- China

- /

- Commercial Services

- /

- SZSE:301203

Insufficient Growth At Hangzhou Guotai Environmental Protection Technology Co.,Ltd. (SZSE:301203) Hampers Share Price

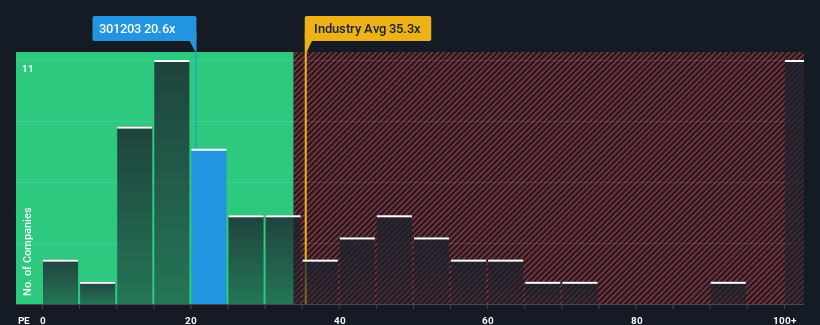

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 37x, you may consider Hangzhou Guotai Environmental Protection Technology Co.,Ltd. (SZSE:301203) as an attractive investment with its 20.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that Hangzhou Guotai Environmental Protection TechnologyLtd's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Hangzhou Guotai Environmental Protection TechnologyLtd

How Is Hangzhou Guotai Environmental Protection TechnologyLtd's Growth Trending?

In order to justify its P/E ratio, Hangzhou Guotai Environmental Protection TechnologyLtd would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 27%. This means it has also seen a slide in earnings over the longer-term as EPS is down 35% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 39% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we are not surprised that Hangzhou Guotai Environmental Protection TechnologyLtd is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Hangzhou Guotai Environmental Protection TechnologyLtd revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Hangzhou Guotai Environmental Protection TechnologyLtd you should be aware of.

If these risks are making you reconsider your opinion on Hangzhou Guotai Environmental Protection TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Guotai Environmental Protection TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301203

Hangzhou Guotai Environmental Protection TechnologyLtd

Hangzhou Guotai Environmental Protection Technology Co., Ltd.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives