There's Reason For Concern Over Ribo Fashion Group Co., Ltd.'s (SHSE:603196) Price

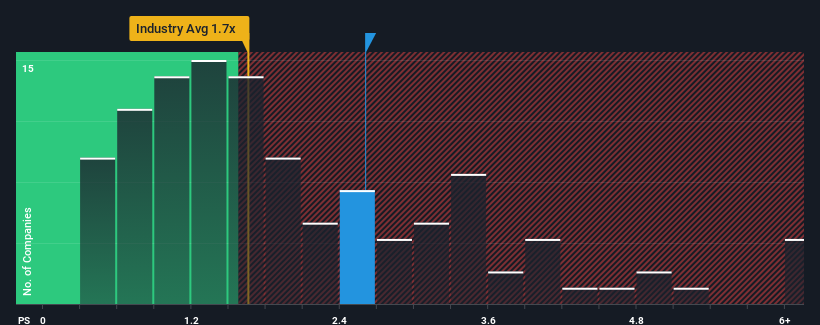

Ribo Fashion Group Co., Ltd.'s (SHSE:603196) price-to-sales (or "P/S") ratio of 2.6x may not look like an appealing investment opportunity when you consider close to half the companies in the Luxury industry in China have P/S ratios below 1.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Ribo Fashion Group

What Does Ribo Fashion Group's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Ribo Fashion Group over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Ribo Fashion Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Ribo Fashion Group's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 6.0% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 11% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to deliver 20% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it worrying that Ribo Fashion Group's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Ribo Fashion Group currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You should always think about risks. Case in point, we've spotted 3 warning signs for Ribo Fashion Group you should be aware of, and 1 of them can't be ignored.

If you're unsure about the strength of Ribo Fashion Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603196

Ribo Fashion Group

Engages in design, production, and sale of clothing products for women in China.

Adequate balance sheet very low.

Market Insights

Community Narratives