- China

- /

- Commercial Services

- /

- SZSE:300774

Revenues Tell The Story For BGT Group Co., Ltd. (SZSE:300774) As Its Stock Soars 29%

BGT Group Co., Ltd. (SZSE:300774) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 33% over that time.

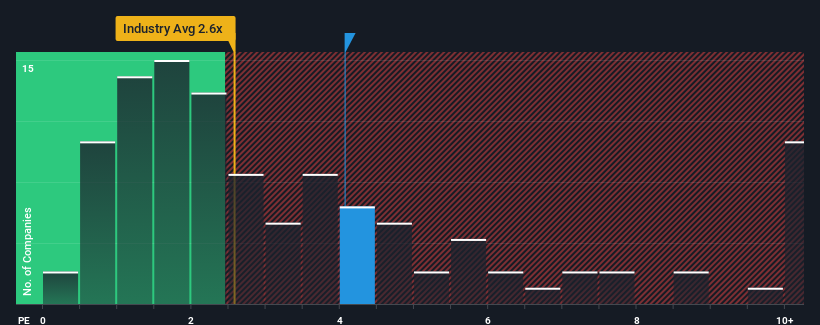

After such a large jump in price, when almost half of the companies in China's Commercial Services industry have price-to-sales ratios (or "P/S") below 2.6x, you may consider BGT Group as a stock probably not worth researching with its 4.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for BGT Group

How BGT Group Has Been Performing

BGT Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on BGT Group.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, BGT Group would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.9%. Even so, admirably revenue has lifted 41% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 55% during the coming year according to the one analyst following the company. That's shaping up to be materially higher than the 30% growth forecast for the broader industry.

In light of this, it's understandable that BGT Group's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

BGT Group shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that BGT Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Commercial Services industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for BGT Group (1 makes us a bit uncomfortable!) that we have uncovered.

If you're unsure about the strength of BGT Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if BGT Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300774

BGT Group

Engages in water treatment technology research and development, system design, equipment manufacturing, installation and commissioning, and operation in China.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives