- China

- /

- Professional Services

- /

- SZSE:300797

Asia's Undiscovered Gems Featuring Three Promising Small Caps

Reviewed by Simply Wall St

Amidst the backdrop of reignited U.S.-China trade tensions and mixed economic signals from key Asian markets, small-cap stocks in Asia present intriguing opportunities for investors seeking growth potential in a volatile environment. In this article, we explore three promising small-cap companies that stand out due to their resilience and adaptability to current market dynamics, making them potential hidden gems in the region's diverse economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ryoyu Systems | NA | 6.45% | 19.55% | ★★★★★★ |

| Chudenko | NA | 4.69% | 17.78% | ★★★★★★ |

| DoshishaLtd | NA | 2.88% | 2.08% | ★★★★★★ |

| Konishi | 0.13% | 1.06% | 11.48% | ★★★★★★ |

| AlpenLtd | 8.25% | 4.04% | -6.85% | ★★★★★★ |

| ISE Chemicals | 1.33% | 16.01% | 33.15% | ★★★★★★ |

| Nice | 75.46% | 0.92% | 22.22% | ★★★★★☆ |

| OUG Holdings | 80.81% | 3.52% | 34.81% | ★★★★☆☆ |

| Bank of Iwate | 87.84% | 1.47% | 13.86% | ★★★★☆☆ |

| Toho Bank | 108.44% | 5.50% | 35.31% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

China Nerin Engineering (SHSE:603257)

Simply Wall St Value Rating: ★★★★★☆

Overview: China Nerin Engineering Co., Ltd is an engineering technology company that operates both in China and internationally, with a market capitalization of CN¥9.05 billion.

Operations: China Nerin Engineering generates revenue primarily from engineering package services, equipment integration, and engineering design and consulting, with the latter two contributing significantly at CN¥1.41 billion and CN¥726.11 million, respectively.

China Nerin Engineering's recent performance highlights its potential as a notable player in the construction sector. The company reported a net income of CNY 74.75 million for the first half of 2025, up from CNY 58.96 million the previous year, showcasing an impressive earnings growth of 11.8% that outpaced the industry's -8.2%. Trading at approximately 26% below its estimated fair value, it presents an attractive opportunity despite recent share price volatility. With more cash than total debt and high-quality earnings, China Nerin seems well-positioned to navigate future challenges and capitalize on growth prospects in Asia's dynamic market landscape.

Shanghai GenTech (SHSE:688596)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai GenTech Co., Ltd. offers process critical system solutions to hi-tech and advanced manufacturing industries in China, with a market capitalization of CN¥13.96 billion.

Operations: Shanghai GenTech generates revenue primarily from providing process critical system solutions to hi-tech and advanced manufacturing sectors. The company's financial performance is highlighted by a net profit margin of 15.3%, reflecting its profitability in the competitive market.

Shanghai GenTech, a promising player in the semiconductor industry, has shown impressive earnings growth of 45% over the past year, outpacing the industry's 10.4%. Its price-to-earnings ratio stands at 27x, which is favorable compared to the CN market average of 45.6x. Interest payments on debt are well covered with EBIT coverage at 11.2 times, indicating strong financial health despite an increase in its debt-to-equity ratio from 23.4% to 53.8% over five years. However, net income for the recent half-year was CNY 94.24 million down from CNY 104.94 million a year ago due to large one-off gains impacting results.

- Click here to discover the nuances of Shanghai GenTech with our detailed analytical health report.

Understand Shanghai GenTech's track record by examining our Past report.

NCS Testing Technology (SZSE:300797)

Simply Wall St Value Rating: ★★★★★☆

Overview: NCS Testing Technology Co., Ltd. offers third-party testing services in China with a market capitalization of CN¥7.77 billion.

Operations: The company generates revenue through its third-party testing services in China. It has a market capitalization of CN¥7.77 billion.

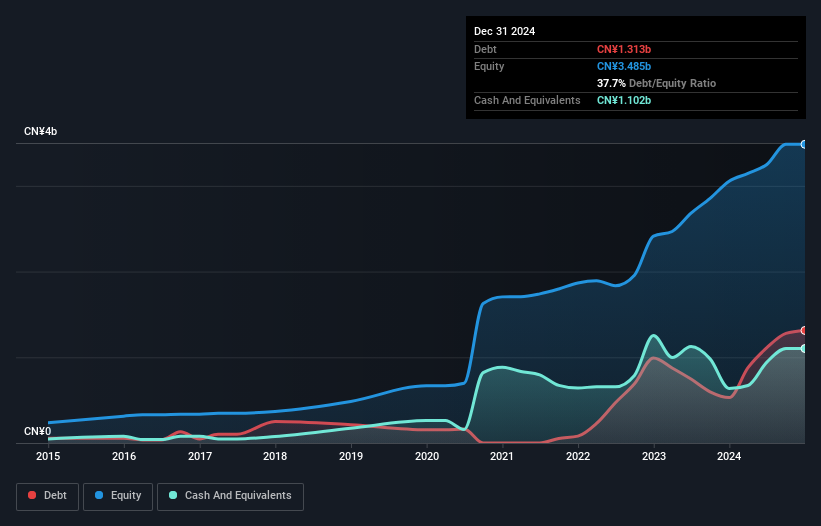

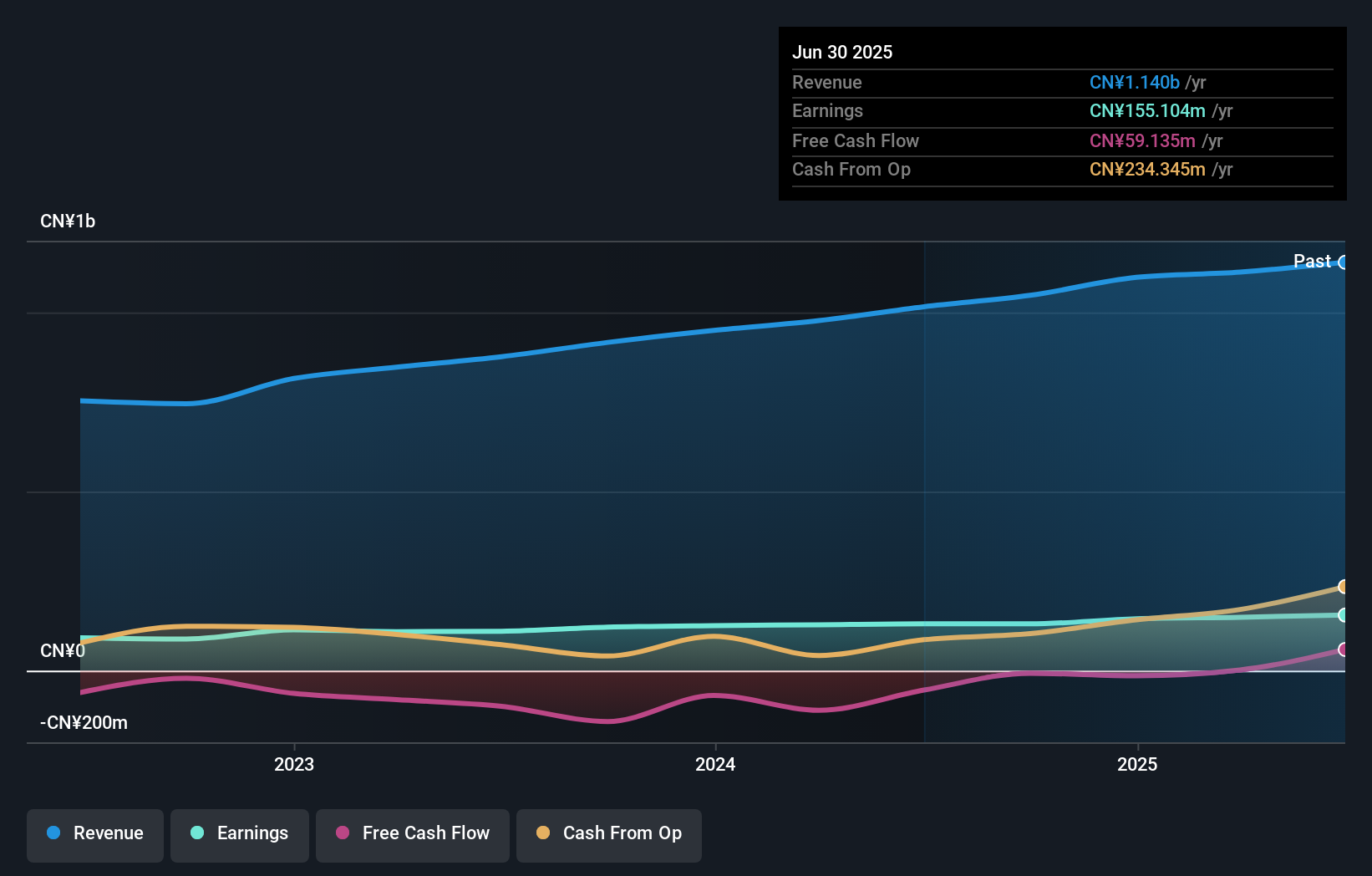

NCS Testing Technology, a small player in the professional services sector, is gaining attention with its recent inclusion in the S&P Global BMI Index. The company reported sales of CN¥499.39 million for the first half of 2025, up from CN¥457.15 million last year, and net income rose to CN¥58.26 million from CN¥48.18 million. Despite a debt to equity ratio increase over five years to 7.4%, NCS has more cash than total debt and covers interest payments comfortably at 19 times EBIT. Earnings growth outpaced industry averages by achieving an impressive 18.6% rise over the past year, although recent volatility in share price may concern some investors.

- Unlock comprehensive insights into our analysis of NCS Testing Technology stock in this health report.

Learn about NCS Testing Technology's historical performance.

Turning Ideas Into Actions

- Reveal the 2362 hidden gems among our Asian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCS Testing Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300797

Excellent balance sheet with proven track record.

Market Insights

Community Narratives