- China

- /

- Commercial Services

- /

- SZSE:300958

Some May Be Optimistic About BCEG Environmental Remediation's (SZSE:300958) Earnings

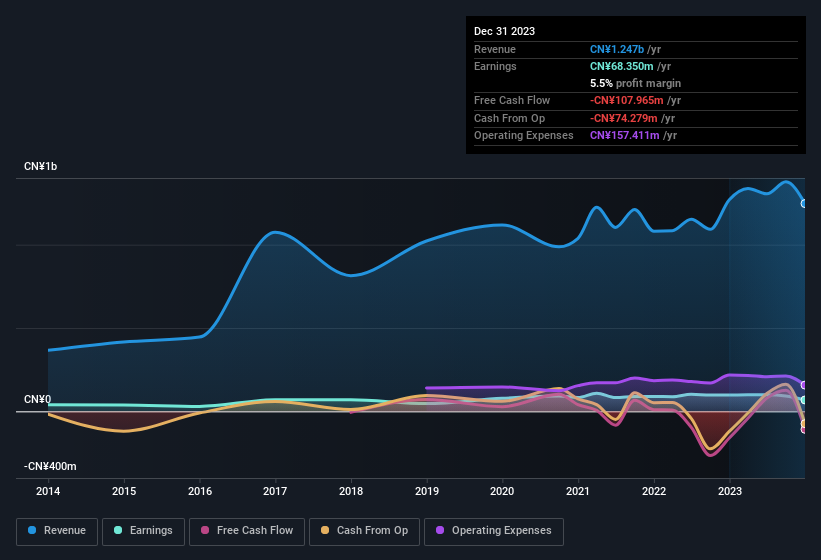

Investors were disappointed with the weak earnings posted by BCEG Environmental Remediation Co., Ltd. (SZSE:300958 ). However, our analysis suggests that the soft headline numbers are getting counterbalanced by some positive underlying factors.

View our latest analysis for BCEG Environmental Remediation

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, BCEG Environmental Remediation increased the number of shares on issue by 9.9% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of BCEG Environmental Remediation's EPS by clicking here.

A Look At The Impact Of BCEG Environmental Remediation's Dilution On Its Earnings Per Share (EPS)

BCEG Environmental Remediation's net profit dropped by 18% per year over the last three years. Even looking at the last year, profit was still down 30%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 33% in the same period. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If BCEG Environmental Remediation's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of BCEG Environmental Remediation.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that BCEG Environmental Remediation's profit suffered from unusual items, which reduced profit by CN¥47m in the last twelve months. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect BCEG Environmental Remediation to produce a higher profit next year, all else being equal.

Our Take On BCEG Environmental Remediation's Profit Performance

To sum it all up, BCEG Environmental Remediation took a hit from unusual items which pushed its profit down; without that, it would have made more money. But on the other hand, the company issued more shares, so without buying more shares each shareholder will end up with a smaller part of the profit. After taking into account all these factors, we think that BCEG Environmental Remediation's statutory results are a decent reflection of its underlying earnings power. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Every company has risks, and we've spotted 3 warning signs for BCEG Environmental Remediation you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you're looking to trade BCEG Environmental Remediation, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BCEG Environmental Remediation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300958

BCEG Environmental Remediation

Provides environmental restoration services.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives