- China

- /

- Professional Services

- /

- SZSE:300712

Fujian Yongfu Power EngineeringLtd (SZSE:300712) investors are up 9.5% in the past week, but earnings have declined over the last five years

Fujian Yongfu Power Engineering Co.,Ltd. (SZSE:300712) shareholders have seen the share price descend 11% over the month. But that doesn't change the fact that shareholders have received really good returns over the last five years. In fact, the share price is 115% higher today. We think it's more important to dwell on the long term returns than the short term returns. Of course, that doesn't necessarily mean it's cheap now. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 49% decline over the last three years: that's a long time to wait for profits.

The past week has proven to be lucrative for Fujian Yongfu Power EngineeringLtd investors, so let's see if fundamentals drove the company's five-year performance.

View our latest analysis for Fujian Yongfu Power EngineeringLtd

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Fujian Yongfu Power EngineeringLtd actually saw its EPS drop 3.8% per year.

So it's hard to argue that the earnings per share are the best metric to judge the company, as it may not be optimized for profits at this point. Therefore, it's worth taking a look at other metrics to try to understand the share price movements.

We doubt the modest 0.4% dividend yield is attracting many buyers to the stock. In contrast revenue growth of 15% per year is probably viewed as evidence that Fujian Yongfu Power EngineeringLtd is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

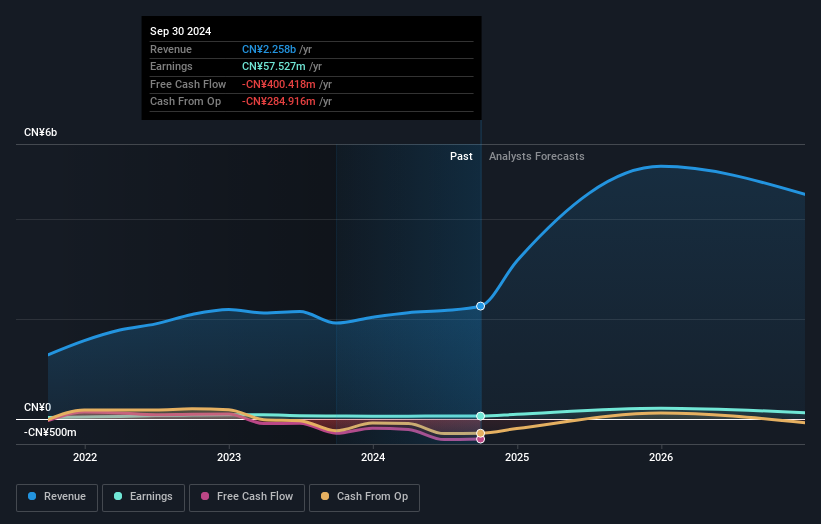

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Fujian Yongfu Power EngineeringLtd's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Fujian Yongfu Power EngineeringLtd, it has a TSR of 119% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Fujian Yongfu Power EngineeringLtd provided a TSR of 14% over the year (including dividends). That's fairly close to the broader market return. It has to be noted that the recent return falls short of the 17% shareholders have gained each year, over half a decade. More recently, the share price growth has slowed. But it has to be said the overall picture is one of good long term and short term performance. Arguably that makes Fujian Yongfu Power EngineeringLtd a stock worth watching. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Fujian Yongfu Power EngineeringLtd (2 are a bit concerning) that you should be aware of.

Of course Fujian Yongfu Power EngineeringLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300712

Fujian Yongfu Power EngineeringLtd

Provides solutions for power and energy systems in China and internationally.

High growth potential low.