- China

- /

- Commercial Services

- /

- SZSE:300952

Discovering Undiscovered Gems in Global Stocks October 2025

Reviewed by Simply Wall St

In the midst of heightened geopolitical tensions and economic uncertainties, global markets have experienced volatility, with U.S. stock indexes declining due to renewed U.S.-China trade tensions and concerns over a prolonged government shutdown. Amidst these challenges, the search for undiscovered gems in the small-cap sector becomes crucial as investors seek opportunities that may offer resilience and growth potential despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 5.00% | 14.21% | 13.26% | ★★★★★★ |

| Saha-Union | 0.74% | 0.97% | 18.05% | ★★★★★★ |

| Wison Engineering Services | 28.12% | -0.65% | 12.25% | ★★★★★★ |

| YH Entertainment Group | 4.44% | -11.47% | -43.36% | ★★★★★★ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Tai Sin Electric | 37.42% | 10.92% | 7.66% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Hospital Corporation of China | 138.30% | 28.23% | 50.13% | ★★★★☆☆ |

| TSTE | 38.15% | 4.63% | -6.91% | ★★★★☆☆ |

| Billion Industrial Holdings | 33.11% | 16.86% | -16.10% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Jiangsu Hanvo Safety Product (SZSE:300952)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Hanvo Safety Product Co., Ltd. specializes in the manufacturing and marketing of safety gloves in China, with a market cap of CN¥5.76 billion.

Operations: The company generates revenue primarily from the sale of safety gloves. It experiences fluctuations in its net profit margin, which influences overall profitability.

Jiangsu Hanvo Safety Product, a smaller player in the safety equipment sector, has shown promising growth with earnings rising 8.3% over the past year, outpacing its industry peers. The company's debt to equity ratio increased significantly from 10.7% to 41.7% over five years, but it maintains a satisfactory net debt to equity ratio of 21%. Recent financial results were influenced by a one-off gain of CN¥33.7 million, impacting overall performance positively for the period ending June 2025. Despite shareholder dilution in the past year, interest payments are well covered at 17 times EBIT, indicating strong operational efficiency.

- Delve into the full analysis health report here for a deeper understanding of Jiangsu Hanvo Safety Product.

Understand Jiangsu Hanvo Safety Product's track record by examining our Past report.

PANJIT International (TWSE:2481)

Simply Wall St Value Rating: ★★★★★★

Overview: PANJIT International Inc. is involved in the manufacturing, processing, assembly, import, and export of semiconductors across Taiwan and various international markets with a market capitalization of approximately NT$29.46 billion.

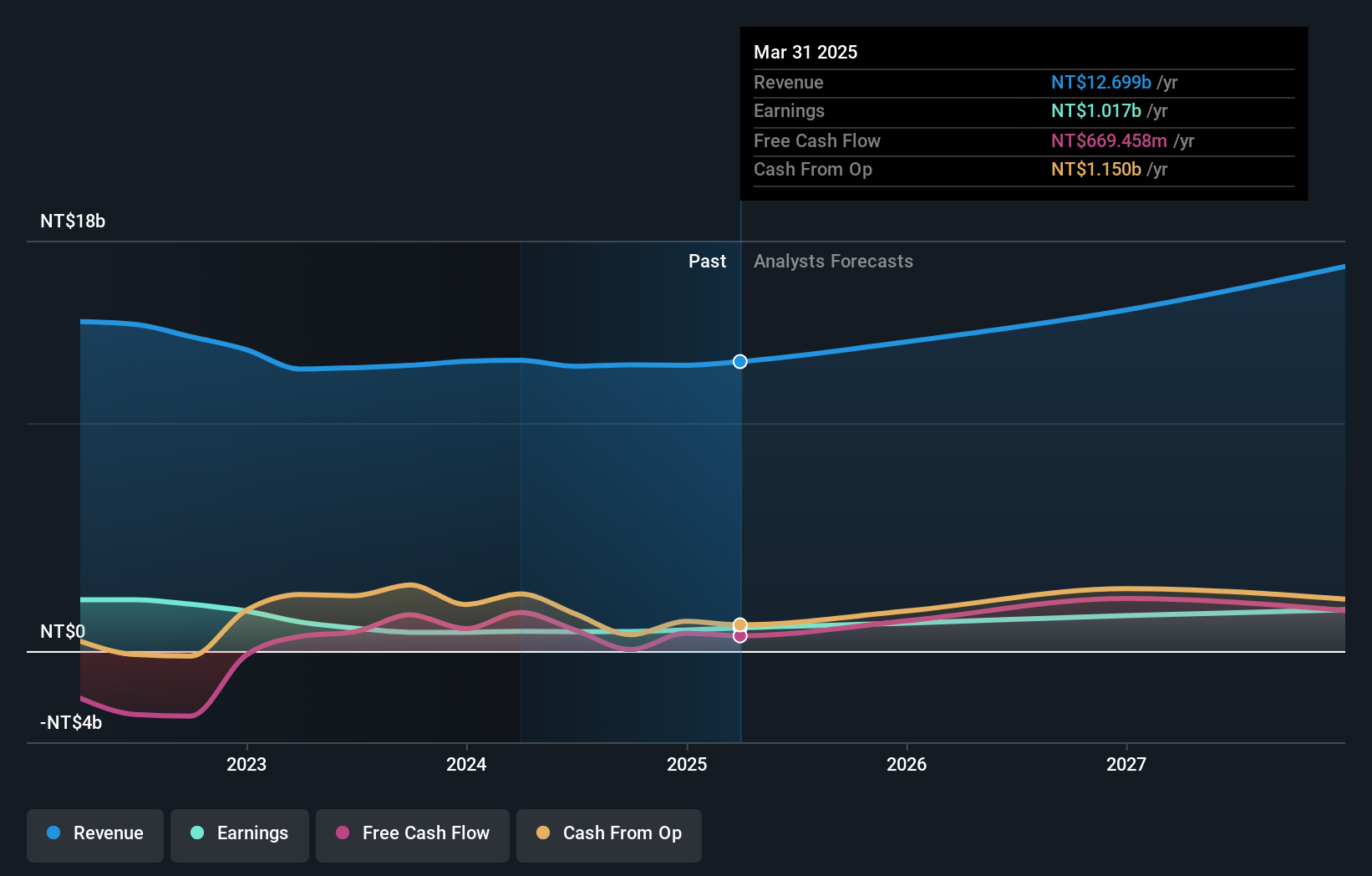

Operations: The company generates revenue primarily from Power Split Components, contributing NT$11.74 billion, followed by Power Integrated Circuits and Components at NT$882.37 million, and Solar at NT$212.29 million.

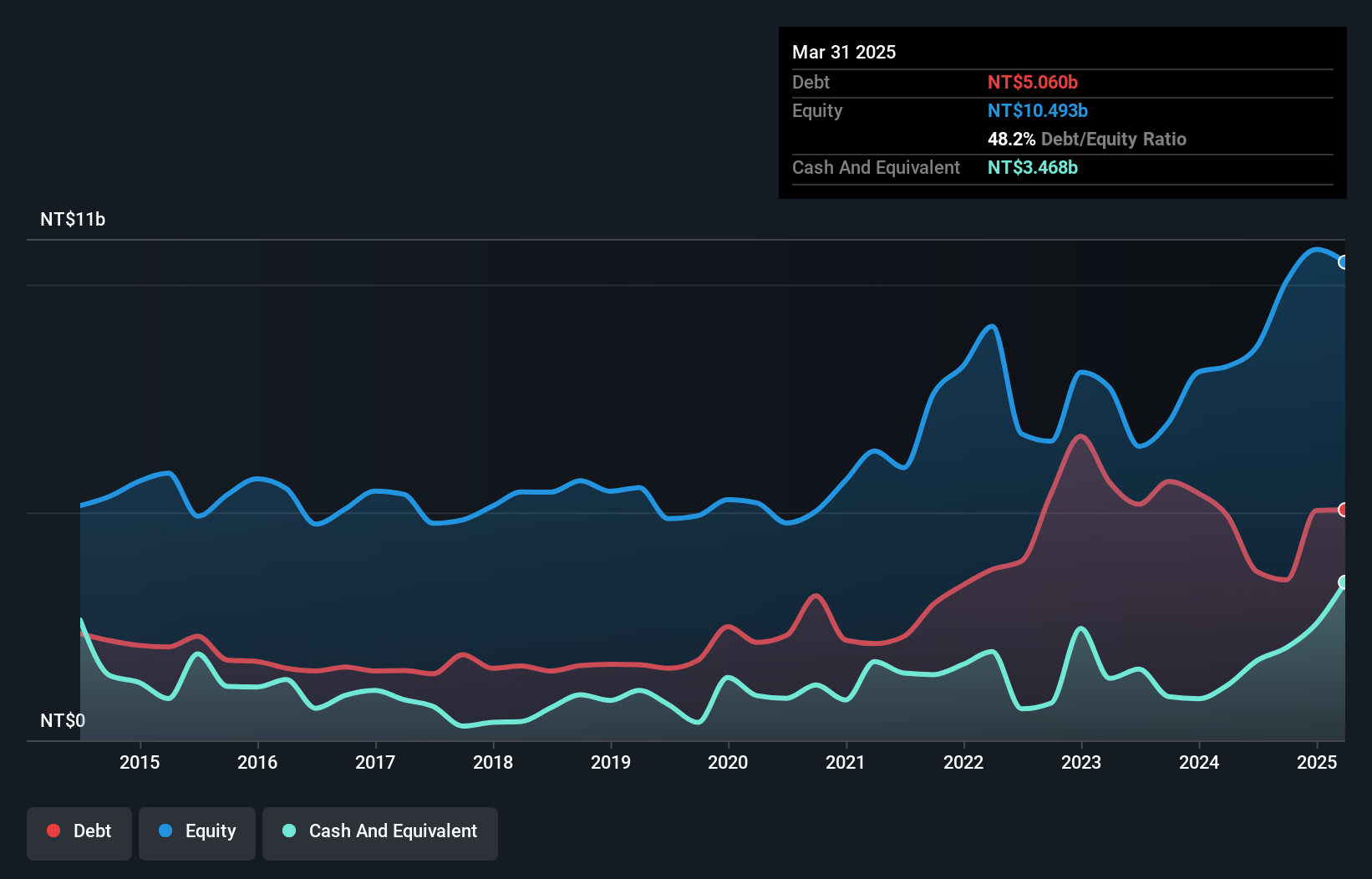

PANJIT International, a player in the semiconductor space, has shown a commendable performance with earnings climbing 16.2% over the past year, outpacing the industry's -6.5%. The company boasts high-quality earnings and its net debt to equity ratio stands at a satisfactory 11.3%, reflecting prudent financial management. Despite recent volatility in share price, PANJIT's interest payments are well covered by EBIT at 75.4x coverage. Recent earnings reports reveal sales of TWD 3,400 million for Q2 and net income of TWD 251 million, though slightly lower than last year's figures. Earnings per share were TWD 0.66 compared to TWD 0.74 previously.

- Click here and access our complete health analysis report to understand the dynamics of PANJIT International.

Gain insights into PANJIT International's past trends and performance with our Past report.

Ruentex Engineering & Construction (TWSE:2597)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ruentex Engineering & Construction Co., Ltd. is a company engaged in construction and engineering services with a market cap of NT$42.59 billion.

Operations: Ruentex Engineering & Construction generates revenue primarily from its Construction Division, contributing NT$21.56 billion, and the Construction Materials Business Segment, which adds NT$4.82 billion. The Interior Decoration Design Segment accounts for NT$2.32 billion in revenue.

Ruentex Engineering & Construction demonstrates robust financial health, with earnings growth of 30.5% surpassing the industry average of 20%. The company trades at a notable 36.2% below its estimated fair value, suggesting potential undervaluation. Despite a high net debt to equity ratio of 45%, interest coverage remains strong, indicating no immediate concerns over interest payments. Recent earnings reports show sales increased to TWD 7.79 billion from TWD 6.78 billion year-on-year for Q2, while net income rose to TWD 745.79 million from TWD 630.77 million, reflecting solid operational performance and profitability improvements over the past year.

Turning Ideas Into Actions

- Discover the full array of 2911 Global Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300952

Jiangsu Hanvo Safety Product

Manufactures and markets safety gloves in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives