As global markets react to the latest economic data, including a weakening U.S. labor market and fluctuating interest rate expectations, investors are keeping a close eye on potential opportunities in various sectors. Penny stocks, though often considered niche investments, continue to present intriguing possibilities for those looking beyond traditional large-cap equities. These smaller or newer companies can offer unique growth prospects when supported by strong financials and sound fundamentals. Here, we highlight several penny stocks that stand out for their potential to deliver impressive returns despite broader market challenges.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.18 | A$102.37M | ✅ 3 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.67 | HK$995.82M | ✅ 4 ⚠️ 1 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.61 | MYR310.17M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.50 | HK$2.14B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.46 | MYR586.27M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.15 | SGD12.4B | ✅ 5 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.17 | £186.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.10 | €290.26M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.928 | €31.3M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,746 stocks from our Global Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Zhewen Pictures Groupltd (SHSE:601599)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhewen Pictures Group Co., Ltd. operates in the production and sale of yarns in China with a market capitalization of CN¥4.34 billion.

Operations: No revenue segments have been reported for this company.

Market Cap: CN¥4.34B

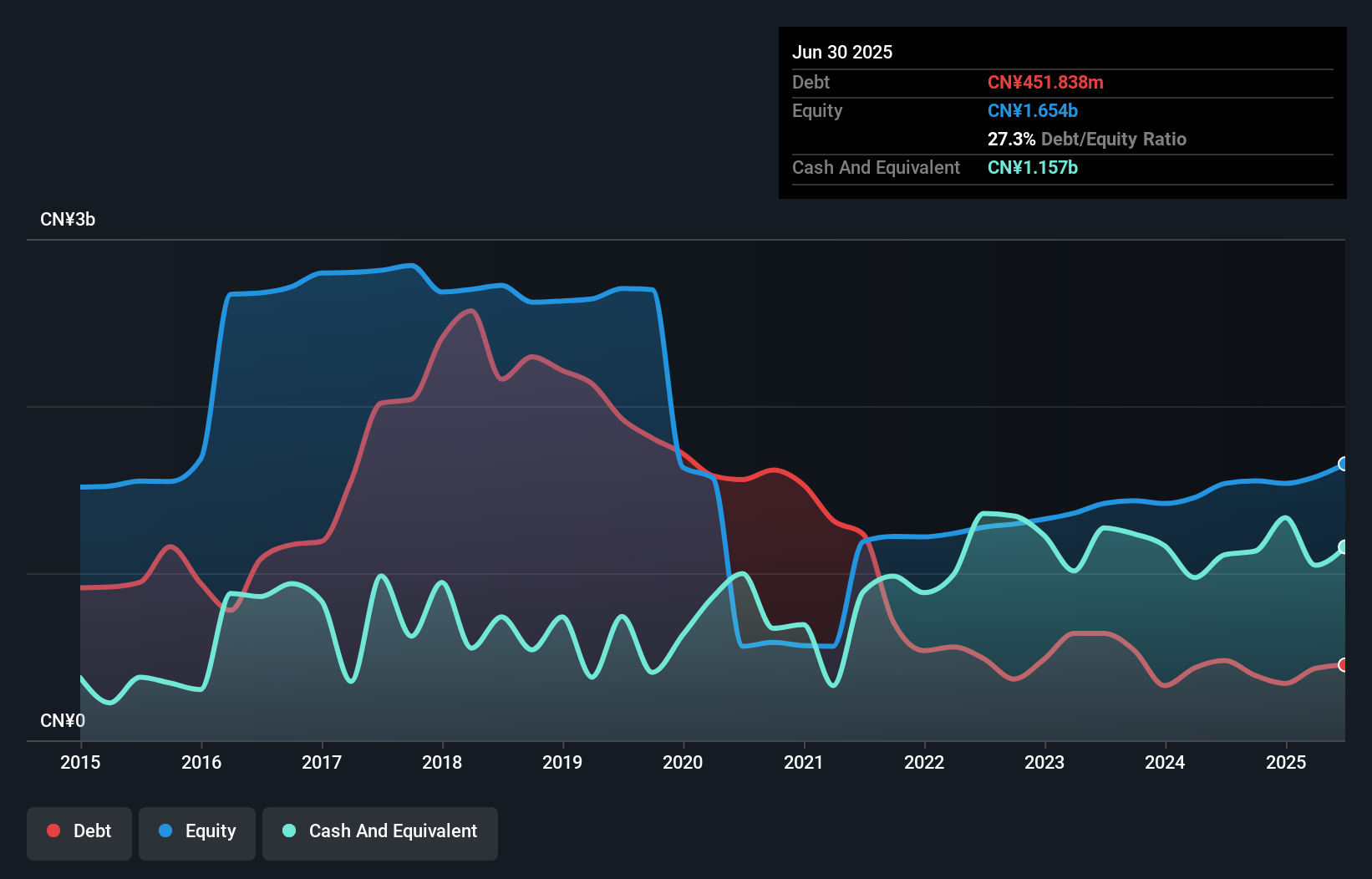

Zhewen Pictures Group Co., Ltd. recently reported sales of CN¥1.76 billion for the half-year ending June 30, 2025, marking an increase from CN¥1.60 billion a year prior, with revenue rising to CN¥1.85 billion from CN¥1.67 billion in the same period. Despite this growth, net income slightly decreased to CN¥115.58 million from CN¥120.77 million year-over-year, indicating challenges in profit margins which dropped to 3.6% from 4.3%. The company has reduced its debt-to-equity ratio significantly over five years and maintains more cash than total debt, suggesting strong financial management amidst volatility concerns.

- Click to explore a detailed breakdown of our findings in Zhewen Pictures Groupltd's financial health report.

- Gain insights into Zhewen Pictures Groupltd's historical outcomes by reviewing our past performance report.

Tatwah SmartechLtd (SZSE:002512)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tatwah Smartech Co., Ltd. operates in the communication networks, digital screens, and digital application services sectors both in China and internationally, with a market cap of CN¥4.33 billion.

Operations: Tatwah Smartech Co., Ltd. has not reported specific revenue segments, but it engages in communication networks, digital screens, and digital application services across both domestic and international markets.

Market Cap: CN¥4.33B

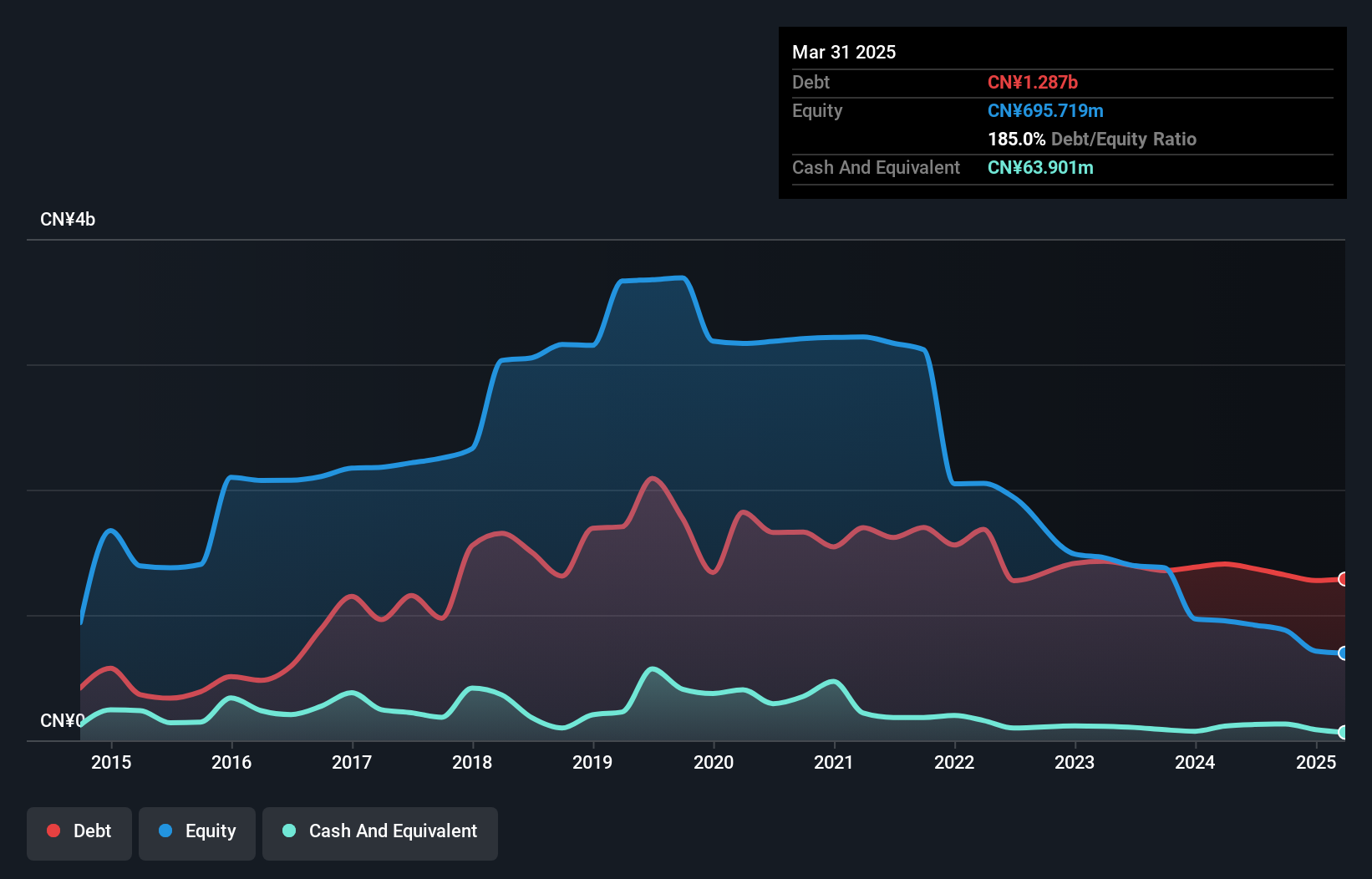

Tatwah Smartech Co., Ltd. recently reported a decline in revenue to CN¥760.99 million for the half-year ending June 30, 2025, from CN¥888.31 million a year ago, with a net loss of CN¥52.59 million compared to a prior net income of CN¥55.63 million. The company is unprofitable and faces challenges with high short-term liabilities exceeding its assets but has reduced its debt-to-equity ratio over five years and maintains an experienced board of directors. Despite these financial pressures, Tatwah has secured additional capital through private placements to support its operations amidst limited cash runway forecasts based on free cash flow estimates.

- Click here to discover the nuances of Tatwah SmartechLtd with our detailed analytical financial health report.

- Assess Tatwah SmartechLtd's previous results with our detailed historical performance reports.

Hainan RuiZe New Building MaterialLtd (SZSE:002596)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hainan RuiZe New Building Material Co., Ltd operates in China, focusing on the production and sale of commercial concrete and municipal sanitation services, with a market cap of CN¥4.11 billion.

Operations: Hainan RuiZe New Building Material Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥4.11B

Hainan RuiZe New Building Material Co., Ltd reported a decline in revenue to CN¥619.02 million for the half-year ending June 30, 2025, from CN¥729.74 million a year earlier, with an increased net loss of CN¥68.03 million. Despite being unprofitable and having a high net debt-to-equity ratio of 108.6%, the company has more than three years of cash runway due to positive free cash flow and short-term assets exceeding liabilities by CN¥600 million. The management team is experienced, but recent changes in company bylaws may indicate strategic shifts amid volatile share prices over the past three months.

- Take a closer look at Hainan RuiZe New Building MaterialLtd's potential here in our financial health report.

- Explore historical data to track Hainan RuiZe New Building MaterialLtd's performance over time in our past results report.

Where To Now?

- Navigate through the entire inventory of 3,746 Global Penny Stocks here.

- Seeking Other Investments? Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhewen Pictures Groupltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601599

Flawless balance sheet with poor track record.

Market Insights

Community Narratives