better stock than Nanjing OLO Home FurnishingLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Nanjing OLO Home FurnishingLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nanjing OLO Home FurnishingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603326

Nanjing OLO Home FurnishingLtd

Engages in the design, research and development, production, sale, and service of furniture products in China.

Excellent balance sheet moderate.

Market Insights

Community Narratives