Improved Revenues Required Before ZheJiang AoKang Shoes Co.,Ltd. (SHSE:603001) Stock's 26% Jump Looks Justified

Those holding ZheJiang AoKang Shoes Co.,Ltd. (SHSE:603001) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

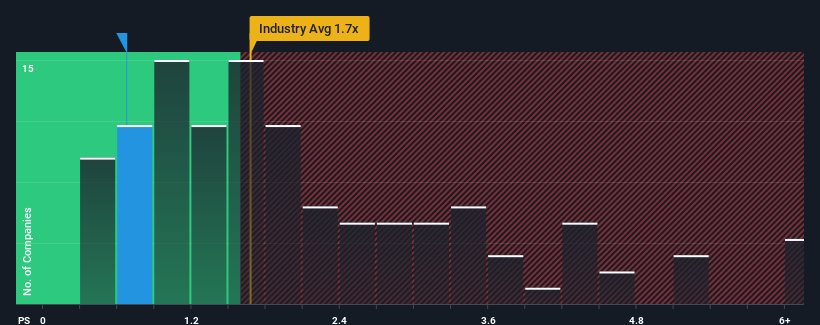

Although its price has surged higher, it would still be understandable if you think ZheJiang AoKang ShoesLtd is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.7x, considering almost half the companies in China's Luxury industry have P/S ratios above 1.7x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for ZheJiang AoKang ShoesLtd

What Does ZheJiang AoKang ShoesLtd's Recent Performance Look Like?

For example, consider that ZheJiang AoKang ShoesLtd's financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on ZheJiang AoKang ShoesLtd will help you shine a light on its historical performance.How Is ZheJiang AoKang ShoesLtd's Revenue Growth Trending?

In order to justify its P/S ratio, ZheJiang AoKang ShoesLtd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period was better as it's delivered a decent 29% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

This is in contrast to the rest of the industry, which is expected to grow by 19% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why ZheJiang AoKang ShoesLtd is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What Does ZheJiang AoKang ShoesLtd's P/S Mean For Investors?

Despite ZheJiang AoKang ShoesLtd's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of ZheJiang AoKang ShoesLtd confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with ZheJiang AoKang ShoesLtd (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if ZheJiang AoKang ShoesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603001

ZheJiang AoKang ShoesLtd

Engages in the manufacture, sale and retail of shoes and shoemaking materials, leather goods, and clothing.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)