- China

- /

- Electronic Equipment and Components

- /

- SZSE:300150

November 2024's Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have shown resilience, with U.S. indexes approaching record highs amid broad-based gains, despite ongoing geopolitical tensions and policy uncertainties. In this context of cautious optimism, investors are exploring diverse opportunities across market segments. Penny stocks, a term that might seem outdated but still relevant, represent a niche investment area where smaller or newer companies can offer significant growth potential when backed by strong financials. These stocks can provide unique opportunities for discovering hidden value in quality companies poised for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$148.62M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.585 | A$69.16M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £811.93M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.05 | £402.8M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.56 | £67.89M | ★★★★☆☆ |

| Genetec Technology Berhad (KLSE:GENETEC) | MYR0.815 | MYR639.69M | ★★★★★★ |

Click here to see the full list of 5,797 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Uniphar (ISE:UPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Uniphar plc is a diversified healthcare services company operating in the Republic of Ireland, the United Kingdom, The Netherlands, and internationally, with a market cap of €571.97 million.

Operations: The company's revenue segments include Pharma with €657.34 million, Medtech at €252.93 million, and Supply Chain & Retail generating €1.77 billion.

Market Cap: €571.97M

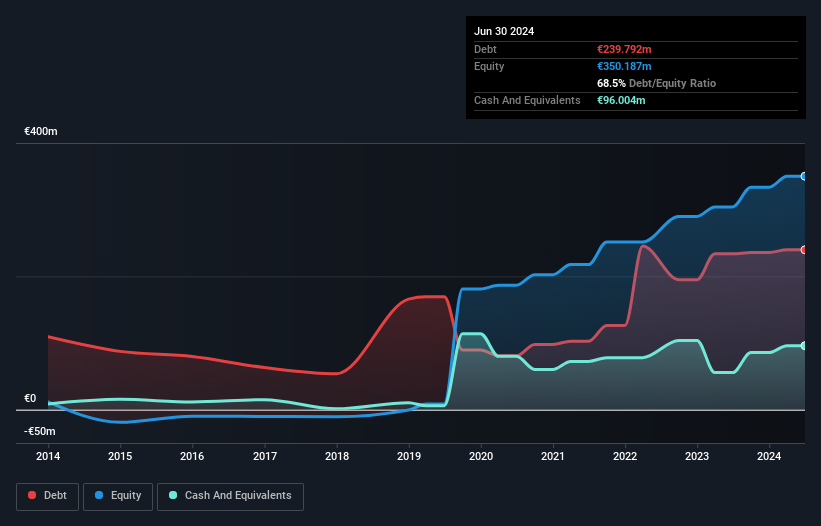

Uniphar plc, with a market cap of €571.97 million, demonstrates a mixed financial profile within the penny stock arena. The company reported half-year sales of €1.37 billion and net income of €15.37 million, showing revenue growth but modest profit margins at 1.7%. Uniphar's seasoned management and board contribute to its operational stability, while its debt is well managed with operating cash flow covering 54.2% of debt obligations and interest payments covered by EBIT at 3.4 times. However, challenges include high net debt to equity ratio (41.1%) and short-term liabilities exceeding assets (€645M vs €581M).

- Click here and access our complete financial health analysis report to understand the dynamics of Uniphar.

- Gain insights into Uniphar's future direction by reviewing our growth report.

Zhewen Pictures Groupltd (SHSE:601599)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhewen Pictures Group Co., Ltd. is involved in the production and sale of yarns in China, with a market capitalization of approximately CN¥4.21 billion.

Operations: No revenue segments have been reported for this company.

Market Cap: CN¥4.21B

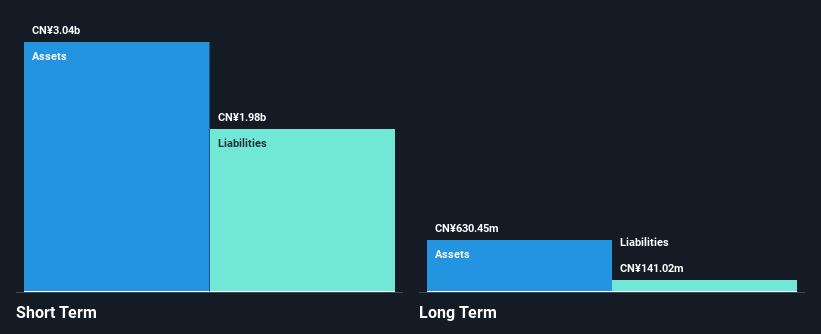

Zhewen Pictures Group Co., Ltd. shows a solid financial foundation with a market cap of CN¥4.21 billion and recent sales of CN¥2,575.92 million for the first nine months of 2024, reflecting growth from the previous year. The company has improved profitability over five years, though recent earnings growth slowed to 5.7%, below its historical average but still outpacing industry norms. Its financial health is robust with short-term assets exceeding liabilities and debt well covered by cash flow, while maintaining more cash than total debt suggests prudent fiscal management despite low return on equity at 7.8%.

- Navigate through the intricacies of Zhewen Pictures Groupltd with our comprehensive balance sheet health report here.

- Evaluate Zhewen Pictures Groupltd's historical performance by accessing our past performance report.

Beijing Century Real TechnologyLtd (SZSE:300150)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Beijing Century Real Technology Co., Ltd specializes in the manufacturing and sale of railway traffic safety monitoring systems, as well as urban rail transit passenger information and broadcast systems, with a market cap of approximately CN¥2.66 billion.

Operations: No specific revenue segments are reported for Beijing Century Real Technology Co., Ltd.

Market Cap: CN¥2.66B

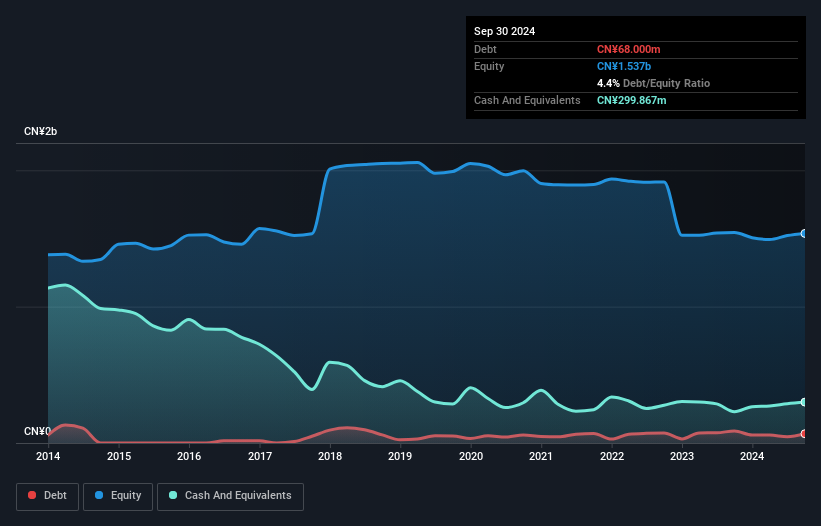

Beijing Century Real Technology Co., Ltd. is financially stable with short-term assets of CN¥1.7 billion surpassing both short-term liabilities of CN¥460 million and long-term liabilities of CN¥7.1 million, indicating solid liquidity. The company's recent earnings report for the nine months ending September 2024 shows increased sales at CN¥485.67 million and net income rising to CN¥32.73 million from the previous year, reflecting a positive trend despite past unprofitability challenges and a negative return on equity at -0.45%. The management team is experienced, contributing to its strategic positioning in the market.

- Jump into the full analysis health report here for a deeper understanding of Beijing Century Real TechnologyLtd.

- Explore historical data to track Beijing Century Real TechnologyLtd's performance over time in our past results report.

Turning Ideas Into Actions

- Reveal the 5,797 hidden gems among our Penny Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Century Real TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300150

Beijing Century Real TechnologyLtd

Engages in the manufacturing and sale of railway traffic safety monitoring systems, and urban rail transit passenger information systems (PIS) and broadcast systems (PA) in China and internationally.

Good value with adequate balance sheet.